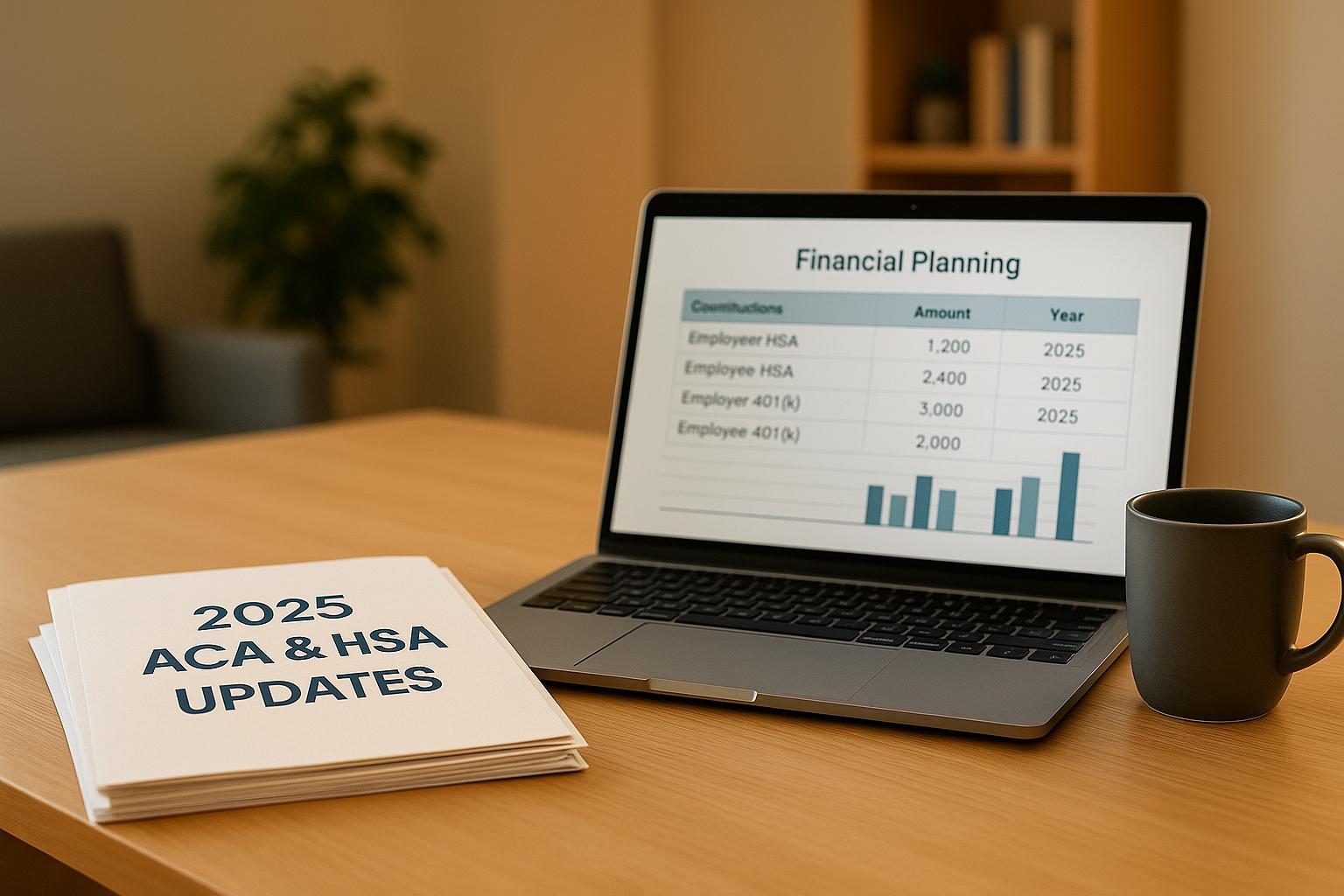

Navigating ACA and HSA regulations in 2025 is crucial for employers in Illinois. Key updates include:

- ACA Affordability Threshold: Rising to 9.02% of household income. For self-only coverage, the maximum monthly contribution is $113.20.

- HSA Contribution Limits: Increased to $4,300 for individuals and $8,550 for families. Those 55+ can add $1,000.

- HDHP Requirements: Minimum deductibles are $1,650 (individual) and $3,300 (family), with out-of-pocket caps of $8,300 and $16,600, respectively.

Employers must ensure compliance to avoid penalties ($2,900-$4,350 per employee) while balancing benefits. Strategies include aligning HSA contributions with ACA rules, using safe harbor methods for affordability, and clear employee communication.

2025 HSA and HDHP Limits: Expert Advice and Strategies for Maximizing Your Benefits

2025 HSA Contribution Limits and Eligibility Rules

As we move into 2025, understanding the updated HSA contribution limits and rules is crucial for Illinois employers designing their benefits packages. These IRS-defined limits directly influence employer strategies for contributions and compliance. Here’s a breakdown of the key points you need to know.

2025 HSA Contribution Limits

The IRS has increased HSA contribution limits for 2025, giving employees more room for tax-free savings. For those aged 55 and older, the additional $1,000 catch-up contribution remains unchanged. Looking ahead, the IRS has also announced limits for 2026.

| Coverage Type | 2024 Limit | 2025 Limit | 2026 Limit |

|---|---|---|---|

| Individual Coverage | $4,150 | $4,300 | $4,400 |

| Family Coverage | $8,300 | $8,550 | $8,750 |

| Catch-up (Age 55+) | $1,000 | $1,000 | $1,000 |

HSA Eligibility Requirements

To contribute to an HSA in 2025, employees must be enrolled in a qualified High Deductible Health Plan (HDHP). The requirements for these plans include:

- Minimum Deductibles: $1,650 for individual coverage and $3,300 for family coverage.

- Maximum Out-of-Pocket Limits: $8,300 for individual coverage and $16,600 for family coverage.

Employees are not eligible to contribute to an HSA if they are enrolled in non-HSA-qualified health plans, such as traditional insurance or full-purpose flexible spending accounts. Additionally, those enrolled in Medicare or claimed as dependents on someone else’s tax return are ineligible to contribute. Employers in Illinois should ensure their HDHP offerings align with these updated requirements.

Mid-Year Eligibility Contributions

Employees who gain HSA eligibility partway through the year must calculate their contribution limits based on the number of eligible months. Typically, eligibility starts on the first day of a month when all criteria are met. The prorated contribution is determined by multiplying the annual limit by the number of eligible months and dividing by 12. For example, an employee who becomes eligible on July 1 can contribute $2,150 (half of the $4,300 annual limit for individual coverage).

The Last Month Rule allows employees who are HSA-eligible as of December 1 to contribute the full annual limit, even if they were not eligible for the entire year. However, they must maintain eligibility through the following calendar year to avoid taxes and penalties.

Employers should implement clear processes to handle mid-year eligibility changes. This includes:

- Tracking employee eligibility status.

- Calculating prorated contribution limits accurately.

- Educating employees about rules like the Last Month Rule.

- Monitoring total contributions to ensure IRS limits are not exceeded.

- Stopping payroll contributions if an employee informs them the limits have been reached.

ACA Employer Requirements and Affordability Rules for 2025

Employers in Illinois with 50 or more full-time employees, also known as Applicable Large Employers (ALEs), are required to offer health insurance that complies with the Affordable Care Act (ACA). These obligations include meeting updated affordability thresholds and other compliance standards. Failing to adhere to these rules can result in penalties. To avoid these, it’s essential to align your health savings account (HSA) strategies with ACA requirements.

2025 ACA Affordability Threshold

Starting in 2025, the ACA affordability threshold will rise from 8.39% in 2024 to 9.02% of an employee’s household income. For coverage to qualify as affordable, the self-only premium must not exceed 9.02% of the employee’s household income. Additionally, the plan must provide minimum value by covering at least 60% of healthcare service costs.

Failure to meet these standards can lead to hefty penalties for ALEs. If an employer does not provide coverage to at least 95% of full-time employees, the penalty is $2,900 per employee annually (excluding the first 30 employees). If coverage is offered but is deemed unaffordable or fails to meet the minimum value requirement, the penalty increases to $4,350 for each employee who receives a premium tax credit through the marketplace.

How HSA Contributions Affect Affordability

While employer contributions to HSAs don’t directly lower the premium costs used in the affordability calculation, they do enhance the overall appeal and value of high-deductible health plans (HDHPs). When paired with HDHPs that meet affordability guidelines, strong HSA contributions improve the plan’s competitiveness. Employers in Illinois should carefully coordinate their HSA contributions with their premium-sharing strategies. This ensures that employee contributions remain within the 9.02% affordability limit while also maximizing the tax advantages of HSAs.

Next, let’s look at safe harbor methods that can simplify ACA compliance.

Safe Harbor Affordability Rules

The IRS offers three safe harbor methods to help employers demonstrate compliance with ACA affordability requirements. These safe harbors shield employers from penalties, even if an employee’s actual household income would otherwise make the coverage unaffordable.

Federal Poverty Level Safe Harbor:

For 2025, coverage is considered affordable if the employee’s share of the premium for the lowest-cost, self-only plan does not exceed $113.20 per month. This amount is calculated as 9.02% of the 2024 federal poverty line, which is $15,060 for the contiguous 48 states.

"The easiest way to ensure affordability in 2025 is to meet the federal poverty line affordability safe harbor by offering at least one medical plan option (that provides minimum value) for which the monthly employee-share of the premium for employee-only coverage does not exceed $113.20." – Brian Gilmore, Lead Benefits Counsel, VP, Newfront

Rate of Pay Safe Harbor:

Under this method, the employee’s monthly contribution cannot exceed 9.02% of their monthly salary (or hourly rate × 130 hours). For example, for an employee earning $20 per hour, the maximum contribution would be approximately $234.52 per month.

Form W-2 Safe Harbor:

This safe harbor uses the employee’s Box 1 wages from the previous year’s W-2 form. The monthly premium contribution is capped at 9.02% of the annual wages divided by 12. This method is less common due to its retrospective nature and the administrative effort required.

Employers can apply different safe harbor methods to various employee groups, provided they remain consistent within each group. For example, businesses with a large number of lower-wage employees may find the Federal Poverty Level safe harbor the simplest to implement. On the other hand, the Rate of Pay safe harbor might work better for companies with higher-paid employees.

| Safe Harbor Method | 2025 Calculation | Best For |

|---|---|---|

| Federal Poverty Level | Maximum $113.20/month | Straightforward compliance for lower-wage employees |

| Rate of Pay | 9.02% of monthly salary or (hourly rate × 130 hours) | Employees with variable or higher wages |

| Form W-2 | 9.02% of prior year Box 1 wages ÷ 12 | Stable workforce with consistent earnings |

Employer HSA Contribution Methods

With updates to ACA and HSA regulations, employers need to carefully choose how they contribute to employees’ HSAs. For Illinois employers, this means selecting a method that aligns with their benefits strategy, payroll systems, budget, and employee needs. The goal is to strike a balance between compliance and providing meaningful support to employees.

Types of Employer Contributions

Employers have three main options for funding HSAs: lump-sum, periodic, or matching contributions. Each method has its own advantages, depending on the company’s priorities and employee preferences.

- Lump-Sum Contributions: This is the simplest approach. Employers deposit the full annual contribution at the start of the plan year or during open enrollment. Employees get immediate access to the funds, which can be helpful for medical expenses early in the year. It also reduces the administrative burden of ongoing payroll adjustments.

- Periodic Contributions: With this method, contributions are spread out over the year – often monthly or per pay period. For instance, an employer contributing $1,200 annually could deposit $100 each month into an employee’s HSA. This method smooths cash flow for employers while providing consistent funding for employees.

- Matching Contributions: Here, employers match employee contributions, either dollar-for-dollar up to a limit or using a partial match. This approach encourages employees to engage with their HSAs while giving employers greater control over costs.

No matter the method, all HSA contributions made through payroll must be reported as a single aggregated amount on the employee’s Form W-2 in Box 12 using code W.

Contribution Strategy Guidelines

To make the most of HSA contributions, employers should integrate them into their overall benefits strategy while staying ACA-compliant.

- Annual Budget Planning: Review contribution levels annually to ensure they align with your benefits goals. Factors like employee usage, healthcare cost trends, and local market competitiveness should guide these decisions.

- Coordination with Premium Sharing: While HSA contributions don’t directly affect premium affordability calculations, they can enhance the appeal of high-deductible health plans. Employers can structure premium sharing to meet the $113.20 monthly Federal Poverty Level safe harbor and use HSA contributions to offset higher deductibles.

- Clear Communication Protocols: Transparency is key. Employees should know how and when they’ll receive employer contributions. Include this information in enrollment materials and handbooks, and notify employees when deposits are made. Clear communication helps employees plan their healthcare spending effectively.

- Catch-Up Contribution Policies: Employees aged 55 and older can contribute an additional $1,000 annually. Employers should establish clear guidelines on whether these catch-up contributions will be matched or supported in any way.

Employee Education Programs

An HSA program is only as effective as employees’ understanding of it. Education is a critical component for helping employees maximize their benefits.

- HSA Basics Training: Many employees lack a clear understanding of HSAs. In fact, only 10% of employees funded or invested their HSA funds last year. Training sessions should explain key features like the triple tax advantage, rollover benefits, and how HSAs differ from flexible spending accounts.

- Investment Education: As HSA balances grow, employees may want to explore investment opportunities. Studies show that while 44% of employees (and up to 50% of millennials) want to invest more, only 25% feel they receive adequate guidance. Employers can close this gap with targeted investment education.

- Year-Round Resources: Engagement shouldn’t stop after open enrollment. Tools like self-service calculators, educational videos, group sessions, and one-on-one consultations can keep employees engaged and informed throughout the year.

- Retirement Planning Integration: HSAs aren’t just for medical expenses – they’re also a valuable retirement savings tool. After age 65, funds can be withdrawn penalty-free, making HSAs an attractive option for long-term financial planning.

sbb-itb-a729c26

2025 HSA and HDHP Compliance Limits Table

Illinois employers need accurate figures for 2025 to ensure compliance. Contribution limits for HSAs have increased, while ACA out-of-pocket maximums have been reduced. The table below provides a clear breakdown of these updates for quick reference.

| HSA and HDHP Requirements | 2025 | 2024 | Change |

|---|---|---|---|

| Annual HSA Contribution Limit (combined employer and employee) | Self-only: $4,300 Family: $8,550 | Self-only: $4,150 Family: $8,300 | Self-only: +$150 Family: +$250 |

| HSA Catch-Up Contribution (age 55 or older) | $1,000 | $1,000 | No change |

| Minimum Annual HDHP Deductible | Self-only: $1,650 Family: $3,300 | Self-only: $1,600 Family: $3,200 | Self-only: +$50 Family: +$100 |

| Maximum HDHP Out-of-Pocket Limit | Self-only: $8,300 Family: $16,600 | Self-only: $8,050 Family: $16,100 | Self-only: +$250 Family: +$500 |

| ACA Requirements | 2025 | 2024 | Change |

|---|---|---|---|

| ACA Maximum Out-of-Pocket Limit (all non-grandfathered plans) | Self-only: $9,200 Family: $18,400 | Self-only: $9,450 Family: $18,900 | Self-only: -$250 Family: -$500 |

The ACA’s reduced out-of-pocket maximums for in-network essential health benefits in 2025 present an interesting opportunity. Employees can save more in their HSAs while benefiting from lower overall out-of-pocket expenses.

How to Use the Compliance Table

Use the table to verify your HDHP meets the updated 2025 deductible and out-of-pocket standards. For family plans, ensure the embedded individual deductible is at least $3,300.

Additionally, all non-grandfathered plans must include an individual out-of-pocket limit when family limits exceed $9,200 . This applies to both HDHPs and traditional health plans.

Make sure to update all relevant plan materials to reflect the 2025 limits. This includes summary plan descriptions, enrollment guides, and any online tools employees rely on for understanding their benefits .

For employers offering multiple health plan options, this table is a handy resource to ensure consistency across your offerings. By aligning your plans with these limits, you can maintain compliance while keeping your benefits competitive throughout 2025.

Illinois Health Agents Support for Employers

Navigating the maze of ACA and HSA regulations can be a daunting task for Illinois employers. That’s where Illinois Health Agents steps in, simplifying compliance and helping businesses enhance their benefits strategies.

Illinois Health Agents Services

Illinois Health Agents provides a full range of services tailored to meet the needs of employers managing ACA compliance and HSA administration. Their support goes beyond just finding insurance plans; they offer ongoing guidance to ensure businesses stay on track.

"We’re here to help you compare the best choices from the highest-reviewed carriers. Services include employee education, contribution strategies, new hire processing, annual reviews, and tax-saving guidance." – Illinois Health Agents

Employee education is a central part of their services, offering clear explanations of the 2025 contribution limits, eligibility rules, and how employer contributions affect overall benefits. They also help employers design effective contribution strategies, whether through flat-dollar amounts, percentage-based contributions, or flexible models that adjust based on employee coverage selections – all while ensuring compliance with ACA affordability requirements.

For businesses with frequent staffing changes, their new hire and termination processing center ensures that HSA eligibility is managed seamlessly throughout the year, addressing the challenges of mid-year eligibility adjustments.

Annual review meetings provide an opportunity to evaluate current strategies, analyze employee participation and contribution trends, and receive tailored recommendations for improvement. These reviews also include tax-saving insights that benefit both employers and their teams.

Additional services include COBRA administration, Section 125 plan management, and ACA reporting support. An online portal for employers and employees simplifies benefits management, giving employees easy access to their HSA details.

With an "EXCELLENT" rating based on 127 reviews, Illinois Health Agents has built a reputation for offering practical, ongoing support rather than one-off solutions. Their extensive service offerings are backed by a strong understanding of local needs, as detailed below.

Local Support for Illinois Businesses

Illinois Health Agents combines their broad service offerings with local expertise, operating as an independent, licensed insurance agency. Their independence allows them to recommend solutions tailored to each business’s unique needs.

This local knowledge is especially valuable when navigating Illinois-specific regulations alongside federal ACA rules. Their pricing model further reflects their commitment to supporting businesses of all sizes: services are free for employers with more than 10 employees, while smaller businesses (10 or fewer employees) pay an annual fee of $250 – which is waived for certified non-profits.

Rather than adopting a one-size-fits-all approach, Illinois Health Agents collaborates with businesses to create customized group coverage solutions. They work closely with employers to align benefits strategies with company culture, budget constraints, and employee needs.

Their Health Savings Account (HSA) support includes assistance with setting up accounts, managing ongoing administration, and educating employees on maximizing their HSA benefits. This guidance becomes even more critical in 2025 as contribution limits change, offering employees greater opportunities to save.

Key Points for Employers

Employers need to align their Affordable Care Act (ACA) compliance efforts with effective Health Savings Account (HSA) strategies. If your business has 50 or more full-time equivalent employees, you’re required to offer at least one health plan where the cost of self-only coverage for employees doesn’t exceed the Safe Harbor Affordability Threshold.

For 2025, this threshold is set at 9.02% of the Federal Poverty Level, which means the maximum monthly contribution for self-only coverage is capped at $113.20. Since the Federal Poverty Level can change, it’s crucial to regularly review and adjust your plan offerings to stay compliant. These affordability standards form the backbone of managing HSAs effectively.

By combining High Deductible Health Plans (HDHPs) with HSAs, employers can simplify compliance while also improving the benefits offered to employees. To make this work, it’s essential to communicate clearly about plan options, affordability calculations, and how contributions are handled. This helps employees fully understand their benefits and make informed decisions.

For businesses navigating these regulations, expert guidance can make all the difference. Illinois Health Agents specializes in providing ACA and benefits management support tailored for businesses in Illinois. They offer practical solutions designed to ensure your benefits program meets every regulatory requirement.

Taking a proactive approach to compliance and maintaining clear communication will not only protect your business but also contribute to the long-term financial well-being of your workforce.

FAQs

How can Illinois employers ensure their health plans comply with the 2025 ACA affordability requirements and avoid penalties?

2025 ACA Affordability Requirements for Illinois Employers

Starting in 2025, Illinois employers need to ensure that the employee’s share of the premium for the lowest-cost, self-only health coverage does not exceed 9.02% of their household income. This updated percentage represents the new affordability threshold set by the Affordable Care Act (ACA).

To steer clear of penalties, employers should take steps to regularly evaluate their health plans. This includes verifying that the plans meet IRS standards for minimum value and affordability. Adjusting employee contributions, when necessary, will help ensure compliance with these guidelines. By staying ahead of these requirements, businesses not only avoid financial penalties but also provide employees with access to reasonably priced health coverage.

What are the pros and cons of different ways employers can contribute to HSAs?

Employers have a few ways to contribute to Health Savings Accounts (HSAs), each with its own pros and cons. Direct contributions give employees immediate tax advantages and make funding straightforward, but they can add complexity to payroll management for employers. Matching contributions, on the other hand, motivate employees to save more but could result in higher long-term costs for businesses.

For employees, HSAs offer some great perks: tax-free growth, the ability to withdraw funds for qualified medical expenses, and the chance to build long-term savings. But there’s a catch – if contributions are too low or the account isn’t used effectively, employees might face financial challenges, especially if unexpected medical bills come up.

In the end, employer-funded HSAs can be a meaningful benefit that boosts morale and satisfaction. However, they need careful planning to fit within the company’s budget while meeting employees’ needs.

What is the ‘Last Month Rule,’ and how does it impact HSA contributions for employees who become eligible later in the year?

The ‘Last Month Rule’ allows employees who qualify for a Health Savings Account (HSA) on December 1 to contribute the full annual limit for that tax year – even if they only became eligible partway through the year. This is particularly helpful for those who switch to a high-deductible health plan (HDHP) later in the year.

However, there’s a catch: employees must stay HSA-eligible for the entire testing period, which spans 12 months starting from December 1. If they lose eligibility during this time, the IRS may require them to repay any excess contributions, and they could face additional taxes or penalties. It’s crucial for both employers and employees to fully understand these rules to make the most of HSA contributions while staying within IRS guidelines.

0 Comments