by Admin | Jan 3, 2026 | Insurance News

If you’re self-employed in Illinois, understanding changes to ACA subsidies in 2026 is essential for managing health insurance costs. Here’s what you need to know: Income Eligibility: Subsidies are based on your Modified Adjusted Gross Income (MAGI) and the Federal...

by Admin | Jan 3, 2026 | Insurance News

In Illinois, small businesses with two full-time employees can qualify for group health insurance. This includes partnerships, corporations, or a business owner with one employee. However, sole proprietors and their spouses do not meet the criteria unless another...

by Admin | Jan 3, 2026 | Insurance News

Missed the Open Enrollment Period? You may still qualify for health insurance under Special Enrollment Periods (SEPs) if you’ve faced unexpected events or errors. SEPs cover situations like natural disasters, serious medical emergencies, or misinformation during...

by Admin | Jan 3, 2026 | Insurance News

Missed Open Enrollment? You might still qualify for health insurance in Illinois. Special Enrollment Periods (SEPs) allow you to enroll or switch health plans after certain life events. These events include losing coverage, having a baby, moving to a new area, or even...

by Admin | Jan 3, 2026 | Insurance News

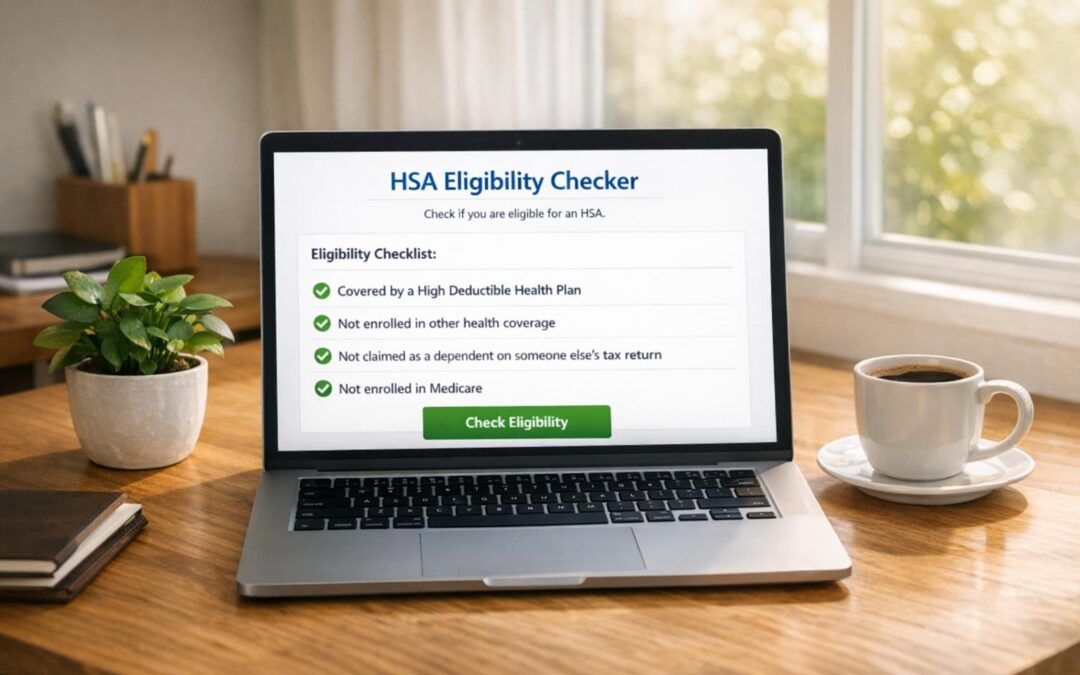

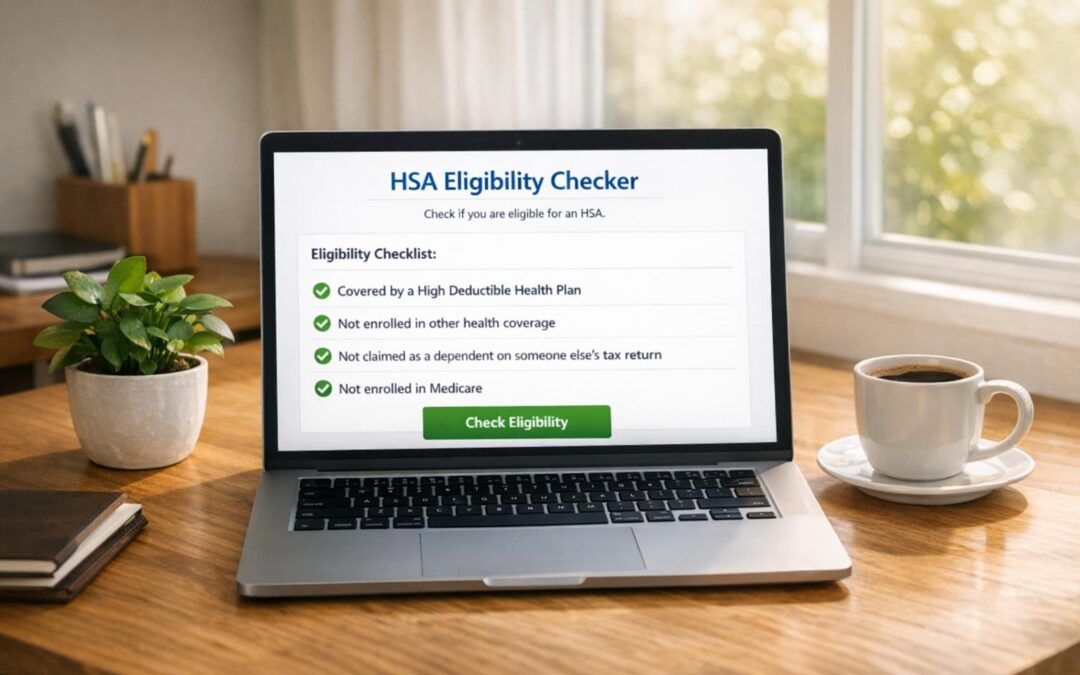

Understanding HSA Eligibility: A Simple Guide Navigating the world of healthcare savings can feel overwhelming, especially when it comes to figuring out if you qualify for a Health Savings Account. These accounts are a fantastic way to save tax-free money for medical...

by Admin | Jan 3, 2026 | Insurance News

Offering health insurance to employees can be costly, but small businesses in Illinois may qualify for a federal tax credit to offset these expenses. The Small Business Health Care Tax Credit, introduced under the Affordable Care Act (ACA), allows eligible small...

Recent Comments