by Admin | Jan 12, 2026 | Insurance News

Understanding Dental Insurance Coverage Made Easy Navigating the world of dental care can feel overwhelming, especially when you’re trying to figure out what your insurance will actually pay for. Whether it’s a simple cleaning or a more complex procedure like a root...

by Admin | Jan 8, 2026 | Insurance News

Understanding Medicare Costs Made Simple Navigating the world of healthcare plans can be overwhelming, especially when it comes to figuring out what you’ll actually pay. That’s where a reliable Medicare plan cost calculator comes in handy. Whether you’re approaching...

by Admin | Jan 6, 2026 | Insurance News

Using Gusto for health insurance? You might be missing out. While Gusto is great for payroll and basic benefits, its health insurance options are limited to six carriers and lack personalized support. Independent brokers, on the other hand, offer access to more...

by Admin | Jan 6, 2026 | Insurance News

Managing employee benefits can be complicated, but using an independent broker with Rippling makes it easier. Here’s why: Save Money: Independent brokers help secure better rates, while Rippling reduces administrative costs. Stay Compliant: Automated tools and...

by Admin | Jan 6, 2026 | Insurance News

Understanding residency rules is key when applying for ACA health insurance in Illinois. Whether you’re a long-time resident, new to the state, or managing multiple residences, proving Illinois residency ensures access to the right plans and financial help....

by Admin | Jan 5, 2026 | Insurance News

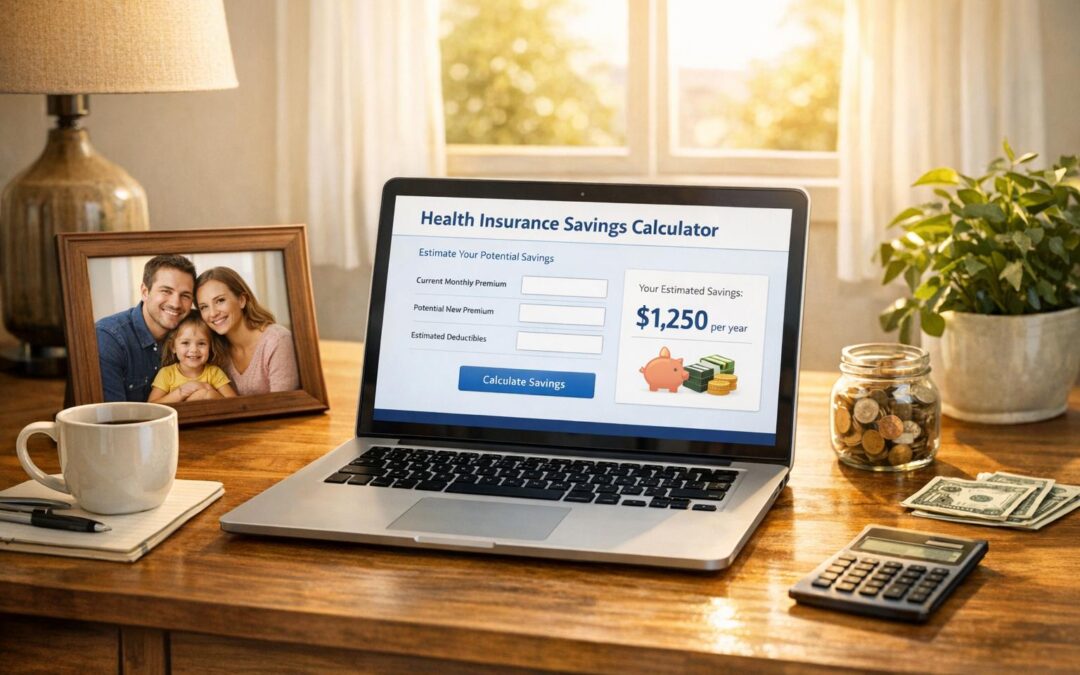

Discover Savings with a Health Insurance Cost Tool Navigating the world of medical coverage can be overwhelming, especially when premiums and deductibles seem to climb every year. If you’ve ever wondered whether you’re paying too much, a tool to estimate potential...

Recent Comments