by Admin | Jan 26, 2026 | Insurance News

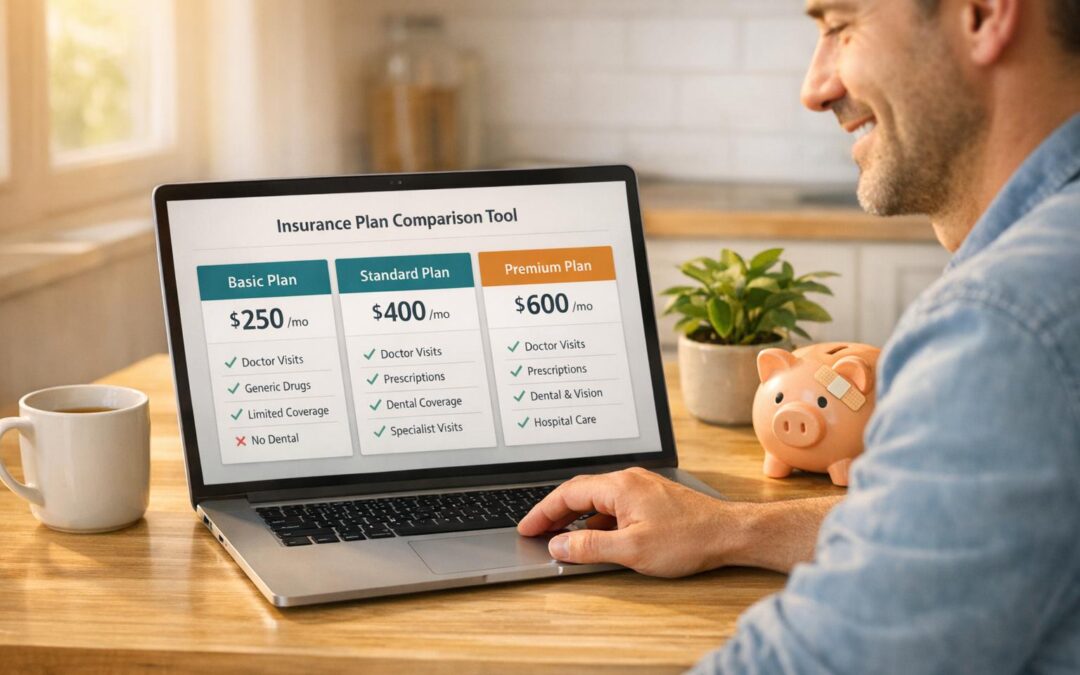

Navigating Health Coverage with Ease Finding the right medical insurance plan can feel overwhelming with so many options and fine print to decipher. That’s where a reliable comparison resource comes in handy. Whether you’re a young professional, a growing family, or...

by Admin | Jan 22, 2026 | Insurance News

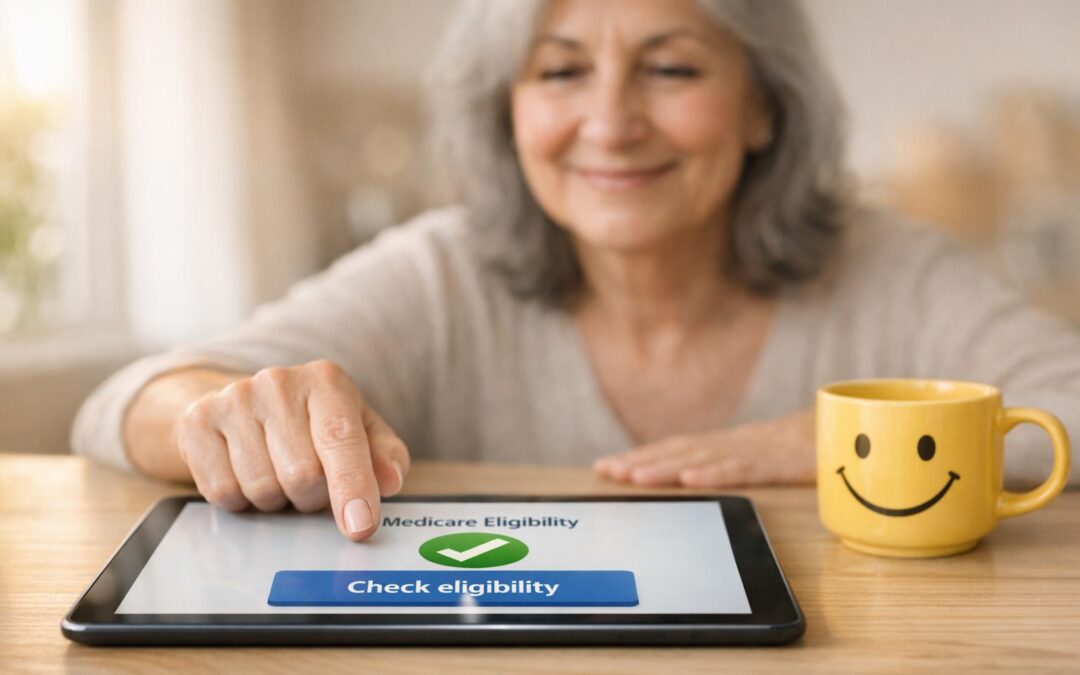

Understanding Medicare Eligibility: A Simple Guide Navigating the world of healthcare benefits can feel overwhelming, especially when it comes to figuring out if you qualify for Medicare. Whether you’re approaching retirement age or dealing with a health condition,...

by Admin | Jan 19, 2026 | Insurance News

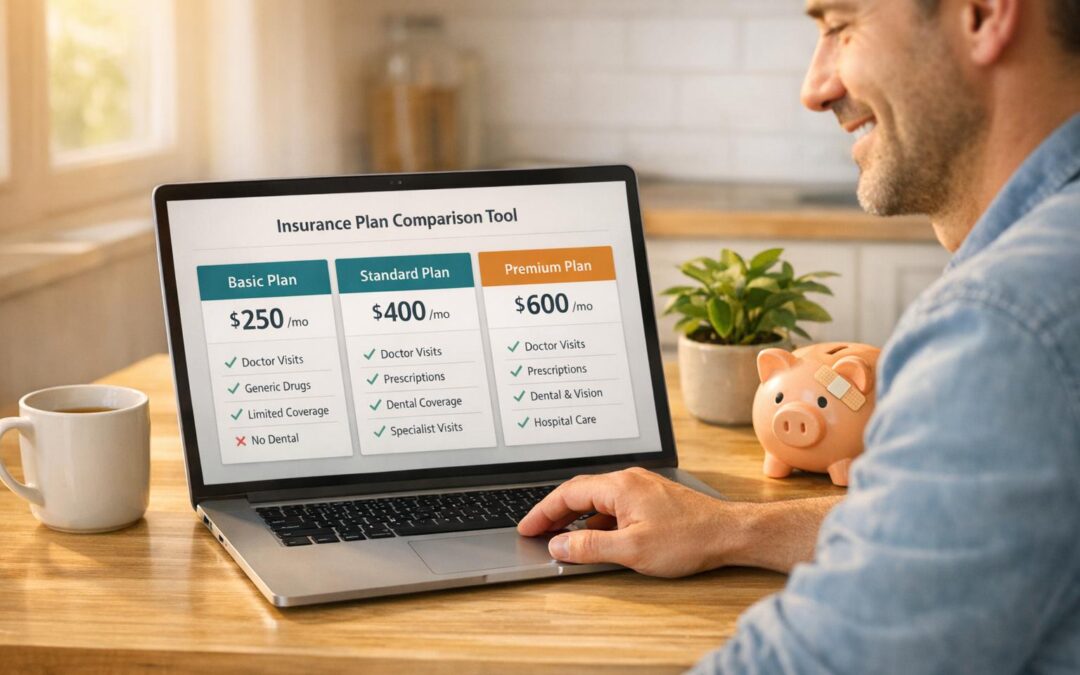

Navigate Short-Term Health Coverage with Ease Finding the right temporary health insurance doesn’t have to be a headache. Whether you’re between jobs, traveling, or just need a bridge until your next plan kicks in, understanding your options is key. That’s where a...

by Admin | Jan 15, 2026 | Insurance News

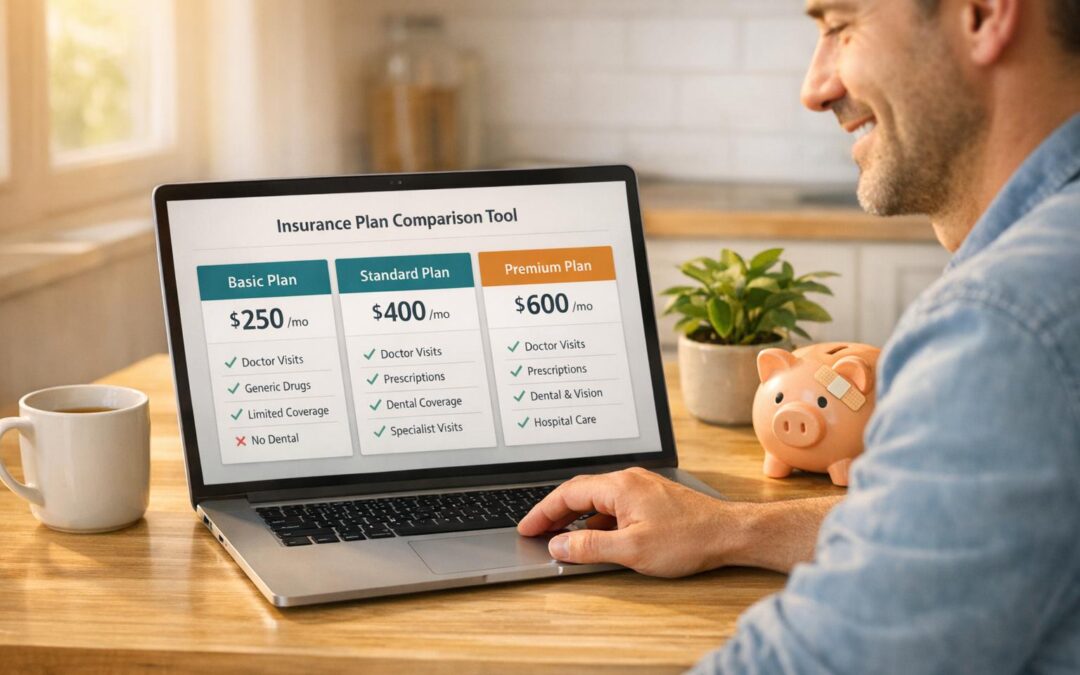

Finding the Right Vision Insurance Made Easy Navigating the world of eye care coverage can feel overwhelming, especially with so many options out there. Whether you’re someone who needs regular checkups or just an occasional pair of glasses, having a plan that matches...

by Admin | Jan 13, 2026 | Insurance News

Freezing eggs in Illinois can cost between $10,000 and $15,000 per cycle, with medications adding $3,000 to $6,000 and annual storage fees of $1,000+. However, Illinois offers a fertility insurance mandate under Public Act 102-0170, requiring many employer-sponsored...

by Admin | Jan 13, 2026 | Insurance News

Illinois residents now have additional time to secure health insurance through the state’s Affordable Care Act (ACA) exchange, Get Covered Illinois. The enrollment deadline has been extended by 16 days, allowing consumers to sign up for coverage until January 31. The...

Recent Comments