by Admin | Feb 16, 2026 | Insurance News

The Affordable Care Act (ACA) provides tax credits and guidelines to help Illinois employers manage health insurance costs. Here’s what you need to know: Small Businesses (Fewer than 25 FTEs): Eligible for the Small Business Health Care Tax Credit, covering up...

by Admin | Feb 9, 2026 | Insurance News

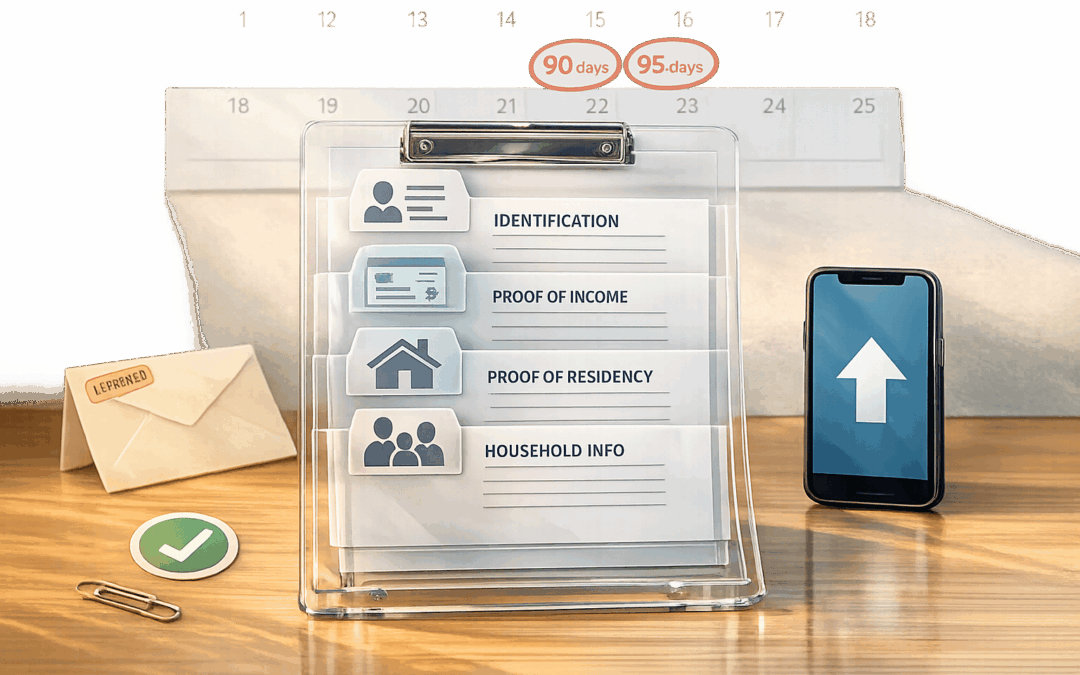

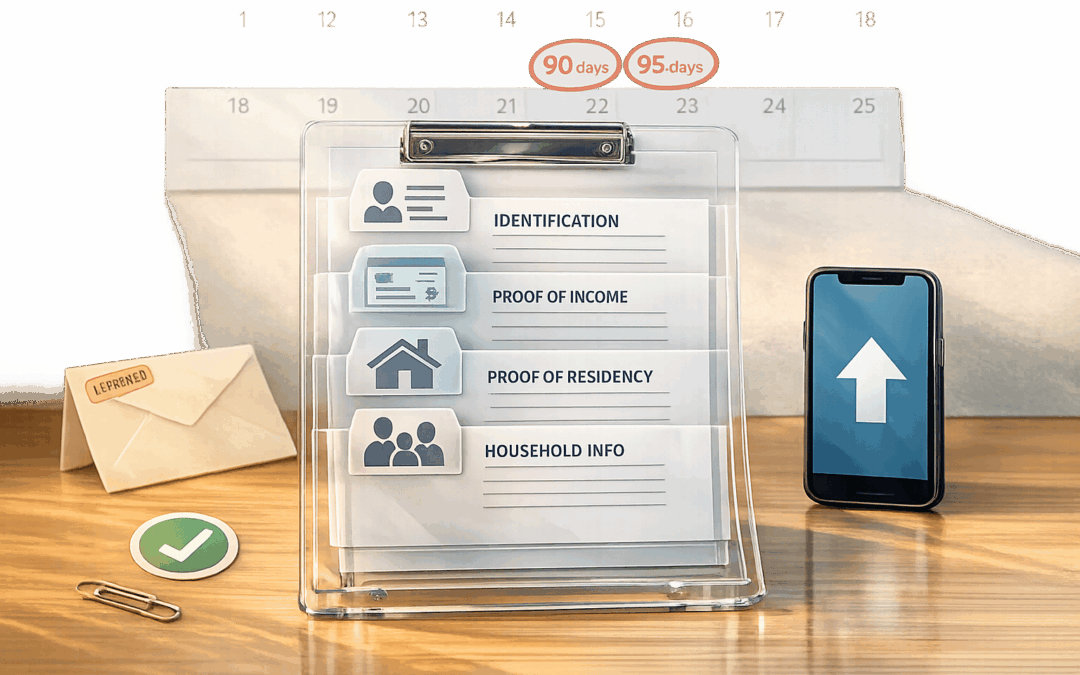

To enroll in ACA health coverage, you need specific documents to verify your identity, income, residency, and eligibility for financial assistance. Missing deadlines could result in losing coverage or financial help. Here’s what you’ll need: Personal ID: Driver’s...

by Admin | Feb 5, 2026 | Insurance News

In Texas, qualifying for a 2-person group health insurance plan requires meeting specific rules set by insurance carriers and the Texas Department of Insurance. Here’s what you need to know: Eligibility: At least two employees must work 30–32 hours per week. One...

by Admin | Feb 2, 2026 | Insurance News

Unexpected medical bills can be overwhelming, but the No Surprises Act, effective since January 1, 2022, protects patients from surprise charges for out-of-network care in emergencies and certain non-emergency services. Here’s what you need to know: Key...

by Admin | Jan 29, 2026 | Insurance News

Shares of major U.S. health insurance companies tumbled following the Centers for Medicare & Medicaid Services (CMS) announcement of its proposed payment rates for 2027 Medicare Advantage (MA) plans. The CMS proposal, which included a modest 0.09% payment increase...

by Admin | Jan 29, 2026 | Insurance News

Plan Smarter with an Employee Benefits Cost Estimator Managing a workforce comes with plenty of challenges, and figuring out the true cost of compensation packages often tops the list. For HR professionals and employers, having a clear picture of expenses tied to...

Recent Comments