Information on Medicare Supplement Insurance

Medicare Supplement Plans, also known as Medigap Plans, are insurance policies that help cover some or all of the deductible, coinsurance, copay, and excess charge gaps that are not covered by Medicare, and are available to anyone enrolled in part A and B of Medicare.

Medicare supplements are somewhat unique in that, although this is insurance, Medicare has mandated a level of standardization that makes it easier to shop for Medicare supplements. As an example, many people aren’t familiar with the fact that a Medicare Supplement Plan F from one company can be priced at $200/month while the same exact plan and coverage from another company can be around $100/month. No difference in benefit. No difference in physician’s networks. The exact same Medicare supplement coverage! That bit of understanding can save someone $100/month or almost $1,200/year. We can ensure you find the Medicare supplement plan that’s going to save you the most money. Get your Medicare Supplement Insurance quote online with us today!

Guaranteed Acceptance

Additionally, if you are just turning 65, you are guaranteed acceptance in any medicare supplement plan from any carrier as long as you enroll in a plan within six months after you turn age 65. All you have to do is make sure you are enrolled in Medicare Part A and Medicare Part B, pick and plan, and submit your application.

What Medicare Doesn’t Cover

Medicare does not cover all health care costs. Medicare coverage consists of Part A (which covers hospital and skilled nursing facility care), and Part B (which covers doctor bills and other medical expenses).

Even with Medicare Part A and Part B coverage, you’re responsible for some out-of-pocket expenses including:

- Part A hospital deductible ($1,676)

- Part B deductible ($257)

- Copayments for hospital stays over 60 days

- Care in a skilled nursing facility after 20 days

- 20% coinsurance for doctor bills and other medical expenses

Medicare Supplement Plans are Standardized

By law, Medicare Supplement insurance is standardized into twelve plans (Plans A through N). That means Plan G from one company must include the same benefits as plan G from another company. Since Medicare Supplement insurance plans are standardized and all insurance companies offer the same basic supplemental coverage, your Medicare supplement choice comes down to price and a company’s service, reputation and experience with Medicare supplement insurance policies.

In addition to the standard Plan A-L Medicare supplement health care policies, Medicare SELECT is a type of Medicare Supplement health care policy that can cost less than standard Medicare supplemental. However, you can only go to certain doctors and hospitals for your care. In Illinois, Medicare Select plans are offered by BlueCross Blue Shield of Illinois.

Illinois – Most Popular Medicare Supplement Companies

BCBSIL – Most Popular Illinois Medicare Supplement Plans

Blue Cross and Blue Shield of Illinois offers the most popular Medicare Supplement plans in Illinois with the most competitive rates. For additional information on these plans:

Mutual of Omaha – Lowest Cost Illinois Medicare Supplement Plans

Mutual of Omaha Medicare Supplement Plans are highly popular in Illinois and usually have the lowest rates. They take an attained-age rating approach to pricing their Medicare supplements and have lower rates for non-tobacco users.

Eligibility

To qualify for a Medicare Supplement policy, you must be age 65 or older (may vary by state), enrolled in Medicare parts A and B, and you must reside in the state in which you are applying for supplemental coverage.

When to Enroll

Your open enrollment period is the best time to buy a Medicare Supplement policy because companies must sell you any plan they offer regardless of your pre-existing health conditions. Your open enrollment period lasts for 6 months and begins on the first day of the month in which you are age 65 or older and enrolled in Part A and B of Medicare.

An insurer must offer you any plan it sells and cannot charge more because of present or past health conditions during open enrollment.

Late Enrollment

To help control rising costs, carriers apply the pre-existing condition clause to newly issued Medicare Supplement plans in most states if you enroll after the open enrollment period. Expenses resulting from a condition existing six months prior to the supplemental policy effective date are not covered unless they are incurred three months after the supplemental policy effective date.

If the supplemental policy replaces another creditable individual or group insurance coverage due to a person’s eligibility for Medicare, this Pre-Existing Conditions Limitation will be reduced by the number of months that coverage was in force. If this supplemental policy replaces another Medicare Supplement policy, this Pre-Existing Conditions Limitation will be reduced by the number of months that the coverage was in force.

Medicare Supplement Basic Benefits

Basic benefits included in all plans include:

- Hospitalization – Part A coinsurance plus coverage for 365 additional days after Medicare benefits end.

- Medical Expenses – Part B coinsurance (generally 20% of Medicare-approved expenses), or in the case of hospital outpatient department services under a prospective payment system, applicable copayments.

- Blood – First three pints of blood each year.

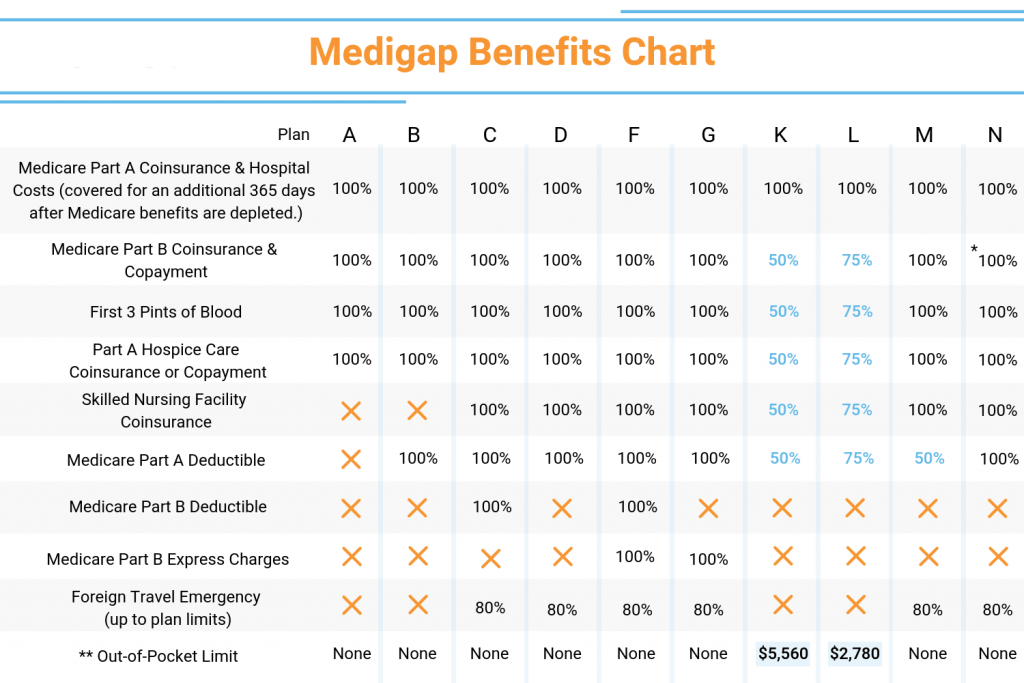

Medicare Supplement Benefits by Plan

The chart below shows the standard benefits included in each plan.

| Plans | A | B | C | D | F* | G | K** | L** | N*** |

|---|---|---|---|---|---|---|---|---|---|

| Basic Benefits | X | X | X | X | X | X | 50% | 75% | X |

| Skilled Nursing Coinsurance | – | – | X | X | X | X | 50% | 75% | X |

| Part A Deductible | – | – | X | X | X | X | 50% | 75% | X |

| Part B Deductible | – | – | X | – | X | – | – | – | – |

| Part B Excess | – | – | – | – | 100% | 100% | – | – | – |

| Foreign Travel Emergency | – | – | 80% | 80% | 80% | 80% | – | – | 80% |

| At Home Recovery | – | – | – | – | – | – | – | – | – |

| Preventive Care | – | – | – | – | – | – | – | – | – |

*Plan F also has a high deductible option, which some companies may offer. These high deductible plans pay the same benefits as Plan F after one has paid a calendar year $2,490 deductible. Benefits from high deductible Plans F will not begin until out-of-pocket expenses exceed $2,490.

**Plan K and Plan L provide for different cost-sharing than plans A-F. Once you reach the annual limit, the plan pays 100% of the Medicare copayments, coinsurance and deductibles for the rest of the calendar year. The out-of-pocket annual limit does NOT include charges from your provider that exceed Medicare-approved amounts, called “excess charges.” You will be responsible for paying excess charges.

*** Plan N pays 100% of the Part B coinsurance, except for a copayment of up to $20 for some office visits and up to a $50 copayment for emergency room visits that don’t result in inpatient admission.

Starting January 1, 2020, Medigap plans sold to new people with Medicare won’t be allowed to cover the Part B deductible. Because of this, Plans C and F will no longer be available to people new to Medicare starting on January 1, 2020. If you already have either of these 2 plans (or the high deductible version of Plan F) or are covered by one of these plans before January 1, 2020, you’ll be able to keep your plan. If you were eligible for Medicare before January 1, 2020, but not yet enrolled, you may be able to buy one of these plans.

What Medicare Open Enrollment is for

The general way that open enrollment works is similar to what those who’ve had private employer-based health insurance coverage during their careers are used to seeing. Each year, you’re given the opportunity to adjust the way that you’re covered under Medicare. The available changes include the following:

- If you’re covered under traditional Medicare this year, then you can move to a Medicare Advantage plan for next year.

- If you’re covered under a Medicare Advantage plan this year, you can either change to a different Medicare Advantage plan, or you can move back to traditional Medicare coverage.

- You can make changes to your prescription drug coverage, either by choosing a Medicare Advantage plan that incorporates prescription drug benefits into its overall package or by selecting a separately offered Part D prescription drug plan. You can also drop your existing drug coverage or add new coverage.

How long Medicare open enrollment lasts

Medicare open enrollment gives participants about a seven-week window to make changes, with the period beginning October 15th and ending December 7th. Changes to your coverage that you make during this year’s open enrollment will take effect on Jan. 1, 2024.

The annual open enrollment period is the primary method most Medicare participants have to make changes to their coverage, but it’s not the only one. Other special periods apply when certain life events happen, such as if you move to a new area where your current plan doesn’t offer coverage or if you become eligible for other benefits such as Medicaid.

Your Biggest Goal during Medicare Open Enrollment

Ideally, open enrollment lets you tailor your Medicare coverage to minimize your total out-of-pocket healthcare costs. Many participants make the mistake of focusing only on paying the lowest premiums for their Medicare coverage, but that’s only part of the equation. Part B premiums are generally fixed, while various Medicare Advantage and Medicare Part D plans can offer very different monthly premiums.

Yet although a lower-premium plan can look like a good deal, the less comprehensive coverage it offers can end up making you pay more in total costs. If the copayments, deductibles, and coinsurance amounts that you have to pay under a plan offset the lower premiums, then what looks like the “cheaper” plan from the premium standpoint can end up actually being more costly. Conversely, more comprehensive plans might cost more in monthly premiums but end up with lower total costs.

The challenge in achieving this goal is that you have to not only assess your current health but also predict how the coming year is likely to go. The perfect plan for a relatively healthy person can be wholly inadequate for someone with a chronic condition. With prescription drug coverage, you can go from needing no medications at all to having a large set of prescriptions if you suffer an illness during the course of a year. That’s why changing from year to year can make sense, and failing to do so can be a huge mistake.

Don’t miss your chance

Looking at all the options you have for Medicare coverage is a great way to prepare for open enrollment. If you use your time now wisely, then by the time mid-October comes, you’ll be more than ready to make the best available choice to take maximum advantage of Medicare for 2024.

Services Not Covered by Medicare Parts A & B

- Routine dental care/dentures

- Cosmetic Surgery

- Custodial/Long Term Care

- Health care while traveling outside the United States

- Concierge Care (also called concierge medicine, retainer-based medicine, boutique medicine, direct care)

- Outpatient prescription drugs (this is covered under Part D)

- Massage Therapy

- Routine eye care and eyeglasses

- Hearing aids

- Covered items or services provided by a doctor or other provider who has opted out of Medicare (except in the case of an emergency or urgent need)