Medical bills can be overwhelming, especially in Illinois, where healthcare costs continue to rise. Fortunately, several organizations can help you reduce, negotiate, or manage these expenses. Here are five key resources:

- Rising Medical Solutions: Focuses on reducing healthcare costs for insurers and employers, identifying errors and overcharges.

- Goodbill: Offers free hospital bill reviews and negotiations for insured and uninsured patients.

- Resolve Medical Bills: Provides patient advocacy, bill reviews, and direct negotiations with providers.

- Right Medical Billing: Specializes in handling out-of-network charges and emergency care costs.

- Illinois Health Agents: Helps individuals and businesses plan insurance coverage and reduce out-of-pocket expenses.

Each organization offers specific services to address different aspects of medical billing challenges, from error corrections to preventive insurance planning. Whether you’re dealing with debt collectors or trying to avoid future issues, these resources can make a difference.

Quick Comparison:

| Resource | Focus | Cost | Eligibility |

|---|---|---|---|

| Rising Medical Solutions | Reducing payer costs | Fee-based | Insurers, employers |

| Goodbill | Hospital bill negotiation | Free | All patients |

| Resolve Medical Bills | Advocacy and bill review | Fee-based | Patients with debt |

| Right Medical Billing | Out-of-network charge handling | Fee-based | Patients with surprise bills |

| Illinois Health Agents | Insurance planning | Varies | Individuals, families, businesses |

Take the first step by gathering your medical bills, income details, and insurance information. Then, reach out to the resource that fits your needs to start resolving your medical bill challenges.

Can’t Pay Your Medical Bill? Don’t Panic, Do This First

Top 5 Medical Bill Assistance Resources

Struggling with medical bills? These five organizations are here to help, offering services designed to ease the stress of navigating complex healthcare costs. Each group brings something different to the table, so you can find the support that fits your situation.

Rising Medical Solutions

Based in Chicago, Rising Medical Solutions specializes in managing healthcare costs for insurance carriers, third-party administrators, self-insured employers, and government entities. While they don’t work directly with individual patients, their services – like medical bill reviews, nurse audits, and provider negotiations – focus on reducing unnecessary charges. Using their proprietary VISION™ platform, they’ve reportedly saved the U.S. healthcare system over $2 billion by tackling duplicate billings, fraud, and inappropriate charges. Their efforts have led to savings of over 60% for their payer clients.

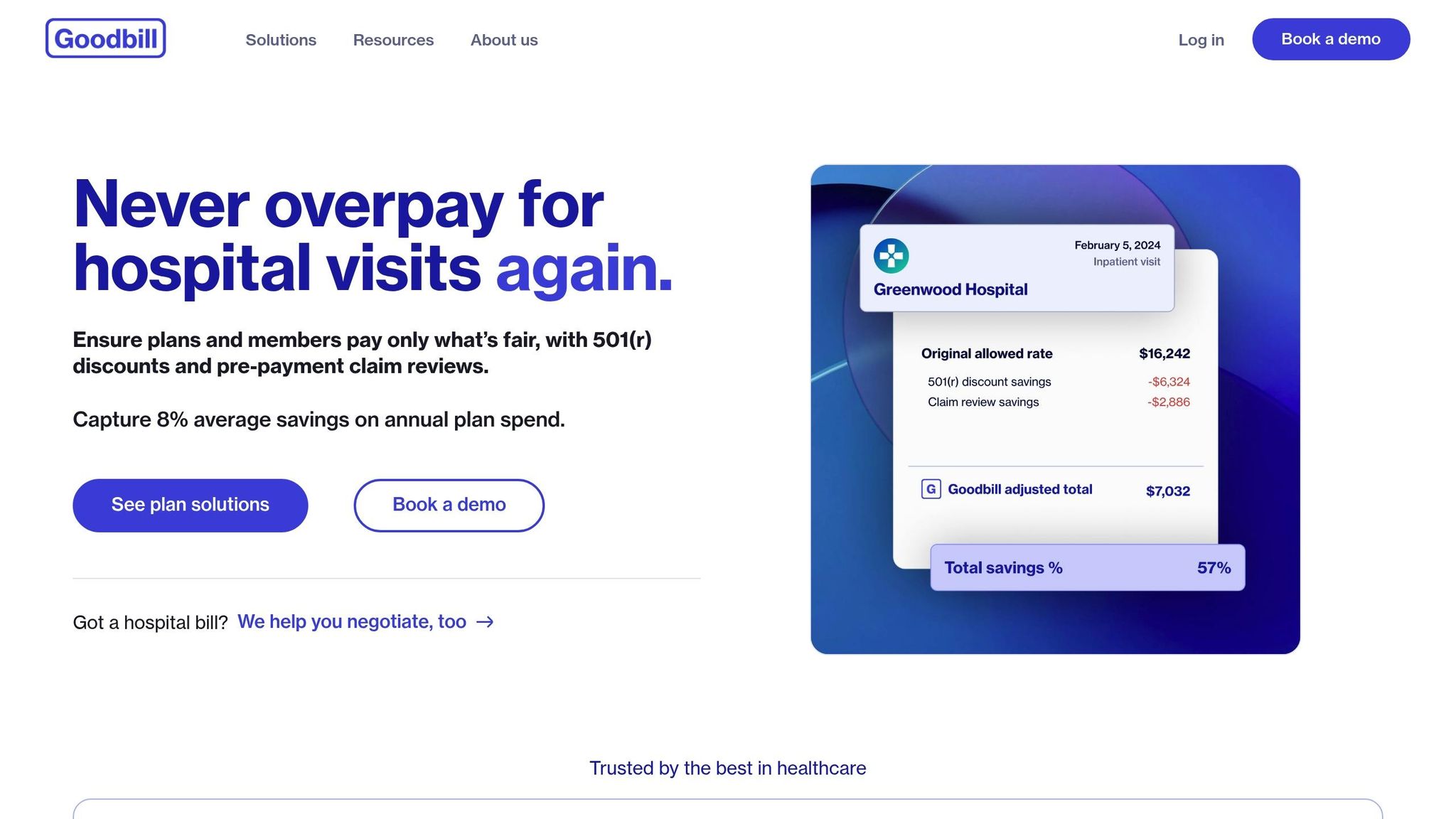

Goodbill

Goodbill simplifies the process of negotiating hospital bills and does it for free. Whether you’re insured or uninsured, their team focuses on hospital-related costs, which are often the largest part of medical debt. They review your bills for errors and overcharges, then handle all communication with the hospital’s billing department. This takes the stress off your shoulders and ensures you’re not paying more than you should.

Resolve Medical Bills

Resolve Medical Bills is all about patient advocacy. Their team works closely with clients to understand their specific circumstances, carefully reviews bills for mistakes, and negotiates directly with healthcare providers or collection agencies. By focusing on reducing overcharges and resolving billing errors, they help patients navigate even the most complicated medical billing challenges.

Right Medical Billing

If you’ve ever received a surprise bill from an out-of-network provider, Right Medical Billing can help. They specialize in negotiating out-of-network charges for hospitals and emergency room services, particularly in Illinois. With expertise in balance billing and emergency care costs, they guide patients through the often-confusing world of insurance gaps and unexpected expenses.

Illinois Health Agents

Illinois Health Agents focuses on reducing out-of-pocket medical costs through personalized insurance planning. They offer a range of services, including group health insurance for businesses, individual and family health plans, and Affordable Care Act options. They even provide specialized coverage for vision, dental, and life insurance.

A standout feature is their guidance on Health Savings Accounts (HSAs), which allow Illinois residents to save pre-tax dollars for medical expenses while enjoying potential tax benefits. With their deep understanding of Illinois-specific insurance rules, they offer ongoing support, like annual reviews and employee education, to help clients make the most of their coverage and lower healthcare expenses effectively.

Feature and Cost Comparison

When it comes to managing healthcare costs, understanding the features and pricing of available resources is crucial. Each organization brings its own focus, fee structure, eligibility requirements, and range of services, making it easier to find one that fits your needs.

Here’s a breakdown of key features:

| Resource | Primary Focus | Cost Structure | Eligibility | Savings Potential | Additional Support |

|---|---|---|---|---|---|

| Rising Medical Solutions | Managing healthcare costs for payers | Fee-for-service | Insurance carriers, employers, government entities | Variable | Digital tools and billing audits |

| Goodbill | Hospital bill negotiation | Free for patients | Insured and uninsured patients | Varies by case | Patient support and provider communication |

| Resolve Medical Bills | Advocacy and bill review for patients | Fee-based | Patients managing medical debt | Varies by case | Billing error resolution and negotiation support |

| Right Medical Billing | Out-of-network charge negotiation | Fee-based | Patients with unexpected bills | Varies by case | Expertise in balance billing and emergency care |

| Illinois Health Agents | Preventive insurance planning | Free consultation; plan-dependent pricing | Individuals, families, and businesses | Long-term cost reduction | Support with Health Savings Accounts (HSAs), annual reviews, and employee education |

Each service addresses specific billing challenges, offering unique solutions. For instance, Goodbill is entirely free for patients, while others charge fees based on the complexity of the case. Illinois Health Agents provides free group consultations for businesses with 10 or more employees. For smaller businesses, there’s a $250 annual fee, which is waived if at least 10 employees enroll.

The timing of intervention also differs. Rising Medical Solutions steps in early, managing costs before bills reach patients. In contrast, Goodbill, Resolve Medical Bills, and Right Medical Billing focus on resolving issues after they arise. Meanwhile, Illinois Health Agents aims to prevent problems altogether by offering tailored insurance plans and tax-beneficial HSAs.

The scope of services varies significantly. Right Medical Billing specializes in handling out-of-network charges, while Illinois Health Agents offers a broad range of preventive insurance solutions. Their services include group health insurance, individual plans, Medicare supplements, and specialized coverage for vision, dental, and life insurance. With a deep understanding of Illinois-specific insurance regulations and market dynamics, they help clients navigate state healthcare policies effectively.

Next, learn how to access these services.

sbb-itb-a729c26

How to Get Medical Bill Help

Navigating medical bills can feel overwhelming, but with the right steps, you can find the assistance you need. In Illinois, the process requires preparation and persistence, but many resources are available to help. While each program or service has its own requirements, certain steps are common to all.

Start by gathering all necessary documentation. This includes your medical bills, Explanation of Benefits (EOBs), personal details (like your name, date of birth, and address), proof of Illinois residency, household composition, and income verification (such as pay stubs or tax returns). Having these documents ready ensures representatives can better understand your situation and identify any potential errors or overcharges. If you’re uninsured, a Social Security Number isn’t required to qualify for charity care, but it can be helpful if you’re applying for public programs like Medicaid.

"IF YOU ARE UNINSURED, A SOCIAL SECURITY NUMBER IS NOT REQUIRED TO QUALIFY FOR FREE OR DISCOUNTED CARE. However, a Social Security Number is required for some public programs, including Medicaid. Providing a Social Security Number is not required, but will help the hospital determine whether you qualify for any public programs."

Calculate your gross monthly income. Add up income from all sources, including wages, unemployment benefits, Social Security payments, pensions, child support, and self-employment earnings. Hospitals in Illinois use standardized financial assistance application forms provided by the Illinois Health and Hospital Association, which require documentation of these income sources.

Organize your financial details. Include information about your insurance (if you have any), assets, and monthly expenses. Assets might include checking and savings accounts, stocks, vehicles, property, and Health Savings or Flexible Spending Accounts. Monthly expenses could include housing, utilities, food, and credit card payments. Nonprofit hospitals often require this information when reviewing charity care applications, as noted by Illinois Legal Aid Online.

Reach out to the resource you’ve chosen. Whether it’s a hospital’s financial assistance department or services like Goodbill or Resolve Medical Bills, contact them directly to begin the application process. Each organization has its own forms and policies, so this step is essential for moving forward.

Notify debt collectors about your application. If you’re dealing with debt collectors, let them know you’ve applied for financial assistance and request that they pause collection activities while your application is being reviewed. This can give you some much-needed breathing room.

Stay on top of your application. Processing medical bill assistance can take time, especially if your case is complex. Follow up regularly to check on the status of your application, and be ready to provide additional information if needed. Keep detailed records of all communications, including the names of representatives you speak with, dates, and any reference numbers.

Plan for the future. To avoid similar issues down the road, consider preventive measures like tailored insurance planning. Illinois Health Agents, for example, can help you understand state-specific insurance regulations and explore options like Health Savings Accounts, which offer tax advantages for medical expenses. If your first approach doesn’t work out, don’t hesitate to try other resources. Staying organized, persistent, and honest about your financial situation will improve your chances of finding a solution.

Conclusion: Lowering Medical Costs in Illinois

Dealing with medical bills doesn’t have to be something you face alone. In Illinois, there are plenty of resources that can help reduce healthcare expenses, from specialized negotiation services to statewide financial assistance programs. The key is identifying the right solution for your circumstances and acting before those bills spiral out of control. Beyond immediate relief, planning ahead is equally important.

The best way to avoid medical debt is prevention. Having the right insurance coverage from the start can save you from many financial struggles. Tools like Health Savings Accounts (HSAs) offer a smart way to prepare for future expenses. These tax-advantaged accounts let you save pre-tax dollars specifically for medical costs, creating a financial safety net. When combined with high-deductible health plans, HSAs can lower your overall healthcare spending while still offering solid coverage.

Combining immediate help with forward-thinking strategies can make a big difference. Whether it’s negotiating current bills or building a better insurance plan for the future, taking action is crucial. Illinois residents who take advantage of these resources often see far better results than those who let bills pile up or stick with inadequate insurance options.

With the right approach, medical expenses can shift from overwhelming to manageable.

FAQs

How can I find the best medical bill assistance program for my needs in Illinois?

To locate a medical bill assistance program in Illinois that fits your needs, start by assessing your financial situation, residency status, and current insurance coverage. Depending on your circumstances, you might qualify for programs like Medicaid or financial aid through the Illinois Department of Human Services. Additionally, many hospitals provide Charity Care or income-based financial assistance programs to help patients manage their medical expenses.

You can also turn to nonprofit organizations that focus on medical debt relief. These groups often assist with applications for hospital aid or help negotiate your bills. By clearly understanding your financial needs and eligibility, you can find the right program to ease the burden of your medical costs.

How can I prepare before reaching out for help with medical bills in Illinois?

Before reaching out to organizations for help with medical bills in Illinois, it’s important to get organized. Start by reviewing your medical bills thoroughly to check for any mistakes or inconsistencies. Gather key documents like your medical bills, insurance information, and proof of income. Having everything ready ahead of time can make the process much easier.

You might also want to draft a short explanation of your financial situation and the type of assistance you’re seeking. This can be useful when applying for help or negotiating payment terms. Additionally, take some time to research programs such as hospital financial aid or state-run initiatives to find out what you may qualify for. Being well-prepared and informed can improve your chances of getting the support you need.

What are some long-term strategies to avoid medical debt in the future?

To steer clear of medical debt over time, here are some practical steps to consider:

- Choose the right health insurance: Select a health insurance plan that aligns with your needs and budget. Make sure you understand the details of your coverage, including deductibles, copays, and out-of-pocket maximums, so you’re not caught off guard by unexpected expenses.

- Take advantage of a Health Savings Account (HSA): If you qualify, contribute to an HSA to set aside pre-tax money for medical costs. This can be a helpful way to handle surprise bills while also lowering your taxable income.

- Prioritize preventive care: Regular check-ups and screenings can help catch potential health issues early, possibly saving you from larger medical bills down the road. Living a healthy lifestyle can also reduce the likelihood of preventable conditions.

- Incorporate healthcare into your financial plan: Factor healthcare costs into your overall budget and savings goals. Being proactive about this can help you avoid turning to credit cards or loans when medical expenses come up.

By weaving these strategies into your financial planning, you can better protect yourself from medical debt and create a more stable financial future.

0 Comments