Offering health insurance to employees can be costly, but small businesses in Illinois may qualify for a federal tax credit to offset these expenses.

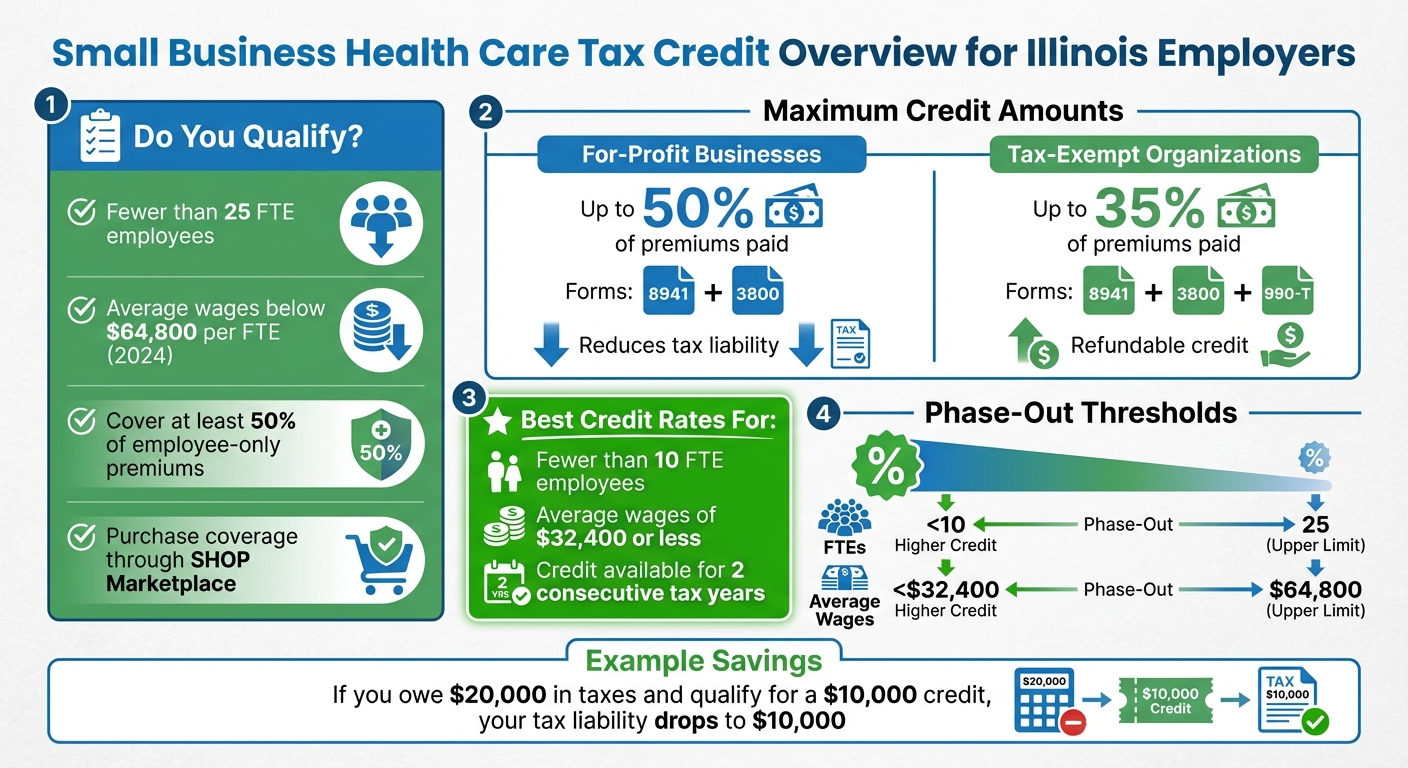

The Small Business Health Care Tax Credit, introduced under the Affordable Care Act (ACA), allows eligible small businesses to claim up to 50% of health insurance premiums paid (35% for tax-exempt organizations). This credit is designed for businesses with fewer than 25 full-time equivalent (FTE) employees and average wages below $64,800 (as of 2024). To qualify, employers must:

- Have fewer than 25 FTE employees.

- Pay average annual wages under $64,800 per FTE.

- Cover at least 50% of employee-only premiums.

- Purchase coverage through the SHOP Marketplace.

This credit directly reduces your federal tax liability and is available for two consecutive tax years. Smaller businesses – those with fewer than 10 employees and average wages of $32,400 or less – benefit the most.

To claim the credit, businesses must complete IRS Form 8941 and include it with their tax return. Tax-exempt organizations follow a slightly different process, filing Form 990-T for a refundable credit.

For Illinois businesses, working with brokers like Illinois Health Agents can simplify plan selection and ensure compliance with IRS rules.

Small Business Health Care Tax Credit Eligibility Requirements and Benefits

What Is The Small Business Health Care Tax Credit? – BusinessGuide360.com

How the Small Business Health Care Tax Credit Works

This tax credit directly lowers your federal tax bill. For instance, if you owe $20,000 in taxes and qualify for a $10,000 credit, your tax liability drops to $10,000. Businesses have been able to claim this credit for two consecutive tax years since 2014.

Credit Percentages and Requirements

For-profit businesses can claim up to 50% of their employees’ health insurance premiums, while tax-exempt organizations can receive up to 35%, offering comparable benefits. The full credit is available to businesses with fewer than 10 full-time equivalent (FTE) employees and average wages of $32,400 or less (for 2024). However, the credit gradually reduces as businesses approach 25 FTEs or an average wage of $64,800.

To qualify, employers must purchase coverage through the SHOP Marketplace and contribute at least 50% of each employee’s single coverage premium. Contributions must be consistent across all eligible employees. Additionally, the IRS caps eligible contributions based on the average cost of health insurance in your state, ensuring businesses don’t opt for overly expensive plans.

Key Terms You Need to Know

- Full-time equivalent (FTE) employees: This metric converts part-time work into full-time positions. For example, two employees working 20 hours per week equal one FTE. Seasonal workers are excluded unless they work more than 120 days in a year.

- Average annual wages: This is calculated by dividing your total payroll by the number of FTEs. For example, if a restaurant in Illinois pays $270,000 in wages to 10 FTEs, the average annual wage is $27,000, which meets the criteria for the maximum credit.

- Employer premium contributions: To qualify for the credit, you must cover at least 50% of the self-only premium for each employee. This percentage must be applied equally to all eligible employees.

Understanding these terms is essential for making informed decisions about selecting and managing health plans in Illinois.

Illinois Small Group Health Insurance Options

Small businesses in Illinois can choose from ACA-compliant small group plans available through the SHOP Marketplace. Options include HMOs, PPOs, and high-deductible health plans, which can be paired with Health Savings Accounts. Illinois Health Agents (https://ilhealthagents.com) offers personalized support to small businesses, helping them navigate plan options from top-rated carriers. This ensures both employee needs are met and tax credit eligibility is maximized. Up next, we’ll dive into the specific eligibility requirements for small employers in Illinois.

Eligibility Requirements for Illinois Small Employers

To determine if your Illinois business qualifies for the Small Business Health Care Tax Credit, you’ll need to meet four key criteria. These requirements are designed to ensure that only genuinely small employers are eligible.

Eligibility Requirements Checklist

Here’s what you need to check off:

- Fewer than 25 FTEs (Full-Time Equivalents): Your business must employ fewer than 25 full-time equivalent employees.

- Average annual wages below $64,800 per FTE: The average wages for your employees must not exceed this threshold.

- Cover at least 50% of employee self-only premiums: You must pay at least half of the self-only premium costs for each eligible employee, applying this consistently across your workforce.

- Purchase coverage through a SHOP Marketplace: Coverage must be obtained through the SHOP Marketplace, unless there are no available SHOP plans in your area.

The credit is most beneficial for very small businesses – those with fewer than 10 employees earning an average of $32,400 or less (adjusted for 2024). However, as your FTE count nears 25 or average wages approach $64,800, the credit percentage decreases.

Once you’ve reviewed these criteria, it’s important to understand how different types of workers, including owners and seasonal staff, factor into the calculation.

How Owners and Family Members Are Counted

When calculating your FTE count and average wages, seasonal workers are excluded unless they work more than 120 days during the tax year. For part-time staff, their hours are combined to calculate FTEs – for example, two employees working 20 hours per week equal one FTE. The IRS provides specific rules for seasonal workers, but it’s a good idea to consult a tax professional to clarify how owners, partners, and family members should be counted.

Quick Eligibility Assessment

To quickly assess your eligibility, follow these steps:

- Calculate FTEs: Add up the total weekly hours worked by part-time employees and divide by 40. For example, 15 employees working a combined 300 hours per week equal 7.5 FTEs.

- Determine average wages: Divide your total annual payroll by your FTE count. For instance, a $240,000 payroll divided by 7.5 FTEs gives an average wage of $32,000, which qualifies.

- Confirm premium contributions: Ensure you’re covering at least 50% of the self-only premiums for employees.

- Verify SHOP Marketplace coverage: Confirm that your health plan is purchased through the SHOP Marketplace or that you qualify for an exception.

If all four criteria are met, your business qualifies for the tax credit.

How to Calculate and Claim the Tax Credit

Once you’ve confirmed your eligibility, the next step is to calculate your tax credit accurately to ensure you maximize your benefits. The IRS provides worksheets to guide you through this process, making it easier to handle the calculations.

Calculating Your Tax Credit Amount

There are four main steps involved in determining your tax credit:

- Determine Your FTE Count:

Start by listing each employee’s total hours worked (using Worksheet 1). Then, divide the total by 2,080 (refer to Worksheet 2) to calculate your Full-Time Equivalent (FTE) employee count. - Calculate Average Annual Wages:

Use Worksheet 3 to add up the wages listed on Worksheet 1. Divide this amount by your FTE count to determine the average annual wages paid to employees. - Record Employer Contributions:

Document the total health insurance premiums paid by your business using Worksheet 4. - Apply IRS Formulas:

Finally, input all this information into Form 8941. The form will calculate your credit based on your FTE count, average wages, and employer-paid premiums.

Keep in mind that the credit is available for only two consecutive tax years. To avoid any issues, it’s crucial to maintain precise and organized records from the start.

Once you’ve completed your calculations, you’re ready to file the necessary forms.

Filing Requirements and Forms

For-profit employers need to fill out Form 8941 to calculate the credit, then report the amount on Form 3800, which consolidates all general business credits. Both forms should be submitted with your income tax return.

Tax-exempt organizations follow a slightly different process. Along with Forms 8941 and 3800, they must also file Form 990-T to claim the credit as a refundable benefit.

Accuracy is key – errors in your worksheets or forms could impact the credit amount you receive.

For-Profit vs. Tax-Exempt Employers: Claiming Differences

The process for claiming the tax credit differs depending on whether you’re a for-profit business or a tax-exempt organization. Here’s a comparison:

| Feature | For-Profit Employers | Tax-Exempt Employers |

|---|---|---|

| Maximum Credit Percentage | Up to 50% of premiums paid | Up to 35% of premiums paid |

| Required Forms | Form 8941, Form 3800 | Form 8941, Form 3800, Form 990-T |

| Claiming Process | Reduces tax liability | Reported as a refundable credit |

The lower credit percentage for tax-exempt organizations ensures they receive a benefit comparable to for-profit businesses. This adjustment accounts for the fact that for-profit employers cannot deduct the credit amount from their taxes.

sbb-itb-a729c26

Strategies to Maximize Your Tax Benefits

Once you’ve got a handle on calculating and claiming the credit, there are additional ways to fine-tune your approach and make the most of your tax savings. By carefully planning contributions, coordinating benefits, and selecting the right plan, you can unlock more savings.

Structuring Contributions to Meet Credit Requirements

The first step to maximizing your credit is ensuring you meet the 50% contribution threshold – this means covering at least half of the single coverage premium for each full-time employee. While meeting the minimum qualifies you, contributing more can increase the total credit amount without changing the credit rate.

Smaller businesses, particularly those with fewer than 10 full-time equivalent (FTE) employees and average wages of $27,000 or less, benefit the most from this credit. However, the credit starts to phase out as you approach 25 FTEs or average wages nearing $65,000 (adjusted annually for inflation).

From here, consider how to pair this credit with other tax-advantaged accounts to maximize your benefits.

Coordinating With HSAs and HRAs

Strategically combining the Small Business Health Care Tax Credit with other tax-advantaged accounts can stretch your savings further. However, there are rules to keep in mind. For example, if you’re using SHOP Marketplace coverage to claim the credit, you cannot offer a Qualified Small Employer Health Reimbursement Arrangement (QSEHRA), as QSEHRAs are intended for employers without group health plans.

Instead, you can explore options like an Integrated HRA (also known as a Group Coverage HRA), which supplements your SHOP plan by covering additional employee costs. Another option is an Excepted Benefit HRA (EBHRA), which allows up to $2,100 annually (as of 2025) to reimburse supplemental costs such as dental, vision, or COBRA premiums – though individual health insurance premiums are excluded. Contributions to these HRAs are typically tax-deductible for your business and tax-free for employees when structured correctly.

For employees enrolled in high-deductible health plans, Health Savings Accounts (HSAs) provide another layer of tax benefits. Employees can make pre-tax contributions and withdraw funds tax-free for qualified medical expenses, adding flexibility and savings.

Once you’ve coordinated these benefits, it’s time to focus on selecting the right plan for your business.

Choosing the Right Plan in Illinois

The health plan you choose plays a key role in determining your credit eligibility. To qualify for the Small Business Health Care Tax Credit, you must offer ACA-compliant coverage through the SHOP Marketplace. Plans purchased outside of SHOP – even if they meet ACA standards – won’t qualify.

In Illinois, premium costs can vary widely depending on factors like location, employee demographics, and coverage options. Since the credit is based on your actual premium contributions, higher premiums can lead to a larger credit amount (up to 50% for for-profit businesses or 35% for tax-exempt organizations). That said, it’s crucial to balance premium levels with your employees’ needs and your budget.

To navigate these choices, working with a knowledgeable broker can make all the difference. For example, Illinois Health Agents specialize in helping small businesses design employer contributions, coordinate HSAs with group plans, and select SHOP coverage that maximizes both employee benefits and tax savings. Their expertise can simplify the process and ensure you’re making the most informed decisions.

How Illinois Health Agents Can Help You Maximize Tax Benefits

Dealing with the complexities of SHOP Marketplace requirements and IRS rules can feel like a full-time job, especially when you’re already juggling the demands of running a business. That’s where working with a broker can make all the difference. We simplify the process, helping you save time and money by streamlining plan selection, contribution strategies, and compliance efforts.

Choosing the Right Plans

The first step to unlocking tax benefits is selecting a qualified plan. To be eligible for the Small Business Health Care Tax Credit, employers typically need to enroll in a plan through the SHOP Marketplace. Even if a plan purchased outside the SHOP meets ACA standards, it usually won’t qualify for the credit. That’s why Illinois Health Agents are here – to guide you through the SHOP enrollment process and ensure the plan you choose aligns with all IRS requirements. And if SHOP plans aren’t available in your area, our team can recommend alternative options that still meet IRS guidelines.

Structuring Employer Contributions for Savings

How you structure your employer contributions can significantly impact your tax savings. Illinois Health Agents help you optimize contributions by factoring in key elements like the number of employees and their average wages. Need a refresher on the eligibility criteria? Check out the earlier section for details. We’ll also explain phase-out thresholds and ensure your contributions stay within the limits set by the average health insurance costs in Illinois. This tailored guidance ensures you’re fully compliant with IRS rules while making the most of available tax credits.

Ongoing Support and Documentation Assistance

As your business evolves, so do IRS thresholds and premium costs. That’s why Illinois Health Agents provide annual plan reviews to help you adjust coverage as your workforce or wages change. This proactive approach ensures you remain compliant year after year. We also assist with the documentation required to claim the tax credit, including step-by-step guidance on filling out Form 8941 (Credit for Small Employer Health Insurance Premiums). With our support, you’ll be ready for tax season and well-positioned to claim the full credit you’ve earned.

Conclusion: What Illinois Small Businesses Need to Know

The Small Business Health Care Tax Credit provides a way for Illinois employers to ease the financial burden of offering health coverage to their employees. For eligible businesses, this credit can cover up to 50% of employee health premiums (for-profit) or 35% for tax-exempt organizations, helping to significantly reduce benefit costs. The credit works on a sliding scale, meaning smaller businesses – those with fewer than 10 full-time equivalent employees and average wages of about $27,000 or less – qualify for the highest percentage. Partnering with knowledgeable professionals can make navigating this process much simpler.

To qualify, your business must meet these key requirements: employ fewer than 25 full-time equivalent employees, maintain average wages below the set threshold (e.g., under $62,000 for 2023), and pay at least 50% of employee-only premiums. Additionally, enrollment in a qualified health plan through the Small Business Health Options Program (SHOP) Marketplace is generally required. Once eligibility is confirmed, you can claim the credit by filing Form 8941, and it can be applied for up to two consecutive tax years.

Beyond reducing taxes, this credit offers other financial benefits. Premium costs exceeding the credit are tax-deductible, and any unused credit can be carried back to previous tax years or forward to future ones, giving your business more flexibility and improving cash flow.

FAQs

What do small businesses need to qualify for the Health Care Tax Credit?

To be eligible for the Small Business Health Care Tax Credit, your business must meet the following requirements:

- Employ fewer than 25 full-time equivalent (FTE) employees.

- Pay an average yearly wage of $65,000 or less per employee.

- Contribute at least 50% of the cost of single-coverage health insurance premiums for employees.

- Provide health insurance through the Small Business Health Options Program (SHOP) marketplace to all full-time employees.

This tax credit aims to ease the financial burden of offering health insurance, making it more accessible for small businesses to support their employees.

How can small businesses with fewer than 10 employees benefit from health insurance tax credits?

Small businesses with fewer than 10 employees may be eligible for a tax credit that covers up to 50% of the premiums paid for employee health insurance. This credit can help significantly lower the expense of offering health coverage, making it easier for small employers to provide this important benefit to their teams.

To qualify, businesses need to meet certain requirements, including having fewer than 25 full-time equivalent employees, paying average annual wages below a specified limit, and covering at least 50% of their employees’ health insurance premiums. This program offers a practical way for small businesses to offer health benefits without straining their budgets.

Can non-profit organizations qualify for the Small Business Health Care Tax Credit, and how is the process different?

Yes, non-profit organizations can qualify for the Small Business Health Care Tax Credit, but the credit is offered at a lower rate compared to for-profit businesses. While for-profit employers may receive up to 50% of the premiums they pay, non-profits are eligible for a maximum of 35%. To qualify, the organization must meet these basic requirements: fewer than 25 full-time-equivalent employees, average annual wages of about $65,000 or less, paying at least half of employees’ single-coverage premiums, and purchasing coverage through the SHOP Marketplace.

The filing process for non-profits has a slight variation. They use Form 8941 to calculate the credit but must follow IRS instructions specific to tax-exempt entities to report it on their annual return. This ensures the credit is applied correctly at the 35% rate. While the reporting process differs, the calculation steps are largely the same as those for for-profit businesses, keeping the process manageable for eligible organizations.

Recent Comments