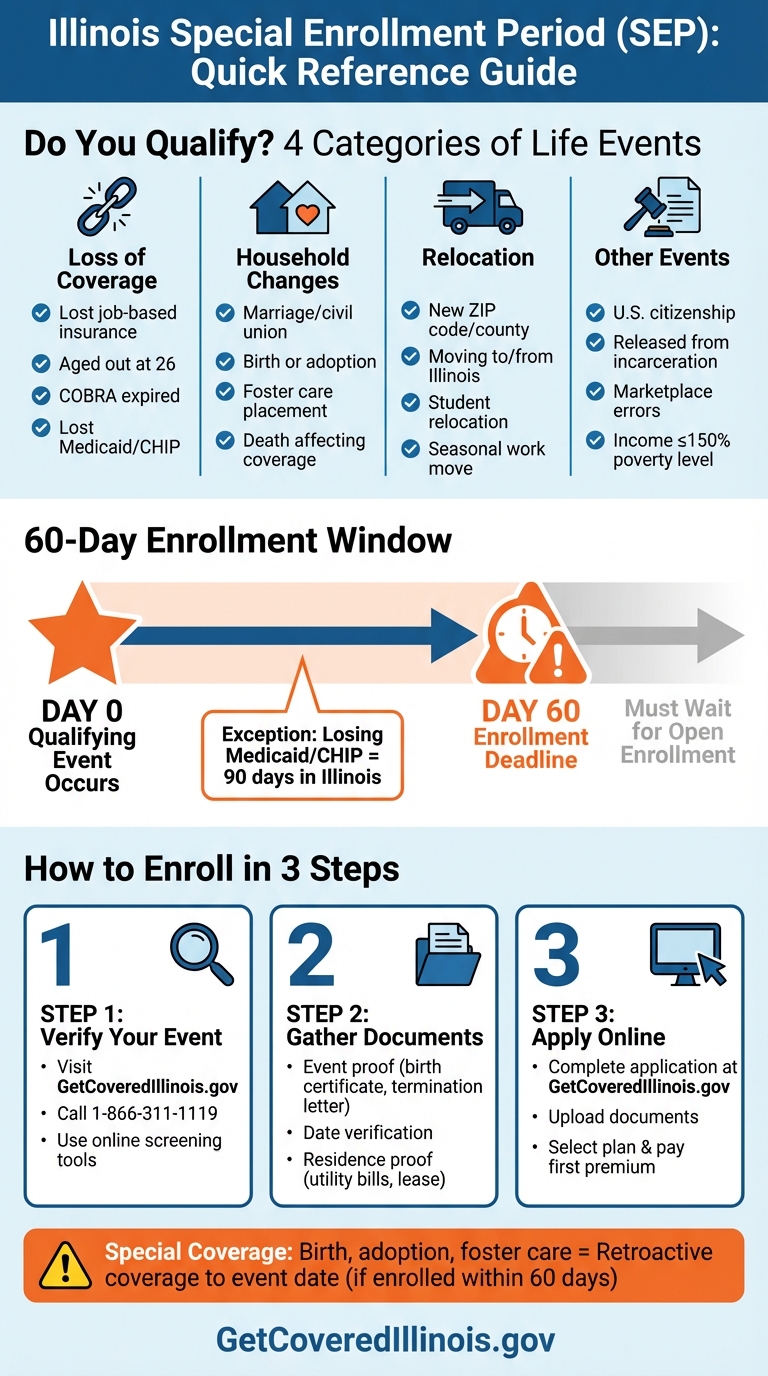

Missed Open Enrollment? You might still qualify for health insurance in Illinois. Special Enrollment Periods (SEPs) allow you to enroll or switch health plans after certain life events. These events include losing coverage, having a baby, moving to a new area, or even becoming a U.S. citizen. SEPs typically last 60 days from the event date, so acting quickly is crucial to avoid coverage gaps.

Key Life Events That Trigger SEPs:

- Loss of Coverage: Examples include losing job-based insurance, aging out of a parent’s plan at 26, or losing Medicaid/CHIP eligibility.

- Household Changes: Marriage, childbirth, adoption, or a family member’s death that affects coverage.

- Relocation: Moving to a new ZIP code, state, or country, or a student relocating for school.

- Other Events: Gaining U.S. citizenship, being released from incarceration, or errors in your previous enrollment.

Important Details:

- Deadline: You have 60 days from the event to enroll. Missing this window means waiting for the next Open Enrollment Period.

- Proof Required: Documents like birth certificates, termination letters, or utility bills are needed to verify your event.

Visit GetCoveredIllinois.gov to check eligibility, gather documents, and enroll online.

Illinois Special Enrollment Period: Qualifying Events and 60-Day Enrollment Timeline

Get Covered Illinois Special Enrollment Period Is Open Now

Qualifying Life Events for Illinois Special Enrollment

Here’s a breakdown of life events that allow Illinois residents to qualify for special enrollment adjustments.

Loss of Health Coverage

Losing your health insurance can open a Special Enrollment Period. This includes situations like losing job-based coverage, COBRA expiring, turning 26 and aging out of a parent’s plan, or losing eligibility for Medicaid or CHIP.

To confirm your eligibility, you’ll need to provide proof, such as a termination letter, COBRA notice, or a Certificate of Credible Coverage. Keep in mind, voluntarily canceling your plan or failing to pay premiums does not qualify as a valid reason.

Changes in Household Size

Certain family changes trigger a 60-day window for special enrollment. For instance, getting married or entering a civil union qualifies. So does having a baby, adopting a child, or placing a child in foster care. If a family member’s death leads to a loss of coverage, it qualifies too. Divorce or legal separation only counts if it directly results in losing health insurance.

For births or adoptions, coverage can even be retroactively applied to the date of the event, as long as you enroll within the 60-day period. Documentation like a marriage license, birth certificate, adoption papers, or a divorce decree will be required to verify the change.

Changes in Residence

Relocating to a new area can qualify you for special enrollment. This includes moving to a different ZIP code or county, relocating to Illinois from another state or country, or being a student moving to or from the area where you attend school. Seasonal workers moving for employment purposes also qualify.

To prove eligibility, you’ll need to show you had coverage for at least one day during the 60 days prior to your move. Documents like utility bills, lease agreements, mortgage statements, or school records can serve as proof of your relocation.

Other Qualifying Events

Additional events that could qualify include having a household income at or below 150% of the federal poverty level, gaining access to an ICHRA or QSEHRA, becoming a U.S. citizen, being released from incarceration, changes in AmeriCorps service, enrollment errors by an insurer or the Marketplace, or losing Medicaid/CHIP (Illinois allows up to 90 days for this).

For each of these events, you’ll need to provide the relevant documentation, such as naturalization papers for citizenship or release paperwork for incarceration, to confirm your eligibility.

Documentation Requirements and Deadlines

What Documents You’ll Need

To complete your application, you’ll need two types of proof: one confirming the event happened and another showing the event’s date. For household changes, you can use documents like a marriage license, birth certificate, or court-ordered adoption papers. If you’re dealing with a loss of coverage, acceptable documents include an employer termination letter, a notice from your insurer, or a Certificate of Credible Coverage.

For residential moves, you’ll need evidence such as a utility bill or a lease agreement that lists your new address. It’s crucial that all documents clearly display the date of the event, as this determines your 60-day window to enroll. Before you submit anything, double-check that your paperwork meets the specific requirements set by your state and insurer to avoid unnecessary delays or rejections. Staying organized and on top of these details is key to activating your new coverage without hiccups.

Submission Deadlines and Coverage Start Dates

The clock starts ticking on your 60-day enrollment window as soon as the event occurs. Missing this deadline means you’ll have to wait until the next Open Enrollment Period to sign up. Blue Cross and Blue Shield of Illinois explains:

You normally have 60 days after your life event to pick a plan.

In most cases, coverage begins on the first day of the month after you enroll. However, certain life events come with retroactive coverage:

There are a few life events, like birth, adoption, fostering or court order, that allow coverage to start on the day of your life event.

For instance, if your baby is born on December 10, 2025, and you enroll by February 8, 2026, your baby’s coverage can start retroactively from December 10.

If you’re waiting on certain documents, like a newborn’s Social Security number, you can still begin your application. Submit the remaining paperwork as soon as it’s available, but remember that your coverage won’t be finalized until everything is verified.

sbb-itb-a729c26

How to Enroll During Special Enrollment

Step 1: Verify Your Qualifying Event

Before diving into the application process, make sure your life event qualifies for a Special Enrollment Period (SEP). Not all life changes trigger an SEP, so double-check that your situation matches one of the qualifying events mentioned earlier.

To confirm, visit the Get Covered Illinois website or call their Customer Assistance Center at 1-866-311-1119. You can also use the online screening tools at GetCoveredIllinois.gov. Remember, the clock is ticking – your 60-day enrollment window starts the day your qualifying event happens. If you miss this deadline, you’ll likely need to wait for the next Open Enrollment Period. Once your event is verified, you’re ready to gather the necessary documents.

Step 2: Gather Your Documents

After confirming your eligibility, collect all the documents needed to verify your qualifying event and its date. This could include items like a termination letter, marriage certificate, birth certificate, or a utility bill. If any of these documents require translation, make sure to include certified versions.

Scan and organize digital copies of these documents so they’re ready for upload. Being prepared ahead of time can save you from delays and help you stay within the 60-day enrollment window. Once your documents are in order, you’re set to apply online.

Step 3: Complete Your Application Online

Head to GetCoveredIllinois.gov to start your application. The platform is accessible 24/7, so you can apply anytime – even outside normal business hours. During the process, you’ll need to provide personal details, income information, and upload your qualifying event documentation.

After submitting your information, you’ll see the available health plans and find out if you’re eligible for subsidies to lower your monthly premiums. Once you select a plan, make sure to finalize your enrollment and pay your first premium within the 60-day window. If you run into any issues or have questions, the Help Center on the Get Covered Illinois website connects you with certified enrollment specialists who can guide you.

Conclusion

Understanding qualifying events and Special Enrollment Period (SEP) rules is crucial to avoiding coverage gaps. Whether it’s a change in household size, moving to a new location, or losing existing coverage, these situations demand quick action within the 60-day enrollment window.

Missing your SEP could result in hefty medical expenses and the loss of financial assistance. Once a qualifying event occurs, make sure to gather any required documents – like a termination letter, marriage certificate, or birth certificate – and begin your application process at GetCoveredIllinois.gov.

If you’re unsure about your eligibility or need help navigating the enrollment process, Illinois Health Agents can offer tailored support. Staying on top of these rules ensures you and your family remain covered when unexpected changes arise.

FAQs

What should I do if I miss the 60-day Special Enrollment Period deadline?

If you miss the 60-day Special Enrollment Period, enrolling in a health insurance plan will have to wait until the next Open Enrollment Period – unless you qualify for specific alternatives. These options might include Medicaid, COBRA, or short-term health insurance, depending on your circumstances.

To prevent any lapse in your coverage, it’s crucial to act swiftly after a qualifying life event. Make sure to collect all required documentation and submit your application within the designated time frame.

Can I qualify for special enrollment if I cancel my current health insurance plan?

No, choosing to cancel your current health insurance plan on your own does not qualify as a special life event that would make you eligible for a Special Enrollment Period. To qualify, you need to go through a specific life change – such as losing your coverage because of a job loss, getting married, or welcoming a new baby into your family.

If you’re not sure what counts or need help navigating your options, reaching out to a knowledgeable health insurance professional, like Illinois Health Agents, can provide you with personalized advice based on your circumstances.

What proof do I need for a qualifying life event to enroll in health insurance in Illinois?

To sign up for health insurance outside the open enrollment period, you’ll need to show proof of a qualifying life event (QLE). This proof confirms the event and your eligibility for a Special Enrollment Period (SEP). Here are some common examples of QLEs and the documents you might need:

- Marriage: A marriage certificate

- Birth or adoption: A birth certificate or adoption papers

- Loss of coverage: A termination letter or proof of unemployment

- Move: A lease agreement, utility bill, or updated driver’s license

- Change in citizenship status: A naturalization certificate or passport

The documentation must confirm the event happened within the 60-day SEP window. You can submit these documents with your application through the Get Covered Illinois portal or by working with Illinois Health Agents, who can help simplify the process. Keep copies of everything for your records in case further verification is required. If you need help, Illinois Health Agents are available to provide personalized assistance.

Recent Comments