If you’re self-employed and enrolled in Medicare, you may be able to deduct up to 100% of your Medicare premiums from your taxable income. This deduction, available on Schedule 1 (Form 1040), applies to premiums for Medicare Parts A, B, C, D, and Medigap plans. It’s an above-the-line deduction, meaning it reduces your adjusted gross income (AGI), regardless of whether you itemize deductions.

Key points:

- Eligibility: Must have self-employment income and a net profit. You cannot claim the deduction if eligible for an employer-subsidized health plan.

- Qualifying Premiums: Includes all Medicare parts (A, B, C, D) and Medigap, but not cost-sharing expenses like deductibles or copayments.

- Limitations: The deduction cannot exceed your net self-employment income. If your business shows a loss, premiums may only be deductible as itemized medical expenses.

- Documentation: Keep records like SSA-1099 forms, billing statements, and Form 7206 to ensure accurate reporting.

This deduction not only lowers your federal tax liability but also reduces your state taxable income in states like Illinois, which base taxes on federal AGI. Proper planning and accurate reporting can help you maximize this tax-saving opportunity.

Medicare Deduction For Self-Employed Individuals

Who Can Deduct Medicare Premiums When Self-Employed

Self-employed individuals who meet specific IRS guidelines can claim a deduction for Medicare premiums. Understanding these rules is crucial to avoid errors on your tax return.

Self-Employment Status Definitions

The IRS defines self-employment as earning income from a trade or business reported on Schedule C (for sole proprietors), Schedule E (as a partner in a partnership), or as an LLC member taxed as a sole proprietor or partner. It also includes S corporation shareholders who own at least 2% of the company’s stock.

- Sole Proprietors: Pay Medicare premiums directly and claim the deduction on Schedule 1 of Form 1040.

- Partners and LLC Members: Medicare premiums must either be paid directly by the partnership or reimbursed, and these amounts are reported as part of gross income through guaranteed payments.

- S Corporation Shareholders (2% or more ownership): The S corporation must pay or reimburse the premiums, which are included in Form W-2 wages, provided the business establishes the plan.

If your income comes solely from a W-2 job without any self-employment earnings, you are not eligible for this deduction. Additionally, only businesses with net profits can take advantage of this tax break.

Net Profit Requirements

To claim the Medicare premium deduction, your business must show a net profit for the tax year. If your business operates at a loss or breaks even, you cannot take this deduction.

The IRS caps the deduction at your net self-employment income. For example, if your net income is $10,000, your Medicare premium deduction cannot exceed that amount.

Here’s how this works in practice:

- A 67-year-old sole proprietor with $40,000 in net profit and $2,500 in Medicare Part B and D premiums can deduct the full $2,500 on Schedule 1, provided no employer-subsidized plan is available.

- A consultant with a $5,000 net loss and $3,000 in Medicare premiums cannot claim the self-employed deduction. However, those premiums might qualify as itemized medical expenses if they meet the applicable AGI threshold.

In addition to net profit, eligibility also hinges on access to employer-subsidized health plans.

Employer Health Plan Restrictions

You cannot claim the self-employed health insurance deduction for any month you are eligible for an employer-subsidized health plan. The key word here is eligible – even if you don’t enroll, eligibility alone disqualifies you from claiming the deduction.

For instance:

- If you or your spouse could have enrolled in an employer-sponsored plan (including retiree plans, COBRA, or part-time W-2 jobs), Medicare premiums for that month cannot be deducted under self-employed health insurance rules. However, those premiums might still qualify as itemized medical expenses.

- A self-employed designer with $20,000 in profit whose spouse has access to a subsidized family health plan cannot deduct Medicare premiums for months when the employer plan is available.

Tax experts suggest avoiding common errors like failing to track months of employer plan eligibility or overlooking the net profit cap. For S corporation owners, ensure Medicare premiums are processed through payroll or reimbursed in the same year, and confirm the business establishes the plan.

When you meet all conditions – no access to employer-subsidized coverage, a net profit, and proper structuring – Medicare premiums for eligible months may be deducted as self-employed health insurance.

For self-employed taxpayers in Illinois, these federal rules directly affect state tax planning. Since Illinois calculates state income tax starting with your federal adjusted gross income (AGI), working with a tax professional or health insurance broker like Illinois Health Agents can help ensure your federal Medicare premium deduction aligns with your state tax strategy and overall health coverage needs.

Which Medicare Premiums You Can Deduct

When figuring out which Medicare premiums qualify for deductions, it’s essential to know that the IRS allows a wide range of premiums to count. However, not all Medicare-related expenses make the cut.

Deductible Medicare Premium Types

If you’re self-employed, you can deduct premiums for all four parts of Medicare – Part A (if you pay a premium), Part B, Medicare Advantage (Part C), and Part D prescription drug plans – as qualifying health insurance costs. Medigap (Medicare Supplement) premiums can also be included.

- Medicare Part A: Deductible only if you pay a premium. If you don’t pay a premium, there’s nothing to deduct. For those who do pay (which can run several hundred dollars a month), the premium qualifies for deduction.

- Medicare Part B: Fully deductible for self-employed individuals, whether the premium is paid directly or withheld from Social Security benefits. For example, if $185 per month is withheld over 12 months, you could include approximately $2,220 in your deduction, subject to earned income and employer-coverage limits. Standard Part B premiums typically range from $160 to $180 monthly, though amounts may vary each year.

- Medicare Advantage (Part C): Premiums for these plans, including any extra costs for supplemental benefits, are deductible.

- Medicare Part D: Prescription drug plan premiums are fully deductible. Regardless of the carrier or plan specifics, any monthly premium you pay qualifies, provided you meet the general requirements.

- Medigap (Medicare Supplement): These premiums are treated like other private health insurance costs and are fully deductible, subject to earned-income and employer-coverage restrictions.

It’s important to note that Medicare cost-sharing expenses – such as deductibles, copayments, and coinsurance – aren’t considered premiums and can’t be claimed as part of the above-the-line deduction. However, if you itemize deductions, these out-of-pocket costs may be included as medical expenses on Schedule A if they exceed 7.5% of your adjusted gross income.

Deductions for Spouse and Dependent Premiums

You can also deduct Medicare premiums for your spouse and dependents, provided they were paid using self-employment income and they didn’t qualify for employer-subsidized coverage. However, this deduction is capped at your net profit. Premiums for non-dependent relatives, like adult children or parents, don’t qualify.

IRMAA Surcharges

If your income is above certain thresholds, you may face Income-Related Monthly Adjustment Amounts (IRMAA) on top of your Medicare Part B and Part D premiums. These surcharges are considered part of your Medicare premium and are fully deductible for eligible self-employed individuals. For example, if you pay a $185 Part B premium plus a $200 IRMAA surcharge (totaling $385 per month), the full amount is deductible. Be sure to include both the base premiums and IRMAA surcharges for Parts B and D when calculating your deduction.

To make claiming these deductions easier, keep organized records like your SSA-1099, Medicare notices, billing statements, and bank records. These documents will simplify completing Form 7206. Also, remember that Medicare premiums claimed as a self-employed health insurance deduction on Schedule 1 cannot also be claimed as itemized medical expenses on Schedule A.

For those in Illinois navigating these rules, Illinois Health Agents can help you choose Medicare plans – such as Medicare Advantage, Part D, and Medigap – that fit your health needs and tax planning goals.

Next, let’s explore how to claim these deductions on your tax return.

sbb-itb-a729c26

How to Claim the Medicare Premium Deduction

Once you’ve determined which Medicare premiums qualify for a deduction, the next step is to include them on your tax return. This involves using specific IRS forms and calculations, and understanding these steps can help you reduce your taxable income effectively.

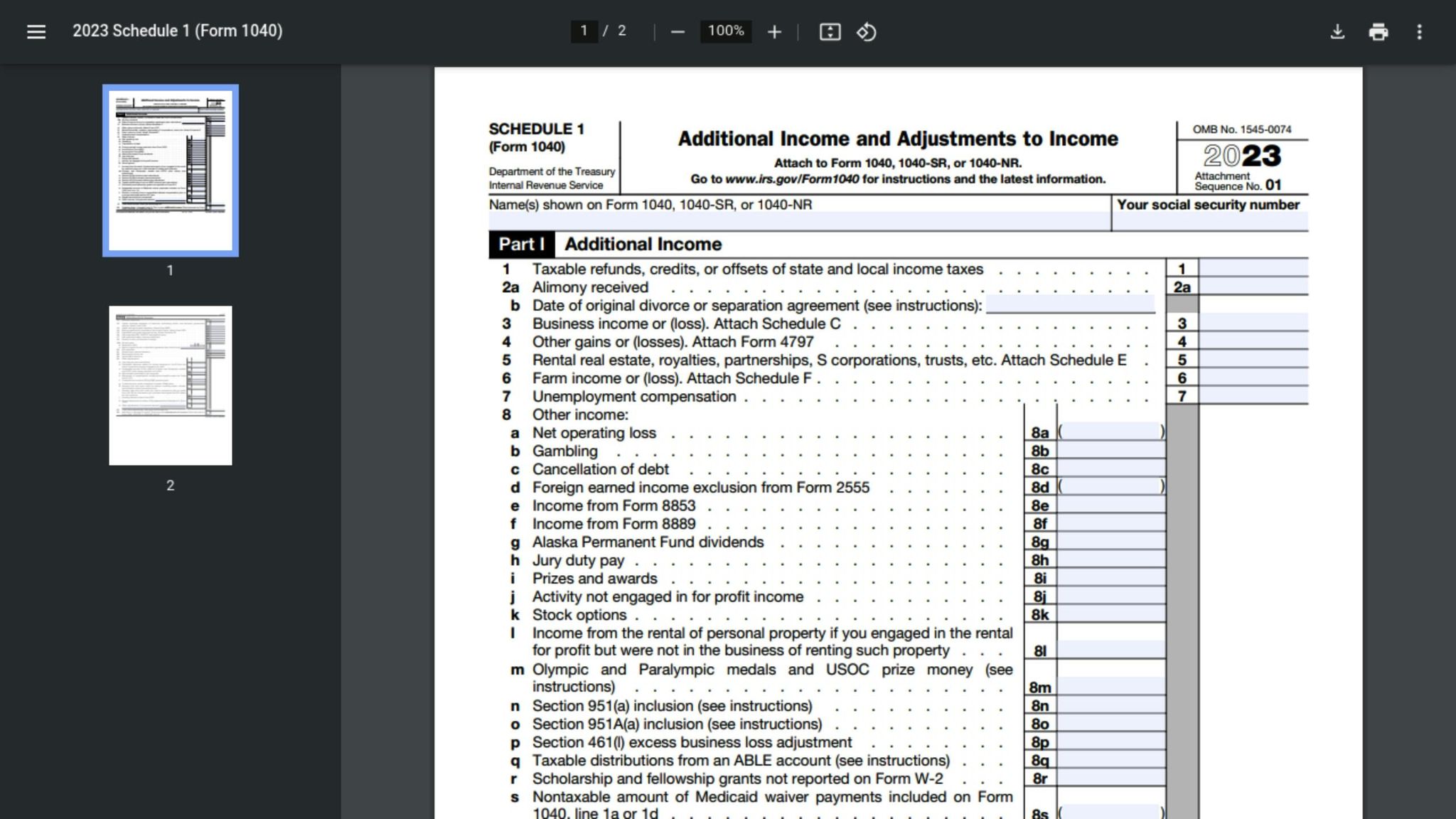

Reporting on Schedule 1 (Form 1040)

Start by confirming your eligibility and then follow these steps. Report the Medicare premium deduction on Schedule 1 (Form 1040), line 17. After calculating the amount you’re allowed to deduct, enter it on Schedule 1. This deduction lowers your adjusted gross income (AGI) directly on Form 1040. Since it’s an “above-the-line” deduction, it benefits you whether you take the standard deduction or itemize.

For instance, if you’re self-employed with a net profit of $50,000 and you determine $5,500 in Medicare premiums is deductible, you’d enter $5,500 on Schedule 1. This reduces your AGI from $50,000 to $44,500.

Calculating Your Deduction Amount

To figure out the exact amount, use Form 7206, which helps you apply the income limits and employer-coverage rules tied to the Medicare premium deduction.

On Form 7206, you’ll:

- List all eligible Medicare premiums for yourself, your spouse, and dependents. This includes premiums for Parts A (if applicable), B, C, D, and Medigap.

- Check two key limits:

- The deduction cannot exceed your net self-employment income. For example, if your net self-employment income is $10,000 but you paid $12,000 in Medicare premiums, the maximum deduction is $10,000. Any excess might be deductible as itemized medical expenses on Schedule A, provided you meet the AGI threshold.

- The form applies a month-by-month eligibility test. If you or your spouse are eligible for a subsidized employer health plan in any month (even if you don’t enroll), you can’t claim the premium for that month. Verify eligibility for each month.

Here’s an example: A self-employed consultant with $40,000 in net profit pays $6,000 in Medicare premiums over the year (about $500 per month) and isn’t eligible for any employer-sponsored plan. Form 7206 would show a full $6,000 deduction, which you’d then report on Schedule 1.

If your business has a net loss, Form 7206 will indicate that no Medicare premium deduction is allowed. However, you might still deduct the premiums as itemized medical expenses on Schedule A, subject to the 7.5% of AGI threshold.

For S corporation shareholders owning more than 2% and partners, premiums must first be reported as income before they’re deductible. S corporation shareholders need the premiums either paid directly by the corporation or reimbursed in the same tax year. These amounts should also appear as wages on your Form W-2. Partners, on the other hand, include premiums as guaranteed payments in gross income. Once properly reported, you can use Form 7206 to claim the deduction and report it on Schedule 1.

Above-the-Line Deduction vs. Itemized Medical Expenses

Understanding the difference between these two options is key. The above-the-line deduction on Schedule 1 directly lowers your AGI, which can improve eligibility for other AGI-sensitive credits and deductions. This deduction is available even if you take the standard deduction. For example, in 2025, the standard deduction is $15,000 for single filers and $30,000 for married couples filing jointly – amounts many taxpayers don’t exceed by itemizing.

On the other hand, if you claim Medicare premiums as itemized medical expenses on Schedule A, you can only deduct the portion of total medical expenses that exceeds 7.5% of your AGI. For example, with an AGI of $60,000, you’d need medical expenses exceeding $4,500 before benefiting from itemizing.

Because the above-the-line deduction reduces AGI without any threshold, it’s generally more advantageous. However, you cannot claim the same premiums both as an above-the-line deduction and as itemized medical expenses.

Keep detailed records, including SSA-1099 forms, billing statements, Form 7206, Schedule 1, bank statements, canceled checks, and for S corporation shareholders and partners, W-2s or K-1s. These documents will be essential if the IRS has questions.

Accurate calculations and organized documentation ensure you make the most of this deduction.

Medicare Premium Deductions for Illinois Self-Employed Individuals

If you’re self-employed in Illinois and paying Medicare premiums, understanding how federal and state tax rules work together can help you lower your tax bill. Since Illinois bases its state taxes on your federal adjusted gross income (AGI), any Medicare premium deduction you claim on your federal return automatically reduces your state tax liability as well.

Illinois State Tax Treatment

Illinois simplifies the process by aligning its tax treatment of Medicare premiums with the federal self-employed health insurance deduction. When you report Medicare premiums on Schedule 1 (Form 1040), the deduction lowers your federal AGI. Illinois then uses this adjusted figure to calculate your taxable income on Form IL‑1040, with minimal changes.

Here’s an example: If your federal AGI decreases by $5,400 due to deductible Medicare premiums, your Illinois taxable income also drops by $5,400, subject to any unrelated state-specific adjustments. With Illinois’s flat income tax rate of 4.95%, this translates to savings of about $49.50 for every $1,000 in Medicare premiums you deduct – on top of the federal tax benefits.

Additionally, Social Security income is completely exempt from Illinois state income tax. This can be a significant advantage for Medicare-eligible, self-employed individuals who are balancing business income with retirement income.

Make sure to review the instructions for Form IL‑1040 each year for updates. If your financial situation involves complexities – such as multiple businesses, partnerships, or S corporations – it’s a good idea to have a tax professional review Schedule M (Other Additions and Subtractions) to ensure everything is reported correctly. This alignment between federal and state rules highlights the importance of local expertise in managing your Medicare and tax strategies.

Working with Illinois Health Agents

Once you’ve addressed your state tax benefits, choosing the right Medicare plan becomes a critical part of your overall strategy. Selecting the right Medicare coverage isn’t just about healthcare – it also plays a role in tax planning. Illinois Health Agents, a brokerage specializing in health insurance, can help you navigate Medicare Advantage, Medicare Supplement (Medigap), Part D, and other plans. They provide unbiased recommendations tailored to your medical needs and budget.

Your choice of plan affects not only your healthcare costs but also how much of your premiums qualify as deductible health insurance under federal rules. For self-employed individuals, Illinois Health Agents can review all available Medicare options alongside other individual or small-group coverage options. They’ll help you choose plans that maximize your deductible premiums and show how those choices impact your federal AGI and state taxable income.

If you’re not yet eligible for Medicare, they can guide you through HSA-eligible high-deductible health plans (HDHPs) available through the ACA marketplace. This allows you to contribute to a Health Savings Account while self-employed and transition to Medicare at age 65 without running into timing conflicts between HSA contributions and Medicare enrollment.

Timing your Medicare enrollment is also key. Illinois Health Agents can help you plan your enrollment – whether it’s your initial, special, or general enrollment period – to align with changes in your self-employment income. This alignment can affect your eligibility for and the size of your self-employed health insurance deduction. For instance, if you’re planning to scale back your business or switch from a sole proprietorship to an S corporation, they can help structure your Medicare premiums to meet IRS requirements. They can also advise on how enrolling in an employer-subsidized retiree or spouse plan might impact your ability to claim the self-employed deduction.

Because health insurance rates in Illinois are regulated by the Illinois Department of Insurance, premium costs remain consistent no matter where you purchase your plan. This ensures that working with Illinois Health Agents provides valuable advice without increasing your premium costs.

Getting Help from Illinois Tax Professionals

While Illinois tax rules are relatively straightforward, their reliance on federal AGI opens up opportunities for strategic planning around self-employed health insurance deductions. Partnering with an Illinois-licensed tax professional ensures that your Medicare premiums are reported correctly and that you maximize your deductions on both your federal and state returns.

Look for a CPA, Enrolled Agent, or experienced tax preparer familiar with self-employed health insurance rules and Illinois’ conformity to federal AGI. They should have experience with Schedule C, Schedule E for partnerships, or S corporation returns involving more-than-2% shareholder health insurance. A qualified tax professional can help you avoid common mistakes, such as:

- Misreporting Medicare premiums as deductible when you or your spouse have access to an employer-subsidized plan.

- Exceeding the allowable deduction when your business profit is low.

- Failing to properly report premiums paid or reimbursed through an S corporation or partnership.

By coordinating with both Illinois Health Agents and a tax professional, you can ensure your Medicare coverage and tax filings meet all requirements. This collaborative approach reduces the risk of disallowed deductions or unexpected notices from tax authorities.

If you’re nearing retirement, a tax professional can also help you project your future self-employment income, Medicare premiums, and any potential IRMAA surcharges. This forward-looking planning can help you determine how long you’ll benefit from the self-employed health insurance deduction as your business income changes.

Conclusion

If you’re self-employed, earning a net profit, and don’t have access to employer-sponsored health plans, you can deduct up to 100% of your Medicare premiums on Schedule 1 (Form 1040) under IRC §162(l). This deduction directly reduces your adjusted gross income (AGI), offering a tax break even if you don’t itemize deductions.

To make the most of this deduction, it’s essential to understand a few key factors: your net self-employment income cap, whether you’re eligible for employer-sponsored coverage, and how to correctly track your Medicare premium payments. If you live in Illinois, there’s an added bonus – this deduction also lowers your state taxable income since it’s based on your federal AGI.

To calculate your deduction, you’ll need to use Form 7206 or the relevant IRS worksheet. Be sure to keep detailed records of your premium payments and business income. If your situation involves multiple income streams, ownership in a partnership or S corporation, or even potential access to employer coverage, consulting with a tax professional and a local Medicare broker – like Illinois Health Agents – can help you navigate the rules. This ensures you get the full benefit of the deduction while staying compliant with IRS requirements.

FAQs

Can self-employed individuals deduct Medicare premiums on their federal and state taxes?

Yes, if you’re self-employed, you can deduct Medicare premiums as part of the self-employed health insurance deduction on your federal taxes. This includes premiums for Medicare Part A, Part B, Part C (Medicare Advantage), and Part D. You can also deduct premiums for your spouse, dependents, or children under the age of 27. This deduction is considered an above-the-line deduction, which means it lowers your taxable income even if you don’t itemize deductions.

That said, state tax rules for this deduction can differ. Some states align with federal guidelines, while others have their own policies. To ensure you’re clear on how this applies to you, it’s a good idea to reach out to a tax professional or check with your state’s tax agency. For those in Illinois, Illinois Health Agents can offer tailored assistance to help you explore health insurance options that fit your needs.

What records do I need to claim a deduction for Medicare premiums as a self-employed individual?

To deduct Medicare premiums as a self-employed individual, it’s essential to keep thorough and accurate records. This means holding onto proof of premium payments – like bank statements, canceled checks, or receipts from Medicare. Additionally, you’ll need a copy of your Form 1040 Schedule C or Schedule F, which documents your self-employment income. Remember, this deduction is only available if you have net earnings from self-employment.

Having your records well-organized and easily accessible can simplify the filing process and ensure you’re prepared to support your claim if the IRS ever audits you. If you’re unsure about health insurance options or need personalized advice, Illinois Health Agents can help self-employed individuals navigate Medicare and other insurance plans.

Can self-employed individuals deduct Medicare premiums if their spouse has access to an employer-sponsored health plan?

Yes, if you’re self-employed, you can usually deduct your Medicare premiums, but there are some important rules to keep in mind. For instance, if your spouse has an employer-sponsored health plan that you’re eligible to join, you likely won’t qualify for the self-employed health insurance deduction. The IRS specifically states that you must not have access to any employer-sponsored health plan, including one through a spouse, to claim this deduction.

To ensure you’re following the rules and getting the most out of your tax benefits, it’s smart to consult a tax professional. They can provide advice tailored to your unique situation and help you stay on the right side of IRS guidelines.

Recent Comments