Understanding the Medicare Coverage Gap with Our Estimator Tool

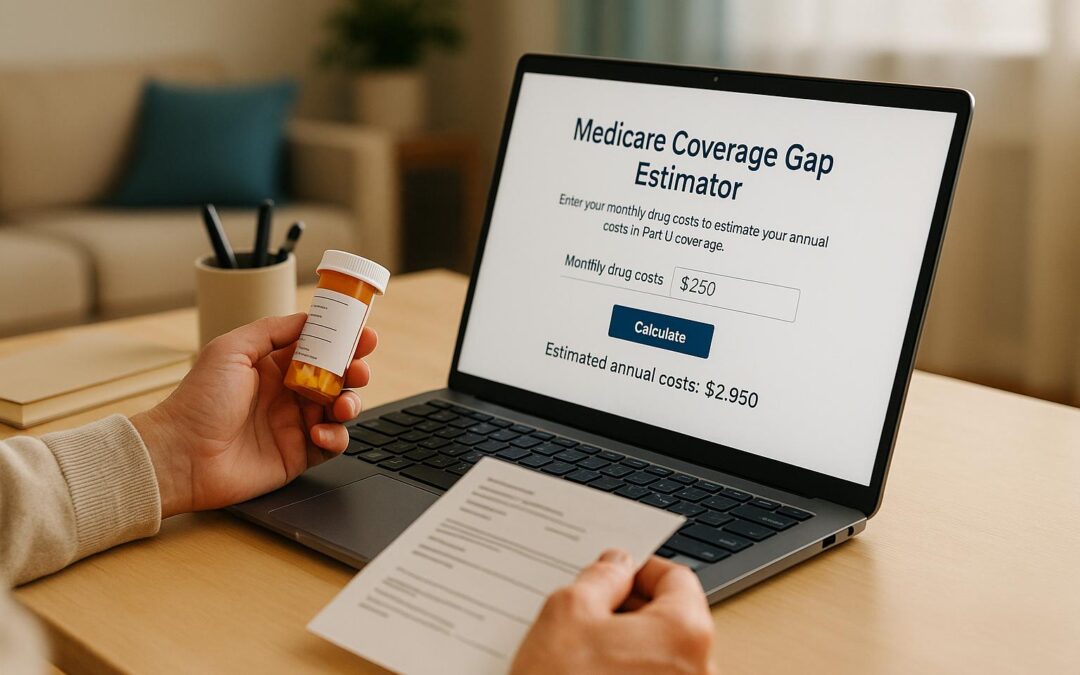

Navigating Medicare Part D can feel like a maze, especially when you’re trying to figure out if you’ll hit that tricky spot known as the donut hole. This phase, where costs for prescriptions spike temporarily, affects many enrollees each year. If you’re unsure about your standing, a quick way to gain clarity is by using a dedicated calculator designed for Part D expenses.

Why Tracking Drug Costs Matters

Prescription expenses add up fast, and before you know it, you might cross into a zone where you’re paying more out of pocket. For 2023, once your total drug spending reaches $4,660, you’re in this gap, covering 25% of both brand-name and generic medication costs. That’s a big jump for most budgets. Having a clear picture of where you stand helps you plan—whether it’s switching to more affordable options or setting aside extra funds.

Take Control of Your Medicare Plan

Don’t let unexpected costs catch you off guard. By estimating your position relative to this threshold, you can make smarter choices about your healthcare spending. Tools like ours simplify the process, giving you peace of mind with just a few clicks.

FAQs

What is the Medicare coverage gap or donut hole?

The coverage gap, often called the donut hole, is a stage in Medicare Part D where you pay a higher percentage of your prescription costs. After your total drug spending hits a certain limit—$4,660 in 2023—you enter this gap and typically pay 25% of the cost for both brand-name and generic drugs. It’s a temporary phase until you reach the catastrophic coverage level, but it can catch folks off guard if they’re not tracking their expenses.

How do I know if I’m close to the donut hole?

You can keep tabs on your drug spending through your Medicare Part D plan statements, which show your year-to-date costs. Or, just plug your numbers into our estimator! We’ll tell you if you’re approaching the gap based on the 2023 limit of $4,660 and give you a heads-up on what’s next. It’s a handy way to stay prepared without digging through paperwork.

Can I avoid the Medicare coverage gap?

Avoiding the gap entirely depends on your prescription needs, but you can lessen the impact. Consider switching to generic drugs if possible, as they’re often cheaper, or ask your doctor about lower-cost alternatives. Some Part D plans also offer extra coverage in the gap for certain meds, so check your plan details. Planning your budget with a tool like ours can also help you anticipate costs and avoid surprises.

Recent Comments