Navigating Health Coverage with Ease

Finding the right medical insurance plan can feel overwhelming with so many options and fine print to decipher. That’s where a reliable comparison resource comes in handy. Whether you’re a young professional, a growing family, or nearing retirement, understanding your coverage options is key to protecting your health and wallet.

Why Compare Plans Online?

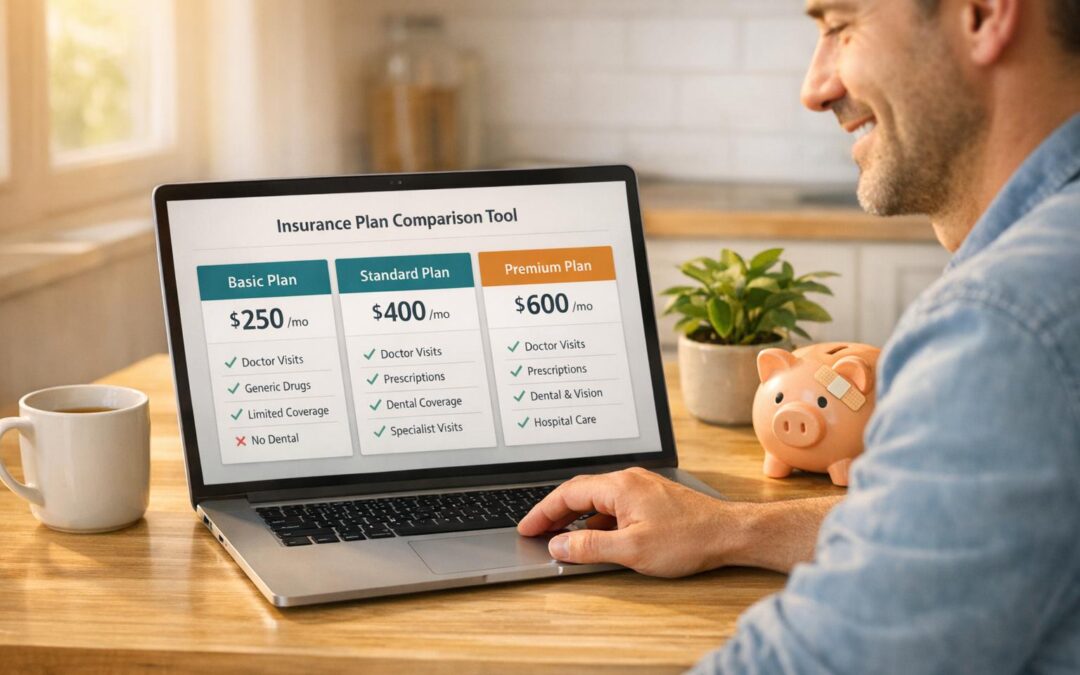

Shopping for health coverage isn’t just about the cheapest premium. Factors like deductibles, copays, and network restrictions play a huge role in what you’ll actually pay. For instance, someone with frequent doctor visits might prioritize low copays over a rock-bottom monthly cost. By using a tool to evaluate different plans side by side, you can spot the sweet spot between affordability and benefits. It’s like having a personal advisor without the hefty fee.

Tailored Choices for Every Need

Everyone’s situation is different. Maybe you’re in a rural area with limited providers, or you’re juggling a tight budget. A good evaluation platform takes these details into account, filtering options based on your location and preferences. This way, you’re not wading through irrelevant choices but focusing on what truly fits. Take a moment to explore and see how easy it can be to secure peace of mind.

FAQs

How accurate are the insurance plans in this tool?

The plans in our tool are based on common structures and sample data, reflecting typical premiums, deductibles, and coverage options. Think of them as a starting point to understand what’s out there. Since pricing and availability vary by insurer and region, we always recommend contacting providers directly for up-to-date quotes tailored to you.

What’s the difference between HMO, PPO, and EPO plans?

Great question! HMO plans (Health Maintenance Organization) usually have lower costs but require you to stay within a specific network and get referrals for specialists. PPO plans (Preferred Provider Organization) offer more flexibility to see out-of-network doctors, though at a higher cost. EPO plans (Exclusive Provider Organization) are a middle ground—lower costs like an HMO but no referrals needed, as long as you stick to the network. Each has trade-offs depending on how much freedom or savings you want.

Can this tool help if I’m on a tight budget?

Absolutely, that’s one of our main goals! Just input your monthly budget, and we’ll prioritize plans that fit within it while still meeting your coverage needs. You’ll see a breakdown of premiums, copays, and deductibles to avoid surprises. If costs still feel high, consider a plan with a higher deductible for lower monthly payments—just make sure you’re okay with potential out-of-pocket expenses.

Recent Comments