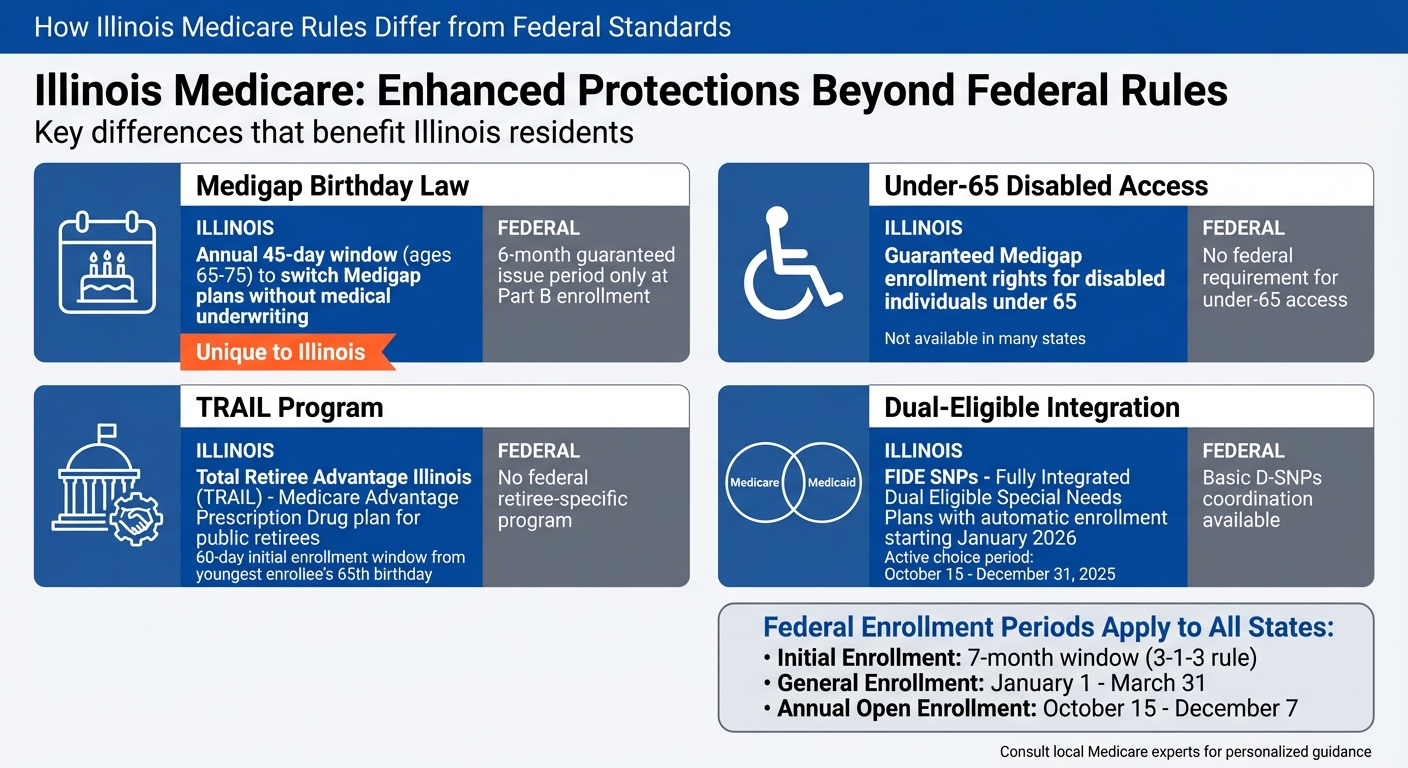

Illinois Medicare rules stand out by offering additional protections and programs beyond federal guidelines. Key differences include:

- Medigap Birthday Law: Allows beneficiaries aged 65–75 to switch Medigap plans within 45 days of their birthday without medical underwriting.

- Under-65 Medigap Access: Guarantees Medigap enrollment rights for disabled individuals under 65, unlike many states.

- TRAIL Program: A Medicare Advantage Prescription Drug plan exclusively for Illinois public retirees, with a unique enrollment period.

- Dual-Eligible Programs: Illinois integrates Medicare and Medicaid benefits through Fully Integrated Dual Eligible Special Needs Plans (FIDE SNPs), with automatic enrollment starting January 2026.

While these rules provide more flexibility for Illinois residents, navigating overlapping timelines and understanding plan options can be complex. For personalized assistance, consulting local Medicare experts is highly recommended.

Illinois Medicare Rules vs Federal Standards: Key Differences

1. Illinois Medicare Rules

Enrollment Windows

In Illinois, residents adhere to the federal Medicare enrollment timelines. These include the Initial Enrollment Period (a seven-month window around your 65th birthday), the General Enrollment Period (January 1 to March 31), and the Annual Open Enrollment (October 15 to December 7). Beyond these federal periods, Illinois goes a step further by offering additional protections, particularly with its enhanced Medigap options.

Medigap Protections

Illinois provides stronger Medigap protections than what federal rules require. Like all states, Illinois offers a six-month Medigap Open Enrollment Period that begins when someone first enrolls in Medicare Part B. During this time, insurers cannot deny coverage or charge higher premiums based on pre-existing health conditions. However, Illinois stands out with its Medigap Birthday Law. This law allows beneficiaries aged 65 to 75 who already have a Medigap policy to switch plans within 45 days of their birthday each year – without needing to go through medical underwriting. This opportunity to find better coverage or lower rates is rare and not available in most states.

Dual-Eligible Programs

For individuals who qualify for both Medicare and Medicaid, Illinois has revamped its approach by introducing Fully Integrated Dual Eligible Special Needs Plans (FIDE SNPs). These plans combine Medicare and Medicaid benefits into a single, streamlined option. Starting January 1, 2026, certain dual-eligible members will be automatically enrolled in FIDE SNPs, with notifications sent by September 30, 2025. Beneficiaries will have an active choice period between October 15 and December 31, 2025, to select their preferred FIDE SNP or opt for Original Medicare with a Part D plan instead. Illinois also offers tailored coverage options for public retirees through specific state-sponsored programs.

State-Sponsored Retiree Medicare Programs

Illinois provides the Total Retiree Advantage Illinois (TRAIL) Medicare Advantage Prescription Drug program, designed for public retirees who qualify for Medicare Parts A and B. Eligible state employees, annuitants, and survivors have a special 60-day Initial Enrollment window starting from the youngest enrollee’s 65th birthday, in addition to an annual open enrollment period. TRAIL offers group Medicare Advantage plans that include prescription drug coverage, creating a coordinated option specifically for Illinois public-sector retirees.

These tailored programs and protections highlight how Illinois goes beyond federal Medicare rules to address the unique needs of its residents.

2. Medicare Rules in Other States with Different Features

Medigap Protections

While Illinois has its own Birthday Law (explored earlier), other states, like California, Connecticut, and New York, also offer their versions of birthday rule protections. However, the specifics – such as eligible age ranges and the length of enrollment windows – can vary significantly across these states. On the other hand, most states stick to the standard six-month Medigap open enrollment period, which begins when someone enrolls in Medicare Part B. Let’s now take a look at how states differ in handling dual-eligible programs.

Dual-Eligible Programs

States approach dual-eligible programs in distinct ways. California’s Cal MediConnect, for example, provides beneficiaries with care coordinators who create personalized budgets. A study in Los Angeles highlighted annual savings of $1,200 thanks to integrated transportation benefits. Florida’s DualSNAP program, meanwhile, emphasizes supplemental benefits, offering a monthly $55 over-the-counter allowance. This adds up to $660 annually and includes extras like meal delivery. Enrollment in Florida is often completed within days, whereas Illinois’ broker-managed process can take 2–4 weeks, delaying access to these benefits.

State-Sponsored Retiree Medicare Programs

Retiree Medicare programs also differ widely from state to state. Wisconsin’s WRS Medicare Advantage stands out with 100% premium subsidies for retirees and a network that covers 98% of providers. A Segal Consulting report found that retirees in Wisconsin report 15% higher satisfaction rates compared to other programs. New York’s Empire Plan offers year-round enrollment for specific transitions and includes enhanced dental and vision benefits. Michigan’s MI Choice program integrates Medicare with long-term care services, offering personalized budgets of up to $2,000 per month. Meanwhile, Pennsylvania extends its special enrollment window for retirees transitioning from employer coverage to 63 days after losing coverage, giving retirees three extra days compared to Illinois’ 60-day window.

3. Federal Medicare Baseline Rules

Enrollment Windows

Medicare’s federal guidelines set the stage for enrollment across all 50 states, ensuring consistency nationwide. One of the key enrollment periods is the Initial Enrollment Period (IEP), which follows a 7-month "3-1-3 rule." This means the window opens 3 months before the month you turn 65, includes your birthday month, and extends 3 months after. For instance, if your 65th birthday is in October, enrolling by late September ensures your coverage begins on October 1. However, if you wait until late October, your coverage will start on November 1 instead.

Missed the IEP? The General Enrollment Period (GEP) offers another chance, running from January 1 to March 31 each year. Be aware, though – late enrollment comes with a permanent 10% annual Part B premium penalty.

For those already enrolled in Medicare, the Annual Enrollment Period (AEP), held from October 15 to December 7, allows changes to Medicare Advantage (Part C) and Part D plans, with updates taking effect on January 1. Additionally, the Medicare Advantage Open Enrollment Period (January 1 to March 31) provides a one-time opportunity to switch plans for beneficiaries already in Medicare Advantage.

These federally set timelines are essential to understanding how Medicare operates, especially when comparing them to state-specific enhancements.

Medigap Protections

Federal law ensures a 6-month guaranteed issue period for Medigap policies, starting when you enroll in Medicare Part B. During this time, insurers cannot deny you coverage or charge higher premiums based on pre-existing conditions, and medical underwriting is not required. But once the 6-month window closes, these protections disappear. Insurers can then deny coverage or increase premiums depending on your health. This federal safeguard forms the baseline for Medigap rights, which states can expand upon.

Dual-Eligible Programs

Federal programs for dual-eligible individuals – those who qualify for both Medicare and Medicaid – create a foundation that states can build on. Coordination happens through Dual-Eligible Special Needs Plans (D-SNPs), where Medicare serves as the primary payer and Medicaid helps with premiums, cost-sharing, and additional services like long-term care.

For those eligible for both Medicare Parts A and B and full Medicaid benefits, Fully Integrated Dual Eligible Special Needs Plans (FIDE-SNPs) are available nationwide. These plans typically require enrollees to be at least 21 years old, live in the plan’s service area, and be U.S. residents. Dual-eligible beneficiaries also have access to Special Enrollment Periods (SEPs), allowing them to make monthly changes to their plans – a flexibility not available during the standard AEP.

These federal guidelines provide a consistent structure for Medicare, serving as a benchmark for states like Illinois to introduce additional protections and benefits.

sbb-itb-a729c26

How Living in ILLINOIS Affects Your Medicare Choices | Sort of a GI State 🙁

Pros and Cons

Illinois Medicare rules bring some distinct perks compared to federal standards, especially when it comes to Medigap coverage. One standout feature is the Illinois Medigap "Birthday Law", which gives beneficiaries aged 65–75 a 45-day period each year, starting on their birthday, to switch Medicare Supplement policies of equal or lesser benefits without going through medical underwriting. This is a significant departure from the federal six-month guaranteed-issue period tied to Part B enrollment. Additionally, Illinois offers more flexibility for Medigap access to individuals under 65 who qualify for Medicare due to disability. For retired state employees, the TRAIL Medicare Advantage Prescription Drug (MAPD) program provides comprehensive MA-PD coverage, offering a simpler alternative to navigating individual plan options.

However, these benefits come with some challenges. While Illinois’ rules expand Medigap opportunities and simplify retiree enrollment, they also add complexity. Beneficiaries need to juggle both federal and Illinois-specific timelines, and these rules don’t necessarily lead to lower premiums. For example, premiums for under-65 disabled Medigap enrollees can still be quite high due to the increased likelihood of claims, making affordability a concern even when access is guaranteed. Furthermore, Illinois doesn’t go as far as some other states in providing broader guaranteed-issue rights or community-rated pricing for Medigap across all ages. Additionally, these state-specific protections don’t extend to reducing costs for Medicare Advantage or Part D plans, which remain subject to variations based on market and insurer.

| Feature | Illinois Advantage | Consideration |

|---|---|---|

| Medigap Birthday Law | Annual 45-day window (ages 65–75) to switch plans without medical underwriting. | Applies only to plans with equal or lesser benefits; premium levels remain unregulated. |

| Under-65 Disabled Access | Same Medigap open enrollment rights as beneficiaries aged 65+. | Premiums for under-65 disabled individuals are typically higher, despite guaranteed access. |

| TRAIL MAPD | Coordinated MA-PD coverage for state retirees with a dedicated enrollment period. | Limited to eligible participants in state programs like SEGIP, TRIP, and CIP. |

| Complexity | Offers more protections than states relying solely on federal rules. | Overlapping rules and timelines can make navigating the system more difficult. |

For those comparing Original Medicare with a Medigap and Part D plan to Medicare Advantage, Illinois’ Birthday Law and disability protections are particularly appealing for individuals who prefer stable, predictable out-of-pocket costs and the ability to adjust coverage annually. On the other hand, Medicare Advantage plans, which follow federal rules without added state-level benefits, might be more attractive to those seeking lower monthly premiums and additional perks. Since plan options and pricing vary greatly by county and insurer, working with a local broker like Illinois Health Agents can be invaluable. They can help residents navigate Illinois’ unique rules, compare local plans, and determine eligibility for programs like TRAIL. Carefully evaluating these pros and cons is key to making an informed decision between Original Medicare with Medigap and Medicare Advantage, especially in Illinois.

Conclusion

Illinois Medicare regulations go beyond federal standards, offering additional safeguards for its residents. One standout feature is the Illinois Medigap "Birthday Law", which allows beneficiaries aged 65–75 a 45-day yearly window to switch Medigap policies without facing medical underwriting hurdles. Additionally, Illinois extends Medigap rights to disabled individuals under 65, matching those available to beneficiaries 65 and older, with an extra six-month enrollment period once they turn 65. For retired state employees, the TRAIL MAPD program ensures access to coordinated Medicare Advantage Prescription Drug coverage, complete with its own enrollment period.

These state-specific provisions work in tandem with federal enrollment periods, such as the seven-month Initial Enrollment and the Annual Open Enrollment running from October 15 to December 7. However, juggling overlapping timelines can be a bit tricky. While Illinois provides greater flexibility compared to most states, choosing between Original Medicare with a Medigap plan and Medicare Advantage still requires thorough evaluation of individual needs and circumstances.

FAQs

What is Illinois’ Medigap Birthday Rule and how can it help me?

In Illinois, the Medigap Birthday Rule guarantees that insurance providers must offer Medigap plans with identical benefits during your Medigap open enrollment period. This period starts the month you turn 65 and sign up for Medicare Part B. The rule ensures that insurers cannot deny you coverage or increase premiums based on your health status or pre-existing conditions if you apply within this timeframe.

This law offers Illinois residents a sense of security, making it easier to access Medigap coverage without facing health-related obstacles during the designated enrollment window.

What are the rules in Illinois for Medigap access for people under 65 with disabilities?

In Illinois, individuals under 65 who have disabilities are entitled to enroll in Medigap plans during the first six months after their Medicare Part B coverage begins. This rule follows federal guidelines, ensuring that coverage is available regardless of any pre-existing conditions. On top of that, Illinois may have additional state-specific rules that provide even more protections for these individuals.

What advantages does the TRAIL program offer Illinois public retirees?

The TRAIL (Total Retiree Advantage Illinois) program is a valuable resource for Illinois public retirees, offering benefits aimed at providing a secure and comfortable retirement. It gives retirees access to affordable healthcare options, including Medicare Advantage plans that often come with prescription drug coverage.

Through the TRAIL program, retirees can benefit from reduced out-of-pocket expenses, predictable healthcare costs, and a network of trusted providers. This initiative is crafted to help retirees safeguard both their health and financial well-being after dedicating years to public service.

Recent Comments