Understanding HSA Eligibility: A Simple Guide

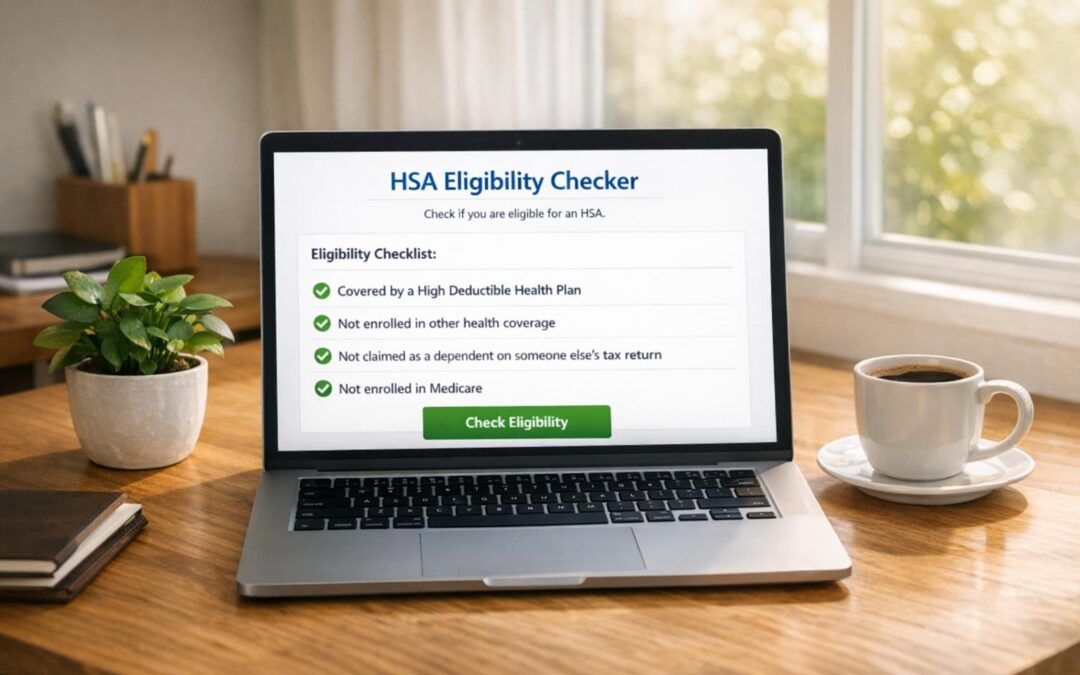

Navigating the world of healthcare savings can feel overwhelming, especially when it comes to figuring out if you qualify for a Health Savings Account. These accounts are a fantastic way to save tax-free money for medical expenses, but the rules can be tricky. That’s where tools like our HSA qualification checker come in handy—helping you cut through the noise with straightforward answers.

Why Check Your Eligibility?

The IRS sets specific criteria for who can contribute to these accounts. You need a high-deductible health plan, no conflicting coverage, and you can’t be a dependent on someone else’s taxes. Plus, there’s an age cap at 65. Missing just one of these can mean you’re out of luck, and nobody wants to deal with tax penalties down the line.

Making Sense of the Rules

Whether you’re switching plans or just exploring options, knowing where you stand is key. Beyond the basics, factors like secondary insurance or family tax status can muddy the waters. A quick eligibility test can save you time and stress, ensuring you’re on the right track for healthcare savings. Take a moment to get clarity—it’s worth it!

FAQs

What makes someone eligible for an HSA?

Great question! To qualify for a Health Savings Account, you need to be enrolled in a high-deductible health plan (HDHP), not have any other health coverage that disqualifies you (like a non-HDHP plan), be under 65 years old, and not be claimed as a dependent on someone else’s tax return. Our tool checks all these boxes for you, so you don’t have to dig through IRS fine print.

What counts as disqualifying health coverage for HSA eligibility?

This can trip people up, but basically, any health plan that isn’t a high-deductible health plan (HDHP) can disqualify you. That includes traditional health insurance with low deductibles, certain FSAs, or being on a spouse’s non-HDHP plan. Medicare enrollment also counts as disqualifying coverage. If you’re unsure about your situation, pop your details into our checker, and we’ll help clarify!

Can I contribute to an HSA if I’m over 65?

Unfortunately, no. IRS rules state that you can’t contribute to an HSA once you turn 65, even if you’re still on an HDHP. However, you can keep using funds already in your account for qualified medical expenses. If age is the only thing holding you back, our tool will let you know with a clear explanation.

Recent Comments