If you’re paying for Medigap premiums, you might be able to deduct them on your taxes. Here’s the quick answer: Medigap premiums qualify as medical expenses, but you can only deduct them if your total unreimbursed medical expenses exceed 7.5% of your adjusted gross income (AGI) and you itemize deductions on your tax return. Here’s what you need to know:

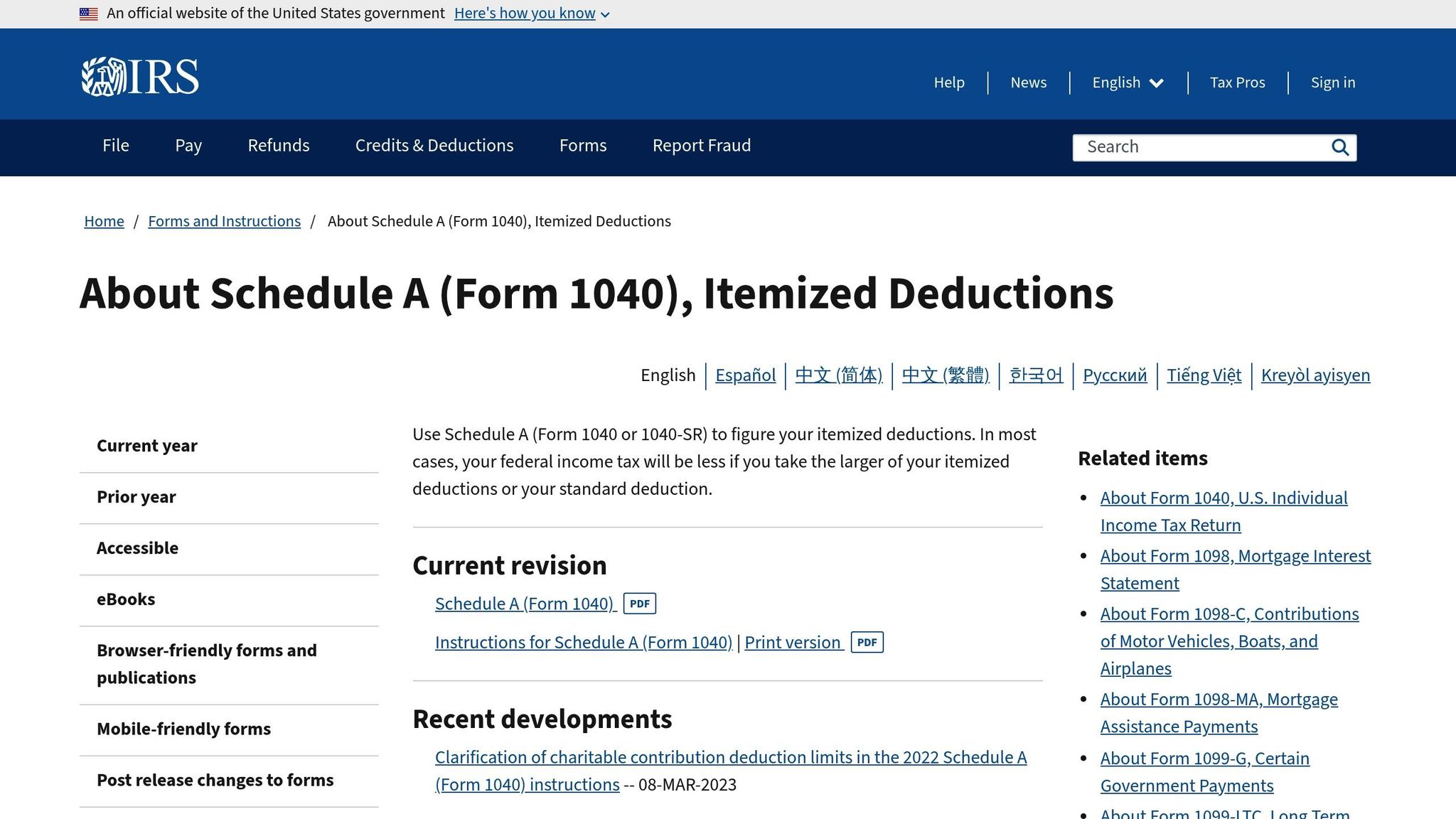

- Eligibility: You must itemize deductions on Schedule A of Form 1040. The standard deduction won’t allow you to claim these expenses.

- Threshold: Only the portion of medical expenses exceeding 7.5% of your AGI is deductible.

- Documentation: Keep records of all Medigap premium payments, receipts, and other medical expenses.

- Self-Employed Tip: While Medicare premiums may qualify for an above-the-line deduction, Medigap premiums require itemizing.

Example: If your AGI is $50,000, the threshold is $3,750. If your total unreimbursed medical expenses (including Medigap premiums) are $5,000, you can deduct $1,250.

This guide explains how to calculate deductions, organize records, and file correctly to maximize your tax savings.

Are Medigap Premiums Tax-deductible? – Get Retirement Help

IRS Rules for Deducting Medigap Premiums

Navigating the IRS rules for deducting Medigap premiums can help you save on taxes while staying within the guidelines. These rules, while straightforward, come with specific thresholds and documentation requirements. Here’s a closer look at how to claim these deductions effectively.

The 7.5% Income Threshold Rule

To deduct unreimbursed medical expenses, including Medigap premiums, your total medical expenses must exceed 7.5% of your adjusted gross income (AGI), and you need to itemize deductions on Schedule A of Form 1040. Only the portion of expenses that goes over this threshold is deductible.

For example:

- If your AGI is $40,000, 7.5% equals $3,000. Only expenses above $3,000 are deductible.

- If your AGI is $60,000, the threshold increases to $4,500.

Higher medical costs, such as paying approximately $145 per month for a Medigap Plan G (around $1,740 annually), can make it easier to surpass the 7.5% threshold.

Medical Expenses That Qualify for Deduction

The IRS defines certain Medicare-related costs as qualified medical expenses. These include Medigap premiums as well as premiums for Medicare Parts A (if applicable), B, C (Medicare Advantage), and D (prescription drug coverage), provided you meet the AGI requirement and itemize deductions.

Other deductible expenses include:

- Medicare deductibles, copayments, and coinsurance

- Transportation costs for medical appointments

- Hearing aid batteries

- Medically necessary home modifications

Standard Deduction vs. Itemized Deductions

To deduct Medigap premiums, you must decide whether to take the standard deduction or itemize your deductions – you can’t do both. Itemizing is beneficial only if your total deductions exceed the standard deduction for your filing status.

For 2025, the standard deduction amounts are:

- Single filers: $14,600

- Married filing jointly: $29,200

- Married filing separately: $14,600

| Filing Status | 2025 Standard Deduction | Break-Even Point |

|---|---|---|

| Single | $14,600 | Must itemize more than $14,600 |

| Married Filing Jointly | $29,200 | Must itemize more than $29,200 |

| Married Filing Separately | $14,600 | Must itemize more than $14,600 |

If you’re self-employed, there’s a potential advantage: Medicare premiums may qualify as an "above-the-line" deduction on Schedule 1 of Form 1040, reducing your taxable income without itemizing. However, this benefit typically doesn’t extend to Medigap premiums, which still require itemizing.

Ultimately, the choice between the standard deduction and itemizing depends on a careful calculation of all your potential deductions, including medical expenses, state and local taxes, mortgage interest, and charitable contributions.

How to Claim Medigap Premiums on Your Tax Return

If you’re planning to claim your Medigap premiums on your tax return, it’s important to follow the IRS rules carefully. Here’s a step-by-step guide to help you navigate the process and ensure you’re meeting all requirements while maximizing your deduction.

Step 1: Gather Proof of Premium Payments

Start by collecting all the necessary documents that show you paid your Medigap premiums during the tax year. The IRS requires clear evidence of these payments.

Look for receipts, bank statements, and policy documents – whether digital or paper – that include details like the payment date, amount, and recipient. If your premiums are deducted automatically, monthly bank statements or records from the Social Security Administration can work as proof.

To stay organized, create a dedicated folder for these documents. Label each one with the payment date and amount, and keep them safely stored for at least three years. This will make tax preparation smoother and ensure you’re ready if the IRS requests verification.

Step 2: Calculate Your Total Medical Expenses

Next, add up all your unreimbursed medical expenses for the year, including Medigap premiums. This total will help you determine if your expenses exceed the 7.5% of adjusted gross income (AGI) threshold needed for a deduction.

Include Medigap premiums, Medicare premiums, prescription medication costs, doctor visits, and any other eligible medical expenses. Only count expenses that weren’t reimbursed by insurance or other sources. For example, if Medicare or your Medigap plan paid part of a bill, only include the amount you personally covered.

Here’s an example: If your AGI is $50,000, the threshold is $3,750. Let’s say your unreimbursed expenses add up to $4,820. The deductible portion would be $1,070.

Step 3: Complete Schedule A on Form 1040

Finally, record your medical expenses on Schedule A of Form 1040. On Line 1 of Schedule A, enter your total medical and dental expenses, including Medigap premiums. The form will guide you in calculating the allowable deduction after applying the 7.5% AGI threshold.

Make sure you’re using the correct version of Schedule A for the tax year, as the IRS occasionally updates the line numbers and formatting. Double-check your calculations to avoid common errors, such as including reimbursed expenses, miscalculating the AGI threshold, or forgetting to itemize deductions.

If you’re unsure about any part of the process, consider consulting a tax professional for expert advice. They can help ensure accuracy and compliance with IRS rules.

sbb-itb-a729c26

Record Keeping and IRS Compliance Tips

Keeping organized records is essential if you want to defend your Medigap premium deductions in case the IRS raises any questions. A solid system for managing documentation will save you time and stress when tax season rolls around.

How to Organize Premium Payment Records

Set up a dedicated file – either physical or digital – for all your Medigap-related documents. This file should include payment receipts, policy statements, bank statements showing automatic deductions, and any correspondence from your insurance company. Clearly label each document with the payment date and amount so you’ll have everything ready when it’s time to prepare your taxes.

For digital records, scan paper documents and store them in a well-organized folder on your computer or cloud storage. Use a consistent naming format, such as "Medigap_Premium_Jan2025_$185.pdf", to make searching for specific files quick and easy. Hold onto these records for at least three years after filing your tax return, as this matches the IRS’s standard audit period.

If your premiums are paid through automatic bank withdrawals, double-check that your bank statements align with your payment records. Ensure the statements clearly show the insurance company name, payment date, and amount. For Social Security deductions, keep your annual Social Security statements, which detail Medicare premium deductions.

Once you’ve organized your premium payment records, make it a habit to track all medical expenses consistently. This will streamline your tax filing process.

Track Medical Expenses Throughout the Year

Start logging qualifying medical expenses from January 1st. Use a spreadsheet, budgeting app, or even a simple notebook to record each expense. Include the date, provider, amount paid, and any insurance reimbursements.

Focus only on unreimbursed expenses – the portion you paid out of pocket. For example, if Medicare or your Medigap plan covered part of a bill, record only the amount you were responsible for. Be sure to include Medigap premiums, Medicare Part B and Part D premiums, prescription costs, doctor visits, dental care, hearing aids, and even transportation for medical appointments.

For detailed guidance, consult IRS Publication 502, which outlines deductible medical expenses and the necessary documentation. This publication is updated annually, so check the latest version to ensure you’re accurately tracking eligible expenses and avoiding non-deductible items.

When to Consult a Tax Professional

If your financial situation or medical expenses are complex, it’s wise to seek advice from a tax professional. They can help you maximize deductions while ensuring you stay within IRS guidelines. This is particularly helpful for Illinois residents, who must navigate both federal and state tax rules.

Self-employed individuals should definitely consult a tax advisor, as they may have unique opportunities to deduct health insurance premiums. A professional can also help you decide whether to itemize deductions or take the standard deduction, running the numbers to determine which option saves you more money.

Before filing, review your expenses carefully to confirm accuracy and compliance with IRS rules. For Illinois residents, Illinois Health Agents can provide additional support, helping you align your record-keeping practices with your tax strategy while assisting with Medigap plan selection and documentation requirements.

How Illinois Health Agents Can Help

Navigating Medigap plans and handling tax documentation can feel overwhelming, especially when you’re trying to maximize deductions while staying on the right side of IRS rules. That’s where Illinois Health Agents steps in. They assist Illinois residents in making smart choices about Medicare supplement plans and ensure they understand the paperwork needed for accurate tax filings. Here’s how they simplify the process for Medigap plan selection and tax documentation.

Expert Guidance on Medigap Plans

Choosing the right Medigap plan, such as Plan F, G, or N, can be tricky. Illinois Health Agents helps you compare these options side-by-side, breaking down how different premiums affect your deductible medical expenses. They work with highly rated insurance providers to present standardized plans, making it easier to weigh your options.

For example, while a lower premium might save you money upfront, it could also mean your deductible medical expenses fall short of the 7.5% AGI threshold required for tax deductions. Illinois Health Agents walks you through these trade-offs, helping you pick a plan that not only meets your healthcare needs but also aligns with your financial goals.

Over time, they’ve earned a reputation for providing detailed comparisons, explaining how premium costs and coverage levels influence both your monthly budget and potential tax benefits. Their expertise ensures you make decisions with confidence.

Simplifying Tax Documentation

When it comes to documenting Medigap premiums for tax purposes, Illinois Health Agents offers practical support. They guide you through the process of keeping records for premium payments and other qualifying expenses. Their educational resources, like their article on claiming tax deductions for Medigap premiums, are designed to clarify IRS requirements and make sure your documentation is accurate and complete.

This targeted assistance ensures you’re well-prepared when tax season rolls around, minimizing stress and helping you avoid costly mistakes.

Personalized Support for Illinois Residents

As a local agency, Illinois Health Agents provides tailored advice and ongoing support. Their licensed agents understand the specific needs of Illinois residents, offering insights that make both tax and insurance decisions easier. Whether you’re self-employed or juggling a variety of medical expenses, their expertise can help you navigate deduction rules and uncover tax-saving opportunities.

Being local also means you can access in-person help when reviewing your insurance needs or preparing tax documents. This ongoing relationship ensures you stay informed about changes in Medigap plans or premium adjustments that could affect your financial strategy. With Illinois Health Agents, you’re not just a number – you’re a neighbor they’re committed to helping year after year.

Summary and Next Steps

Claiming Medigap premiums on your taxes requires careful attention to IRS guidelines and diligent recordkeeping. These premiums qualify as medical expenses, but they only become deductible if your total medical expenses exceed 7.5% of your adjusted gross income (AGI). To take advantage of this deduction, you’ll need to itemize deductions on Schedule A of Form 1040 and maintain thorough records of all premium payments throughout the year.

Here’s how to approach the process:

- Gather your premium payment records: Keep detailed documentation of every payment made.

- Calculate your total medical expenses: Add up all eligible medical costs to see if they surpass the 7.5% AGI threshold.

- Complete your tax forms accurately: Ensure everything is properly itemized on Schedule A.

Navigating IRS rules can be tricky, which is why many individuals turn to professionals for guidance. Expert advice can help ensure compliance while maximizing potential deductions.

Now is a great time to review your medical expenses and premium payments to see if you’re likely to exceed the 7.5% AGI threshold. If you’re close or already above this amount, itemizing your deductions could lead to meaningful tax savings. For those in Illinois, Illinois Health Agents offers tailored support in choosing the right Medigap plan and assisting with tax documentation. Their expertise can help you make informed decisions about Medicare supplement coverage while staying organized for tax season.

"Learn how to claim tax deductions for Medigap premiums, including eligibility criteria and tips for self-employed individuals." – Illinois Health Agents

Taking these steps now will ensure you’re well-prepared when it’s time to file your taxes, giving you confidence and clarity as you organize your medical expense records for the year.

FAQs

Can I deduct Medigap premiums if I take the standard deduction instead of itemizing?

No, you can’t deduct Medigap premiums if you’re taking the standard deduction. To deduct medical expenses, including Medigap premiums, you need to itemize your deductions using Schedule A on your tax return. Keep in mind, only the portion of your total medical expenses that exceeds 7.5% of your adjusted gross income (AGI) qualifies for deduction.

If you’re uncertain about how this works for your specific situation, it’s a good idea to consult a tax professional. For those living in Illinois, Illinois Health Agents can assist with health insurance options, including Medigap plans, to help you better manage your healthcare expenses.

What documents should I keep to claim my Medigap premiums as a tax deduction?

To make sure the IRS accepts your Medigap premium deductions, keeping detailed and accurate records is a must. Hold onto proof of payment, like bank statements, canceled checks, or credit card receipts. It’s also a good idea to save billing statements or invoices from your Medigap insurer that clearly show the premium amounts.

If you’re working with a tax professional, they’ll likely recommend keeping these records for at least three years, as that’s how long the IRS typically has to audit a return. Staying organized not only simplifies tax filing but also ensures you have the necessary documents to back up your deduction if questions arise.

Should I itemize my deductions or take the standard deduction if I want to include my Medigap premiums?

Deciding whether to itemize your deductions or stick with the standard deduction comes down to which option reduces your taxable income the most. To figure this out, tally up all your potential itemized deductions – including Medigap premiums – and compare that total to the standard deduction for your filing status. If the itemized amount is higher, you could save more by itemizing.

Tax laws and thresholds can get tricky, so it’s often a good idea to consult a tax professional or use trusted tax software to ensure an accurate comparison. While Illinois Health Agents can help you find the right health insurance, including Medigap plans, they don’t offer tax advice.

Recent Comments