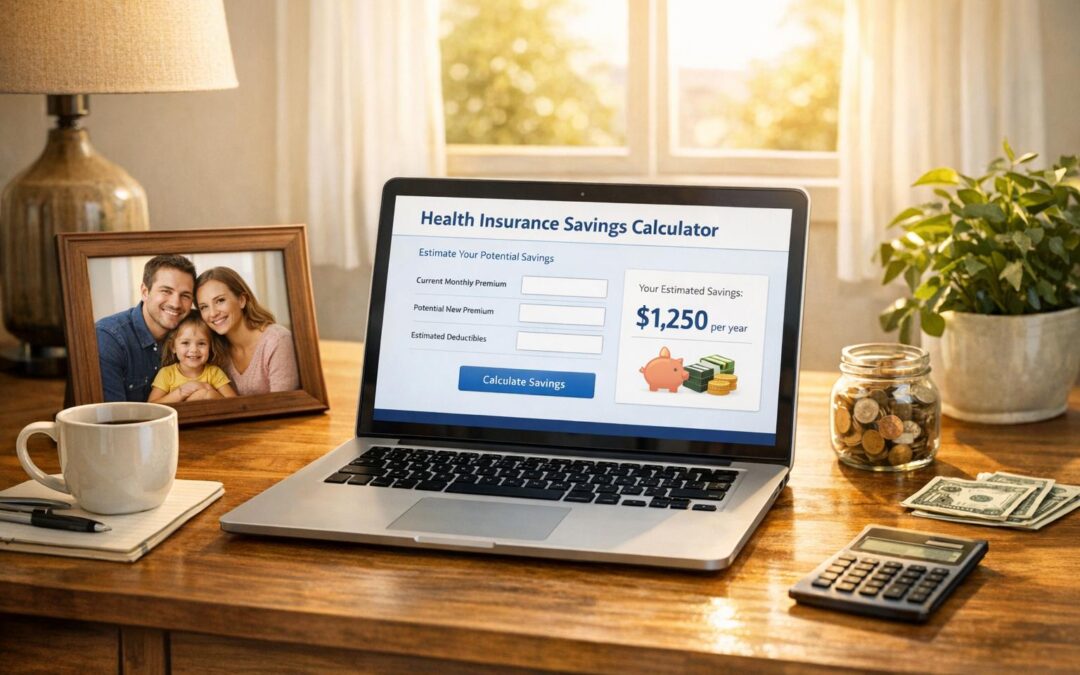

Discover Savings with a Health Insurance Cost Tool

Navigating the world of medical coverage can be overwhelming, especially when premiums and deductibles seem to climb every year. If you’ve ever wondered whether you’re paying too much, a tool to estimate potential savings on health plans can be a game-changer. It’s not just about cutting costs—it’s about finding a plan that fits your life, whether you’re managing solo expenses or covering a whole family.

Why Compare Coverage Options?

Every plan has its quirks, from HMO restrictions to high-deductible trade-offs. By entering a few details like your current monthly payments and expected medical needs, you can see how different options stack up. Maybe a lower premium plan could free up cash each month, or better coverage might save you during an unexpected health event. Tools like these take the guesswork out of the equation, offering a clear snapshot of where your money’s going.

Take Control of Your Budget

Don’t let confusion keep you locked into an overpriced policy. Exploring alternatives with a simple calculator empowers you to make informed choices without needing to be an expert. Start today and see how small changes could lead to big relief in your budget.

FAQs

How accurate are the savings estimates in this calculator?

Our tool uses placeholder data based on average costs for standard plans like HMO, PPO, and high-deductible options. While it’s not a perfect match for every provider or region, it gives a solid starting point to see where you might save. For exact numbers, you’ll want to check with specific insurers, but this helps narrow down your options.

Does family size really impact my insurance costs that much?

Absolutely, it does. Adding a spouse or kids to your plan often raises premiums and sometimes deductibles, since insurers account for more potential medical needs. Our calculator adjusts estimates based on whether you’re a single person, a couple, or a family, so you get a more realistic picture of costs and savings.

What if I don’t know my exact medical expenses for the year?

No worries at all! Just make your best guess based on past years or typical costs like doctor visits, prescriptions, or any ongoing care. The tool isn’t about precision—it’s about giving you a ballpark idea of savings. You can always tweak the numbers later to see how they affect the results.

Recent Comments