.markdown

Understanding Health Insurance Costs Made Simple

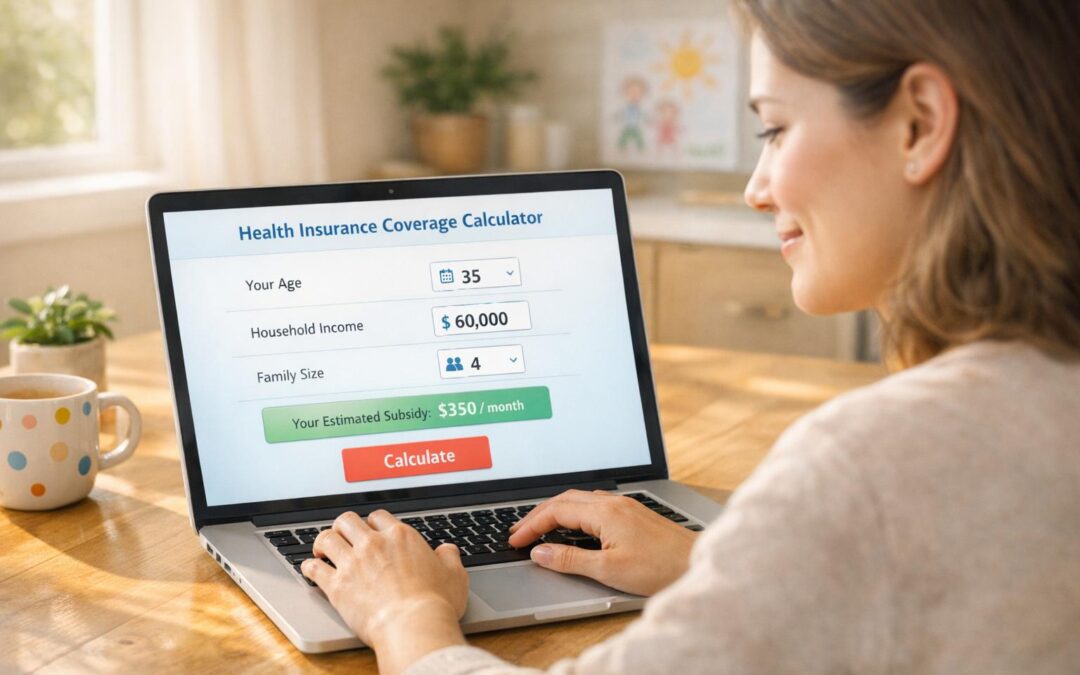

Navigating the world of medical coverage can be a daunting task, especially with so many variables at play. Whether you’re a single individual or managing a family, knowing what to expect in terms of premiums and out-of-pocket expenses is crucial. That’s where a tool like our Health Insurance Coverage Calculator comes in handy. It takes the guesswork out of budgeting for healthcare by offering personalized estimates based on your age, location, and specific needs.

Why Estimate Your Coverage Needs?

Healthcare expenses aren’t one-size-fits-all. Factors like household income, expected doctor visits, and even your zip code can impact what you’ll pay for a plan. By using a cost estimation tool, you gain insight into different tiers—Bronze, Silver, and Gold—and see how subsidies might reduce your burden. This kind of clarity empowers you to make informed decisions without wading through endless fine print. Plus, understanding potential tax credits under the Affordable Care Act can reveal savings you didn’t even know were available. Take a few minutes to input your details, and you’ll have a clearer picture of what lies ahead when shopping for a policy.

FAQs

How accurate are the estimates from this health insurance calculator?

Our tool provides estimates based on publicly available averages and standard insurance data, along with guidelines from the Affordable Care Act for subsidies. While we aim for accuracy, actual costs can vary depending on specific insurers, your exact location, and other personal factors. Think of this as a starting point—always reach out to insurance providers or a licensed agent for precise quotes tailored to your situation.

What types of health insurance plans does this tool cover?

We break down costs for three common plan tiers: Bronze, Silver, and Gold. Bronze plans typically have lower monthly premiums but higher out-of-pocket costs when you need care. Silver offers a middle ground with moderate premiums and deductibles, while Gold plans come with higher premiums but lower costs at the doctor’s office. Each estimate includes a quick note on coverage, like preventive care or emergency services, to help you weigh your options.

Does this calculator account for government subsidies?

Yes, it does! Based on your income and household size, our tool factors in potential tax credits and subsidies under the Affordable Care Act. These can significantly lower your monthly premiums, especially if you fall within certain income brackets. We’ll show you how much you might save, but keep in mind that final subsidy amounts are determined when you apply through an official marketplace or insurer.

Recent Comments