In Texas, qualifying for a 2-person group health insurance plan requires meeting specific rules set by insurance carriers and the Texas Department of Insurance. Here’s what you need to know:

- Eligibility: At least two employees must work 30–32 hours per week. One must be a non-owner W-2 employee (not a spouse or partner).

- Employer Contributions: Employers must cover at least 50% of employee premiums.

- Participation Rate: At least 75% of eligible employees must enroll unless they have alternative coverage.

- Required Documentation: Proof of business structure, payroll records, and employee census data are essential for verification.

- Spouses: Married owner-employee groups are allowed if both meet employee requirements.

Plan options include HMO, PPO, EPO, and HDHP, each offering varying levels of flexibility, network access, and costs. Understanding these requirements and submitting accurate documentation ensures a smoother application process.

Who Qualifies for 2-Person Group Plans in Texas

Employee and Owner Eligibility Rules

In Texas, insurance carriers require at least one enrolled non-owner employee to establish a valid 2-person group plan. To qualify, employees must work full-time, typically defined as 30–32 hours per week. Business owners, including partners, proprietors, and firm members, are also eligible if they meet the same hourly requirements.

Texas Insurance Code §1501.151 mandates that carriers cover a husband and wife working together as a group of two, regardless of their marital status. This state-specific rule differs from federal guidelines, which often require an additional non-spouse employee to qualify. As noted in Commissioner’s Bulletin # B-0035-01:

Texas considers a group of two eligible employees to be a small group, regardless of marital status.

Independent contractors (1099 workers) may also be included in the group, provided at least one W-2 employee is enrolled. For instance, Blue Cross and Blue Shield of Texas accommodates this arrangement, though specific rules may vary between carriers.

Once eligibility is confirmed, you’ll need to gather the required documentation to verify your group status.

Documents Needed to Prove Group Status

To establish your group plan, carriers will request documentation that verifies your business structure and employee relationships. These documents often include organizational paperwork like LLC filings, partnership agreements, or corporate formation records. These materials help confirm the connection between the business owners and employees.

Tax filings and payroll records are critical to proving that your employees are legitimate W-2 workers. In some cases, carriers may waive detailed payroll requirements if both individuals are listed as partners in the LLC documentation. Additionally, an employee census outlining the hours worked by each individual is typically required to confirm full-time employment status.

Before submitting your application, ensure the insurance company is licensed in Texas. You can verify this by contacting the Texas Department of Insurance (TDI) Help Line or visiting their website. Use carrier-specific tools, like the Blue Cross and Blue Shield of Texas "Form Finder", to locate and complete all necessary documents. Proper preparation and complete documentation will help avoid delays during the approval process.

Shop Small Business Health Insurance Plans by Blue Cross Blue Shield of Texas

Employer Contribution and Participation Rules

Once group status is verified, carriers assess employer contributions and employee participation to ensure the health plan remains viable.

Minimum Employer Contribution Amounts

In Texas, carriers typically require employers to cover at least 50% of each employee’s premium. This contribution applies only to employee coverage – there’s no obligation to contribute to premiums for dependents or spouses, though employers can choose to offer additional support.

The Texas Department of Insurance explains this standard practice clearly:

"The law doesn’t require you to pay an employee’s health plan premiums. But your insurance company might require you to pay at least 50% of your employees’ premiums."

For example, if an employee’s monthly premium is $400, the employer must contribute at least $200. This 50% minimum is a common requirement across most major Texas carriers.

How Participation Rates Are Calculated

To meet Texas carrier requirements, 75% of full-time employees must enroll in the group health plan. However, employees with other health coverage – like Medicare, TRICARE, or a spouse’s employer-sponsored plan – are excluded from this calculation.

Here’s a practical example: If you have two eligible employees and one is already covered under their spouse’s plan, that employee is excluded. The remaining employee who enrolls would represent 100% participation, meeting the 75% requirement. On the other hand, if both employees are eligible and neither has other coverage, both must enroll to meet the standard for guaranteed issue coverage.

If the 75% participation rate isn’t met, there are still opportunities to comply. The annual open enrollment period (Nov 1–Jan 15) allows you to make adjustments to meet the threshold. Be sure to review your application documents to ensure all requirements are met.

Application Documents and Information Required

Once you’ve established group status and met the employer contribution rules, you’ll need to gather specific documents and information to complete your application.

Employee Census Data Requirements

Texas insurance carriers require detailed employee census data to calculate premiums. You’ll need to provide each employee’s age, tobacco status, and ZIP code. These factors play a big role in determining costs. For example, premiums for a 64-year-old can be up to three times higher than those for a 21-year-old. Similarly, tobacco users may face premiums that are up to 50% higher than non-tobacco users.

Additionally, you’ll need to confirm each employee’s full-time status by documenting their weekly work hours, which typically range between 30 and 32 hours. Be sure to include information for spouses, children under 25, and domestic partners. For domestic partners, carriers may require supporting documents like affidavits, joint bank statements, or shared leases. Once you’ve compiled this census data, you’ll need to shift your attention to records of prior coverage and compliance.

Coverage History and Compliance Records

In addition to census data, carriers require records to verify coverage history and compliance efforts. If any employees have alternative coverage, such as Medicare or coverage through a spouse’s plan, document these details. This information helps exclude those employees from the 75% participation requirement. You’ll also need to submit HIPAA Privacy and Standard Authorization Forms to ensure proper handling of employee data.

Finally, provide documentation showing that former employees were informed of their rights under Texas continuation law. For new hires, remember that a waiting period of up to 90 days is allowed before coverage begins, but no premiums can be charged during this time.

sbb-itb-a729c26

Available Plan Types and Carrier Differences

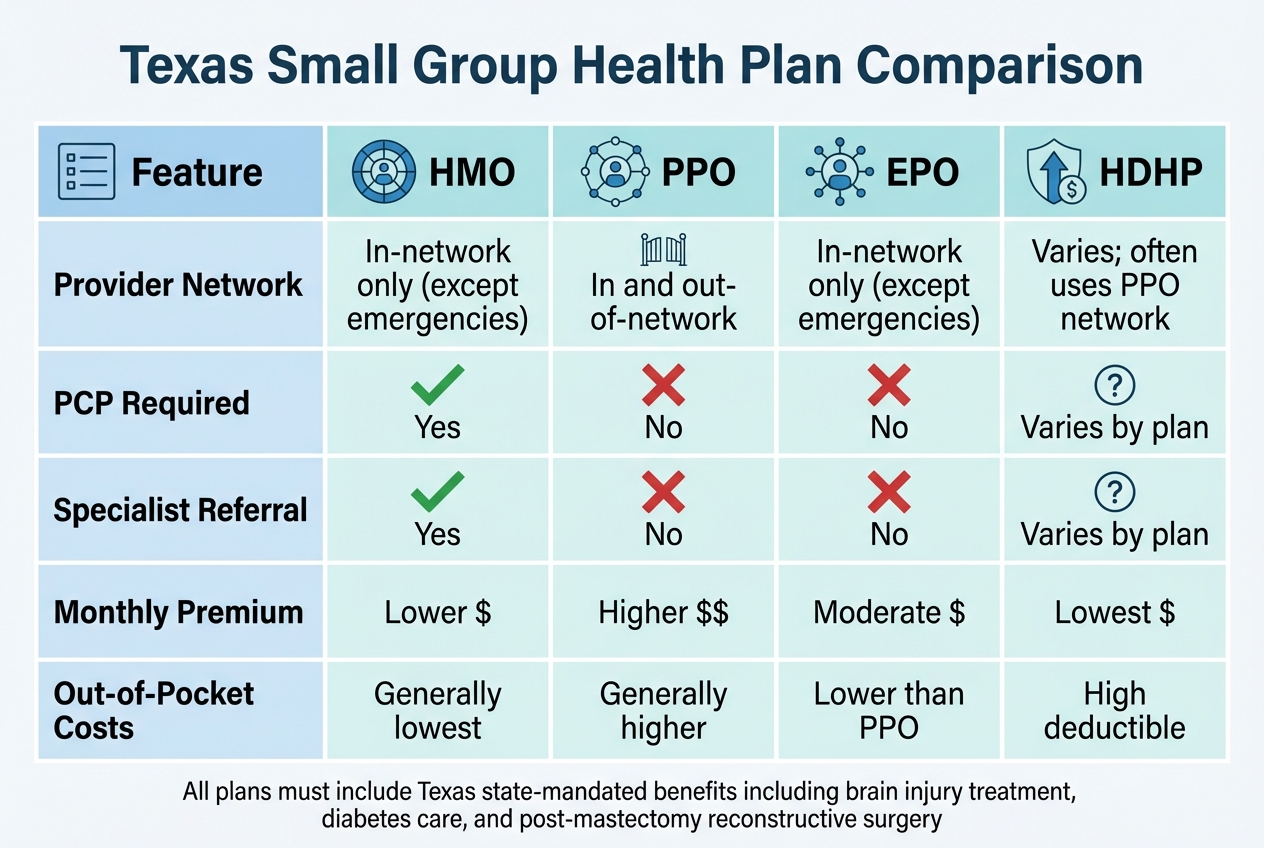

Texas 2-Person Group Health Insurance Plan Types Comparison Chart

Once your documentation and compliance are set, it’s time to explore plan options that align with your business needs. For 2-person groups in Texas, carriers like Blue Cross and Blue Shield of Texas offer four main plan types: HMO, PPO, EPO, and HDHP. Each plan comes with its own set of advantages and trade-offs.

For instance, HMO plans require members to choose a Primary Care Physician (PCP) to manage their care and provide specialist referrals. Coverage is typically limited to in-network providers, except in emergencies, which helps keep premiums on the lower side.

In contrast, PPO plans offer more flexibility. You can see any doctor without referrals and even receive coverage for out-of-network care, though at a higher cost. EPO plans, while similar to HMOs in restricting out-of-network coverage (except for emergencies), do not require a PCP or referrals for specialists.

Finally, HDHP plans are designed for those willing to trade lower monthly premiums for higher deductibles. These plans are often paired with Health Savings Accounts (HSAs), allowing members to save for medical expenses with tax advantages. It’s worth noting that premiums for 2-person groups in Texas vary based on the participants’ ages.

HMO, PPO, EPO, and HDHP Plan Comparison

Choosing the right plan depends on your budget and how you prefer to access healthcare. For example, if you’re looking to minimize monthly costs and don’t visit doctors often, an HMO or HDHP might be a good fit. On the other hand, if you value the freedom to see specialists without referrals or need out-of-network options, a PPO could be worth the extra expense.

Additionally, all small group plans in Texas must include state-mandated benefits that go beyond federal ACA requirements. These include coverage for acquired brain injury treatment, diabetes care management, and reconstructive surgery following a mastectomy.

| Feature | HMO | PPO | EPO | HDHP |

|---|---|---|---|---|

| Provider Network | In-network only (except emergencies) | In and out-of-network | In-network only (except emergencies) | Varies; often uses PPO network |

| PCP Required | Yes | No | No | Varies by plan |

| Specialist Referral | Yes | No | No | Varies by plan |

| Monthly Premium | Lower | Higher | Moderate | Lowest |

| Out-of-Pocket Costs | Generally lowest | Generally higher | Lower than PPO | High deductible |

Each plan type offers benefits tailored to different needs, but carriers also include unique features that set their offerings apart.

Carrier-Specific Features and Benefits

Blue Cross and Blue Shield of Texas (BCBSTX) provides additional options through its network structures. Their Blue Choice PPO℠ offers broad statewide access and BlueCard coverage for travel, while the Blue Advantage HMO℠ focuses on lower premiums with a localized network.

For the 2026 plan year, BCBSTX is introducing digital tools aimed at weight management, musculoskeletal care, and diabetes reversal. However, availability of these tools may vary across HMO networks.

Members also gain access to the Blue365 discount program, which offers savings on health-related products from top retailers. Additionally, the Well onTarget wellness program rewards members with "Blue Points" for making healthy lifestyle choices. These features add an extra layer of value to their plan offerings.

Texas Rules for Owners and Spouses

In Texas, group health coverage for owner-spouse businesses comes with specific rules. Both spouses must meet the criteria for employees, ensuring fair treatment while maintaining clear eligibility standards for forming a legitimate two-person group.

Spouse-Only Group Eligibility in Texas

Texas law ensures that married owner-employee groups are treated fairly, but both spouses must qualify as eligible employees by working at least 30 hours a week. The Texas Department of Insurance states:

"A small employer carrier shall not deny two individuals who are married the status of ‘eligible employee’ solely because of that marital status."

To enroll in a small-employer health plan, the business owner needs at least one other employee to qualify and enroll as well. In this case, your spouse must meet the eligibility criteria as an employee, not just as a dependent.

Carriers often ask for proof of your spouse’s employee status. This can include business checks, invoices, incorporation records, DBA filings, or documentation of job duties. Keeping these records organized and accessible can help avoid delays during the application process. These requirements emphasize the importance of verifying employee status for small group plans.

Workers’ Compensation and Coverage Continuation

Texas does not require workers’ compensation coverage, so group health plans generally do not cover work-related injuries. If you or your spouse are injured on the job, separate workers’ compensation insurance is necessary to handle those costs.

For continuation coverage, Texas provides more extensive protections than federal law. While COBRA applies only to employers with 20 or more employees, Texas state continuation laws extend to businesses of any size, even two-person groups. This means if your group health coverage ends, you and your spouse can continue your coverage under state law, giving you time to arrange new insurance options.

Summary and Action Steps

To secure group health insurance for a two-person business, follow these essential steps based on the eligibility and documentation rules outlined earlier.

First, qualify as a small employer by having at least two eligible employees working 30 hours per week. Employers are required to contribute at least 50% of each employee’s premium, and a 75% employee participation rate ensures access to guaranteed issue protections.

When submitting proof of eligibility, carriers accept various documents, such as articles of incorporation, business checks, sales tax licenses, or licensure records. No single document is universally required, so choose what best fits your situation.

If the 75% participation rate isn’t met, you can still apply during the open enrollment period (November 1–January 15). During this time, confirm the carrier’s licensing status through the Texas Department of Insurance. To make the process smoother, gather employment-related documents like job descriptions, invoices, and tax filings in advance.

Texas law offers strong protections for two-person groups, including guaranteed issue requirements and extended state continuation coverage, even in cases where federal COBRA doesn’t apply. By understanding these rights and preparing the necessary documentation, you’ll be better equipped to navigate the application process and secure the health coverage your business needs.

FAQs

What documents are needed to qualify for a 2-person group health insurance plan in Texas?

To qualify for a 2-person group health insurance plan in Texas, you’ll need to provide specific documents to confirm your group’s eligibility. These typically include proof of a legitimate business relationship, such as partnership agreements or payroll records showing at least two employees. Other legal documents that verify compliance with Texas insurance regulations may also be required.

If you’re seeking coverage through an association, additional paperwork might be necessary, like the association’s constitution, bylaws, or articles of incorporation. The group must meet Texas law’s definition of a bona fide employer or association. It’s important to check with your insurance carrier to understand their exact documentation requirements.

What are the differences between Texas and federal rules for spousal eligibility in 2-person group health plans?

In Texas, spouses can qualify as employees for 2-person group health plans if they work an average of 30 or more hours per week for the business. This is in line with Texas insurance regulations, which permit small group coverage for businesses with at least two employees. Spouses are eligible under this rule as long as they meet the required work-hour threshold.

On the other hand, federal guidelines, such as those under the Affordable Care Act (ACA), generally do not classify spouses as employees unless they are considered "common law" employees. This means that in partnerships or sole proprietorships, spouses aren’t typically counted toward the employee requirement unless they are formally employed by the business.

This difference highlights how Texas provides more flexibility for small businesses and partnerships. By allowing spouses to join group health plans if they meet specific state eligibility rules, Texas makes it easier for these businesses to access small group coverage.

What are the key differences between HMO, PPO, EPO, and HDHP health insurance plans?

When deciding between HMO, PPO, EPO, and HDHP plans, it’s essential to weigh their differences and what they mean for your healthcare needs.

- HMO (Health Maintenance Organization) plans tend to have lower premiums and out-of-pocket costs. However, they require you to select a primary care physician (PCP) and get referrals to see specialists. Coverage is typically limited to in-network providers, so staying within the network is crucial.

- PPO (Preferred Provider Organization) plans provide more freedom by allowing you to visit any provider without needing referrals. They also cover some out-of-network care, but this flexibility often comes with higher premiums and deductibles.

- EPO (Exclusive Provider Organization) plans are somewhat like PPOs but with stricter rules. They don’t cover out-of-network providers unless it’s an emergency. These plans strike a balance between affordability and a limited provider network.

- HDHP (High Deductible Health Plan) options feature lower monthly premiums but higher deductibles. They’re commonly paired with Health Savings Accounts (HSAs), which allow you to save pre-tax dollars to cover medical expenses.

The right choice depends on your priorities. If keeping costs low is your main focus, an HMO or HDHP might suit you best. On the other hand, if having the freedom to choose providers matters more, a PPO or EPO could be the way to go. Think about your budget, healthcare habits, and how much flexibility you need to make the best decision.

Recent Comments