In Illinois, small businesses with two full-time employees can qualify for group health insurance. This includes partnerships, corporations, or a business owner with one employee. However, sole proprietors and their spouses do not meet the criteria unless another non-family employee is included. Here’s what you need to know:

- Eligibility: At least two full-time employees working 30+ hours weekly.

- Participation: 70% of eligible employees must enroll unless applying during the waiver period (Nov 15–Dec 15).

- Employer Contribution: Minimum of 25% toward employee premiums.

- Documentation: Proof of business operations, payroll records, and tax forms are required.

- Plan Options: Choose between HMO, PPO, or POS plans based on flexibility and cost.

For coverage starting Jan 1, 2026, complete enrollment by Dec 31, 2025. During the waiver period, participation and contribution rules are relaxed, making it easier for small groups to qualify. Reach out to a licensed agent if you need help navigating the process.

Eligibility Requirements for 2-Person Groups

Full-Time Employee Definition

In Illinois, a full-time employee is defined as someone working 30 or more hours per week. This standard applies to all members of the group. For employees working between 20 and 30 hours per week, eligibility may still be possible with underwriter approval and proper payroll tax documentation.

If a business has one full-time owner and one full-time employee, it satisfies the eligibility criteria. Similarly, business owners and partners can count toward the two-person minimum, provided they meet the same hourly requirements. These definitions are crucial for understanding how enrollment works under guaranteed issue coverage.

Guaranteed Issue Coverage Rules

Most carriers require 70% of eligible, uninsured full-time employees to enroll in the plan. For a two-person group, this typically means both individuals must participate. However, if you apply between November 15 and December 15, this participation rule is waived. Additionally, carriers cannot base your premium rates on health status, medical history, or claims experience. Next, let’s explore how spouses and business partners factor into eligibility.

Spouse and Business Partner Requirements

A business made up of only a sole proprietor and their spouse does not qualify for small group coverage. To meet the requirements, you need at least one "common-law" employee who is not an owner, the owner’s spouse, or a family member.

On the other hand, business partners are eligible for small group coverage. If you have a legitimate partnership or corporation with two partners working full-time, you meet the eligibility criteria. To verify this, you’ll need to provide documentation, such as Schedule K-1 forms, to confirm the partnership structure. The same rules apply to corporations with two officers or shareholders who work full-time for the business.

Documentation Needed for Enrollment

Proof of Business Operations

To confirm your 2-person group qualifies as a legitimate Illinois business, carriers require specific documentation. If your business is already established, you’ll need to submit the latest Illinois Employer’s Contribution and Wage Report (Form UI 3/40) with your business details. For newer businesses, provide state-filed proof of operations along with W-4 forms for all W-2 employees. Additional documents like incorporation papers, business licenses, or other state filings demonstrating active business operations should also be included.

Once this is complete, you’ll need to gather payroll records to verify employee eligibility.

Payroll and Employee Records

Payroll documentation is essential for confirming that employees meet the required work hours to qualify as full-time. The UI 3/40 form is typically used to verify payroll details. If any owners, partners, or shareholders are not listed on the UI 3/40, you’ll need to provide supplemental tax forms, such as Federal Tax Schedule C, Form 941, or Schedule K-1. In some cases, carriers may accept alternative documentation, like a recent payroll report or an employee’s W-2, but you’ll need to include an explanation.

Prior Coverage Verification

If there’s any history of prior coverage, this needs to be addressed before enrollment. While proof of prior coverage isn’t usually required for initial enrollment, you must provide a specific waiver reason if any member declines coverage due to existing insurance. For this, BCBSIL offers tools like a quoting checklist and a notice of special enrollment rights. If you have questions or need guidance, reach out to BCBSIL customer service at 1-800-538-8833.

Carrier Requirements and Policies

Blue Cross Blue Shield of Illinois Requirements

For 2-person groups, Blue Cross Blue Shield of Illinois (BCBSIL) has specific rules regarding participation and premium contributions. Employers must ensure 70% enrollment and contribute at least 25% toward employee premiums. However, between November 1 and December 15, these participation and contribution rules are waived. Retiree coverage is only available to those previously insured under the group plan. Serving over 8.9 million members across Illinois, BCBSIL has been a trusted provider in the state for more than 85 years. Additionally, it’s essential to understand the distinctions in network and referral protocols for HMO and POS plans.

HMO and POS Plan Guidelines

HMO plans, such as Blue Precision HMO, require members to select a Primary Care Physician (PCP) and obtain referrals for specialist visits. These plans generally limit coverage to in-network providers, with out-of-network care covered only in emergencies. Members must also live or work within the designated network areas. EPO plans share similar out-of-network restrictions but may differ in premium costs.

PPO Plan Requirements

PPO plans offer greater flexibility compared to HMOs. Both Standard PPO and Blue Choice Preferred PPO plans do not require referrals or group selection, and they include out-of-network benefits – though at higher out-of-pocket costs. While Blue Choice Preferred PPO members must reside in Illinois, Standard PPO and Blue Options plans typically have no residency restrictions. All small group plans come with pharmacy benefits, including access to 90-day prescriptions and home delivery services. BCBSIL also offers "Smart" networks, which feature reduced premiums by working with smaller provider groups.

How to Enroll: Step-by-Step Process

Choosing a Plan

First, ensure your group includes at least two full-time employees (the owner can be one of them). To get a quote, provide your company name, start date, headquarters ZIP code, and the number of full-time employees. You’ll also need to submit census data, which includes each employee’s age and gender. You can either enter this information manually or import it, depending on your preference, to receive accurate premium estimates.

Next, compare the ACA metal levels to find the right fit for your group. Platinum plans come with lower out-of-pocket costs but higher premiums, while Bronze plans offer lower premiums but higher deductibles. Choose the network type that suits your needs. PPO plans are more flexible, offering out-of-network benefits, whereas HMO and POS plans generally require referrals from a primary care physician but may save you money with lower premiums. Finally, decide on your employer contribution strategy. In Illinois, employers are required to contribute at least 25% toward employee premiums during standard enrollment periods. Once you’ve settled on a plan and contribution strategy, gather the necessary documents to proceed.

Submitting Required Documents

You’ll need to provide proof of wages using the Illinois Employer’s Contribution and Wage Report (Form UI 3/40). If your business is new, submit state-filed documentation along with W-4 forms for any W-2 employees. Carrier-specific tools, like the BCBSIL "Form Finder", can help you locate the most up-to-date enrollment forms. This tool offers access to over 900 forms for both employers and members. Your enrollment package should also include the Blue Balance Funded Quoting Eligibility Checklist, RFP Producer Application Forms, and HIPAA Privacy/Standard Authorization Forms.

If you’re aiming for coverage to begin on January 1, 2026, make sure to complete your enrollment by December 31, 2025. For groups that can’t meet the standard 70% participation rate or the 25% contribution requirement, there’s a waiver period from November 1 to December 15, during which these requirements are temporarily suspended. After submitting your documents, confirm your plan complies with all ACA and state regulations.

Meeting ACA and State Compliance Requirements

Under Illinois law (215 ILCS 97/40), small employers who meet eligibility criteria must be accepted for coverage. Verify that your plan aligns with Mental Health Parity standards and meets the Illinois Department of Insurance’s network adequacy requirements. Additionally, all plans must qualify as Qualified Health Plans (QHPs), which are categorized by metal levels to define the cost-sharing ratio between the insurer and the member.

sbb-itb-a729c26

Uninsured Small Business Waiver Period- Take Advantage Now!

Required Benefits and Coverage Comparisons

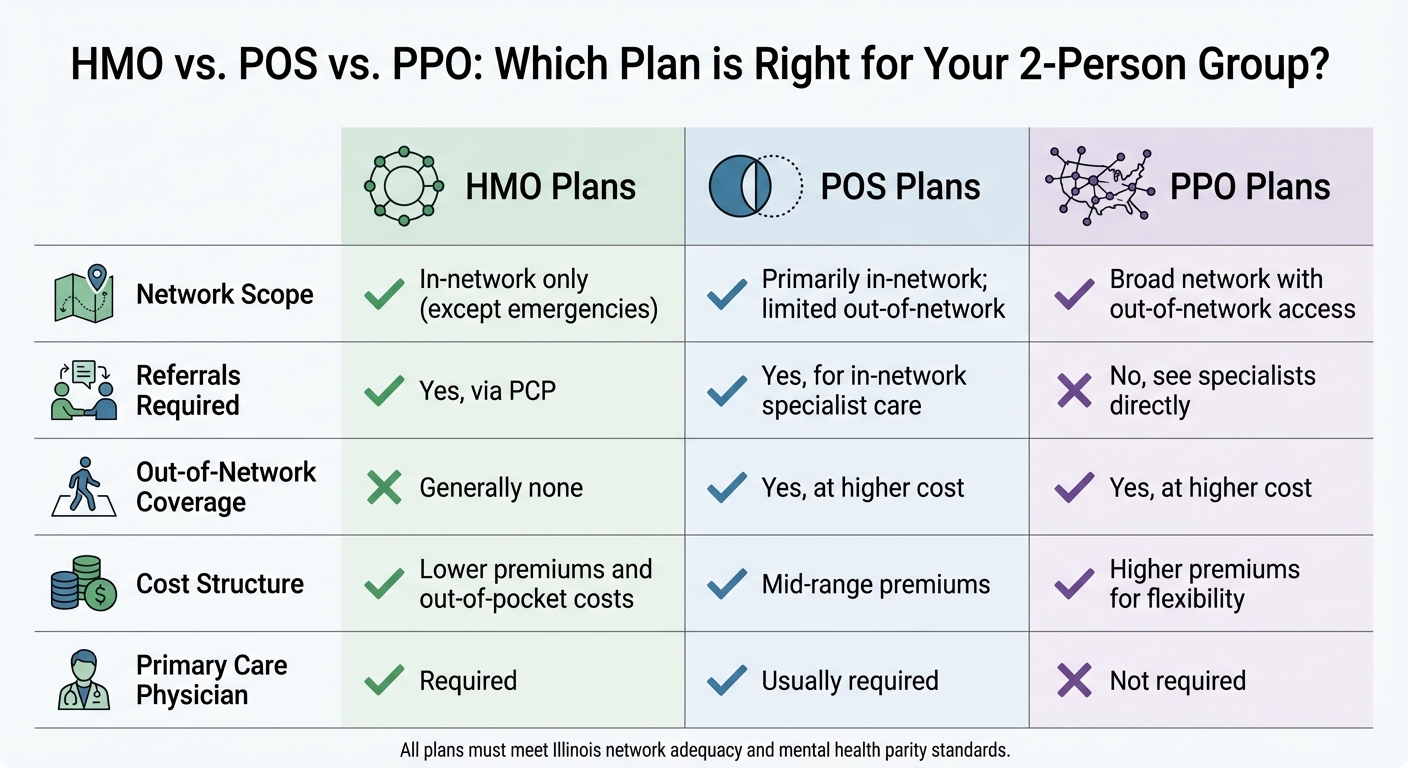

Illinois 2-Person Group Health Insurance: HMO vs POS vs PPO Plan Comparison

Mandated Benefits for Small Groups

In Illinois, small group health plans must follow specific state laws that ensure guaranteed issue coverage for all groups in this category. For instance, your plan is required to include maternity and prenatal care, as outlined in 50 Ill. Admin. Code 5421.130(e). Additionally, preventive services such as mammograms, pap smears, and prostate screenings are mandatory, as per 215 ILCS 5/356g. Coverage must also extend to autism spectrum disorders and post-mastectomy care. For children under 19, habilitative services are required under 215 ILCS 5/356z.15.

Some benefits, however, are not universally mandated. For example, infertility treatment is only required for groups with more than 25 employees, so smaller groups won’t automatically have this coverage. Similarly, mental health and substance abuse benefits are optional for groups with 50 or fewer employees. If you decide to include these benefits, they must comply with parity regulations under 215 ILCS 5/370c.

Next, let’s compare how different types of plans handle network access and referrals.

HMO/POS vs. PPO Coverage Comparison

Different plan types offer varying levels of flexibility and cost structures, though all must meet the essential benefit standards under the Affordable Care Act (ACA). Here’s how they stack up:

- HMO plans: These require you to stick to in-network providers, except in emergencies, and typically involve a primary care physician (PCP) to manage referrals.

- PPO plans: These provide access to a wider network and allow out-of-network care, though at a higher cost. Referrals are not required to see specialists.

- POS plans: These are a middle ground, usually requiring a PCP for referrals but offering some out-of-network coverage at higher costs.

| Feature | HMO Plans | POS Plans | PPO Plans |

|---|---|---|---|

| Network Scope | In-network only (except emergencies) | Primarily in-network; limited out-of-network | Broad network with out-of-network access |

| Referrals Required | Yes, via PCP | Yes, for in-network specialist care | No, see specialists directly |

| Out-of-Network Coverage | Generally none | Yes, at higher cost | Yes, at higher cost |

| Cost Structure | Lower premiums and out-of-pocket costs | Mid-range premiums | Higher premiums for flexibility |

| Primary Care Physician | Required | Usually required | Not required |

When choosing a plan, it’s important to confirm that it complies with the Illinois Department of Insurance’s network adequacy standards, which regulate the maximum time and distance for accessing healthcare providers. Additionally, any plan that includes mental health benefits must adhere to mental health parity standards, ensuring equal treatment limits for mental and physical health services.

Conclusion and Next Steps

To secure 2-person group health coverage in Illinois, start by meeting the eligibility requirements, gathering the necessary documentation, and adhering to your chosen carrier’s guidelines. Key requirements include having at least two full-time employees working 30+ hours per week, maintaining a 70% participation rate, and contributing at least 25% as an employer. If meeting these criteria is difficult, you can apply during the special waiver period from November 1 to December 15, when these rules are temporarily relaxed. Be sure to have all payroll and business operation documents ready as previously outlined.

Once your documents are prepared, compare plans to find the one that best suits your group’s needs. Look into carrier options by evaluating network access, plan types (such as HMO, POS, or PPO), and ensure the selected coverage aligns with Illinois’s requirements for small group benefits.

If the process feels overwhelming or you’re unsure about your options, reach out to a licensed agent who specializes in Illinois small group coverage. They can guide you through comparing plans, verifying your documentation, and ensuring compliance with state and carrier regulations.

FAQs

What are the main differences between HMO, PPO, and POS plans for small group health insurance in Illinois?

HMO, PPO, and POS plans each bring distinct features to the table, catering to various healthcare needs for small groups in Illinois. Here’s a quick breakdown:

- HMO (Health Maintenance Organization): These plans are known for their cost efficiency but come with restrictions. Members must stick to in-network providers and typically need referrals to see specialists.

- PPO (Preferred Provider Organization): If flexibility is your priority, PPO plans might be the way to go. They allow members to visit out-of-network providers (at a higher cost) and don’t require referrals for specialist care.

- POS (Point of Service): Think of POS plans as a mix of the two. Like an HMO, they emphasize in-network care but also allow out-of-network visits, similar to a PPO. However, referrals are often needed for specialists.

In Illinois, while carriers may group HMO and POS plans together for regulatory purposes, they function differently. HMO plans are generally the most budget-friendly but limit provider options. PPO plans, on the other hand, offer more freedom to choose providers but come with higher premiums. POS plans strike a balance between cost and flexibility, making them a middle-ground choice for those looking for both options.

Always check the fine print of any plan to ensure it aligns with your group’s specific healthcare needs.

Can a sole proprietor in Illinois qualify for small group health insurance?

Yes, sole proprietors in Illinois can qualify for small group health insurance, but there are specific requirements they need to meet. The business must have an average of 1 to 50 employees during the previous calendar year – or reasonably expect to fall within this range if it’s a new business. Additionally, there must be at least one employee on the first day of the plan year. If the owner pays themselves a regular wage and receives a W-2, they can count as the required employee.

To apply, the proprietor needs to provide certain documentation, including:

- Proof of business existence, such as an Illinois business registration or a state tax return.

- Proof of wages, like payroll records or a W-2 form.

- The company’s legal name and address.

It’s also worth noting that most insurance carriers require employers to cover at least 25% of their employees’ premiums and ensure that at least 70% of eligible employees enroll in the plan.

By meeting these criteria, sole proprietors in Illinois can gain access to small group health insurance options.

What documents do I need to verify eligibility for a 2-person group health plan in Illinois?

To qualify for a 2-person group health plan in Illinois, insurance carriers usually require a completed Illinois Standard Health Employee Application along with specific supporting documents. These materials help confirm the business’s legal status and verify that qualifying wages are being paid.

Here’s what you may need to provide:

- Proof of business existence: Acceptable documents might include Articles of Incorporation, a partnership agreement, an LLC operating agreement, a business license, or an IRS Form SS-4 that shows your employer identification number (EIN).

- Proof of wages: This can be demonstrated through recent payroll records, W-2 or 1099 forms, IRS Form 941 (quarterly wage report), or other statements showing employees meet the minimum hourly requirement (commonly 20–30 hours per week).

- Employee details: A roster listing each employee’s name, Social Security number, date of birth, and confirmation of their full-time status.

Providing these documents alongside the signed application helps carriers quickly verify your group’s eligibility.

Recent Comments