If you’re self-employed in Illinois, understanding changes to ACA subsidies in 2026 is essential for managing health insurance costs. Here’s what you need to know:

- Income Eligibility: Subsidies are based on your Modified Adjusted Gross Income (MAGI) and the Federal Poverty Level (FPL). For 2026, a single person qualifies for subsidies if their income is between $15,650 (100% FPL) and $62,600 (400% FPL). A family of four qualifies between $32,150 and $128,600.

- Subsidy Cliff Returns: If your income exceeds 400% of the FPL, you lose all subsidy eligibility. For example, earning just $1 over the threshold means no assistance.

- No Repayment Caps: Starting in 2026, if you underestimate your income and receive excess subsidies, you must repay the full amount.

- Medicaid in Illinois: If your income is below 138% of the FPL ($21,597 for an individual), you may qualify for Medicaid instead of Marketplace subsidies.

Accurate income projection is vital to avoid losing subsidies or facing unexpected repayments. Tools like the KFF Health Insurance Marketplace Calculator and expert guidance from Get Covered Illinois can help ensure you choose the right plan and calculate your eligibility.

Can’t Afford Your ACA Plan? 2026 FIXES & CHEAPER OPTIONS!

sbb-itb-a729c26

2026 ACA Subsidy Income Limits

2026 ACA Subsidy Income Limits by Household Size in Illinois

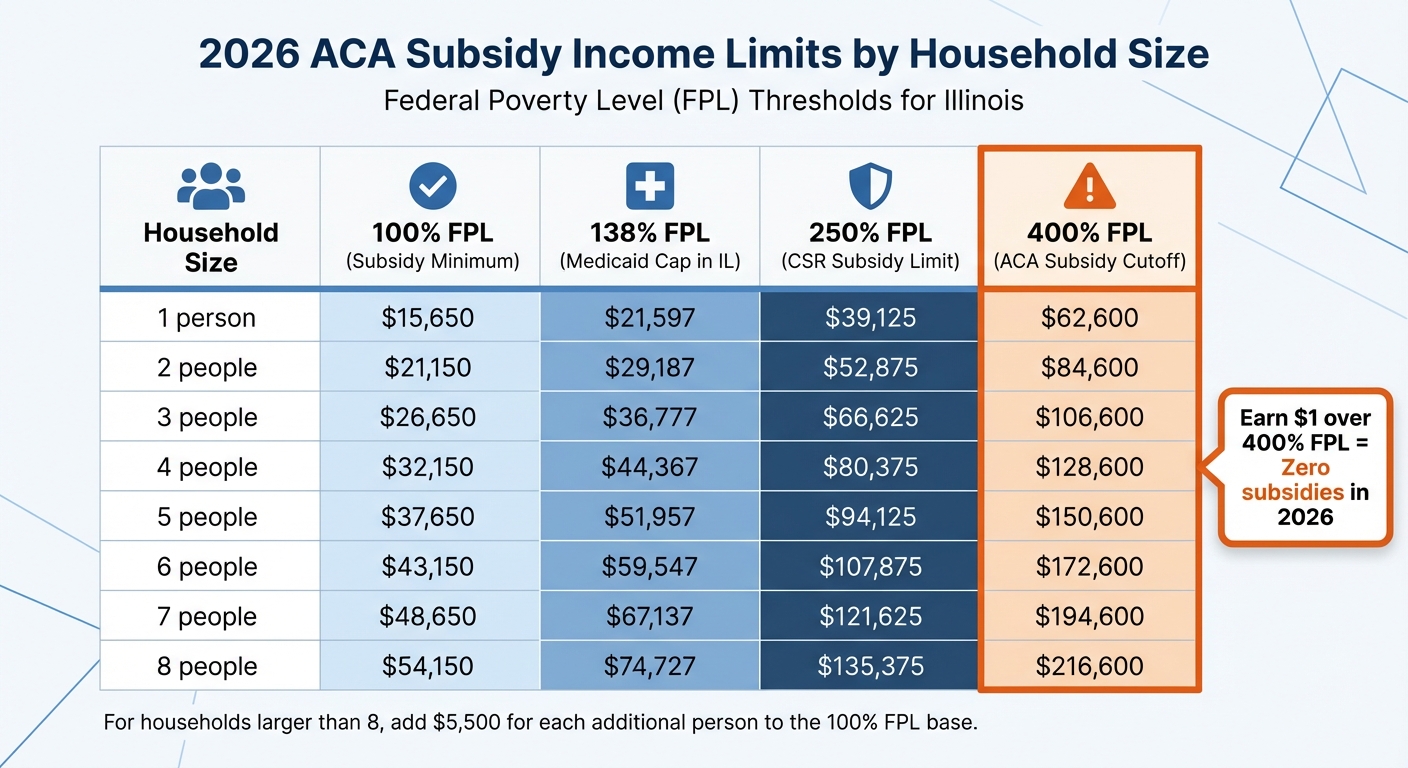

Your eligibility for ACA subsidies depends on how your income stacks up against the Federal Poverty Level (FPL). For 2026, these calculations are based on the 2025 FPL guidelines. These thresholds define the income range needed to qualify for financial assistance under the ACA. Below, we break down the 2026 FPL guidelines, Medicaid thresholds in Illinois, and the implications of the subsidy cliff.

2026 Federal Poverty Level (FPL) Guidelines

The FPL is the key benchmark used to determine who qualifies for ACA subsidies and how much support they can receive. For 2026, a single person must earn at least $15,650 (100% FPL) to qualify for premium tax credits. For a family of four, the minimum income requirement is $32,150. Subsidies phase out entirely at 400% of the FPL, which equals $62,600 for an individual or $128,600 for a family of four.

Here’s a breakdown of the 2026 FPL thresholds by household size:

| Household Size | 100% FPL (Subsidy Minimum) | 138% FPL (Medicaid Cap in IL) | 250% FPL (CSR Subsidy Limit) | 400% FPL (ACA Subsidy Cutoff) |

|---|---|---|---|---|

| 1 | $15,650 | $21,597 | $39,125 | $62,600 |

| 2 | $21,150 | $29,187 | $52,875 | $84,600 |

| 3 | $26,650 | $36,777 | $66,625 | $106,600 |

| 4 | $32,150 | $44,367 | $80,375 | $128,600 |

| 5 | $37,650 | $51,957 | $94,125 | $150,600 |

| 6 | $43,150 | $59,547 | $107,875 | $172,600 |

| 7 | $48,650 | $67,137 | $121,625 | $194,600 |

| 8 | $54,150 | $74,727 | $135,375 | $216,600 |

Note: For households larger than eight, add $5,500 for each additional person to the 100% FPL base.

Medicaid Expansion and Income Limits in Illinois

Illinois expanded Medicaid under the ACA, which directly impacts those on the lower end of the income scale, especially self-employed individuals. In Illinois, if your Modified Adjusted Gross Income (MAGI) falls below 138% of the FPL – $21,597 for an individual – you qualify for Medicaid instead of Marketplace subsidies. If you think you fall into this category, you can check your eligibility through Illinois’ Application for Benefits Eligibility (ABE) portal.

The Subsidy Cliff and Its Effects

The “subsidy cliff” makes its return in 2026, following the expiration of the 2025 subsidy enhancements. This means that if your income exceeds 400% of the FPL – even by a dollar – you lose all eligibility for premium tax credits. For instance, a single self-employed person earning $62,756, which is just 0.25% above the $62,600 cutoff, would receive zero subsidies. Meanwhile, someone earning exactly $62,600 would still qualify.

The consequences can be dramatic. It’s estimated that 1.6 million people nationwide – about 6.7% of all ACA enrollees – will lose their subsidy eligibility in 2026 because their income exceeds 400% of the FPL. For a 60-year-old just over the threshold, monthly premiums could increase by as much as $881. This highlights how critical it is for self-employed individuals with fluctuating incomes to carefully project their earnings throughout the year.

How to Calculate MAGI for Self-Employed Individuals

Your Modified Adjusted Gross Income (MAGI) plays a key role in determining eligibility for ACA subsidies in Illinois. To calculate MAGI, you start with your Adjusted Gross Income (AGI) from your tax return and then add back specific non-taxable items such as tax-exempt interest, non-taxable Social Security benefits, and excluded foreign earned income. The Illinois marketplace, Get Covered Illinois, uses this figure to evaluate whether you qualify for Medicaid or premium tax credits. Below, we’ll break down how to adjust your self-employment income and apply relevant deductions to arrive at your MAGI.

Adjusting Your Self-Employment Income

The process begins with your net profit, which is your total business revenue minus all qualified business expenses reported on Schedule C. From this net profit, you subtract certain above-the-line deductions. One major deduction is half of your self-employment tax – for instance, if your self-employment tax is $10,000, you can deduct $5,000.

Another key factor is the health insurance deduction, which directly reduces your AGI. This deduction impacts your subsidy calculation and is handled iteratively by tax software. The IRS describes this as “a circular relationship” because the deduction and the ACA premium tax credit influence each other.

Deductions That Lower Your MAGI

In addition to adjusting your income, several deductions can further reduce your MAGI. Contributions to a SEP-IRA are one example. If you contribute $6,000 to a SEP-IRA in 2026, that amount is directly deducted from your AGI, lowering your income for subsidy purposes. Similarly, contributions to a Health Savings Account (HSA) reduce your AGI when paired with a High Deductible Health Plan.

You can also deduct 100% of the health insurance premiums you pay for yourself, your spouse, dependents, and children under 27. This includes premiums for medical coverage, qualifying long-term care, and Medicare (Parts A, B, C, and D). However, this deduction isn’t available for any month you were eligible for a subsidized health plan through your own or your spouse’s employer.

Once you’ve accounted for these deductions and calculated your AGI, you’ll need to add back three specific items to determine your final MAGI: tax-exempt interest, non-taxable Social Security benefits, and excluded foreign earned income. These additions are crucial for ensuring your subsidy eligibility is calculated accurately.

How to Estimate Your ACA Subsidy Eligibility

Estimating your ACA subsidy eligibility in Illinois requires a clear understanding of your Modified Adjusted Gross Income (MAGI), Federal Poverty Level (FPL) thresholds, and the subsidy changes set for 2026. Here’s how to navigate the process:

Step 1: Determine Household Size and Project Your Annual MAGI

Start by identifying your household size, which includes you, your spouse, and any tax dependents. Then, calculate your projected annual MAGI. Use the Adjusted Gross Income (AGI) from IRS Form 1040, line 11, and adjust for any expected changes in 2026. For example, if you’ve recently signed a new client contract worth $15,000 or foresee a $10,000 increase in business revenue, add those amounts to your baseline. As HealthCare.gov explains:

“Marketplace savings are based on your expected household income for the year you want coverage, not last year’s income”.

It’s important to update your Marketplace application if your income or household size changes to avoid unexpected tax repayments. Keep in mind, the Open Enrollment period for 2026 coverage ends on January 15, 2026.

Once you’ve calculated your MAGI, the next step is comparing it to FPL thresholds.

Step 2: Compare Your Income to Federal Poverty Level (FPL) Guidelines

The Marketplace uses the 2025 Federal Poverty Guidelines to assess eligibility for 2026. To determine your FPL percentage, divide your projected MAGI by the 100% FPL figure for your household size. For instance, if you’re a self-employed individual expecting to earn $35,000 in 2026, divide that by $15,650 (the 100% FPL for one person). This results in 224% FPL.

| Household Size | 100% FPL | 138% FPL (Medicaid) | 250% FPL (CSR Cap) | 400% FPL (Subsidy Cap) |

|---|---|---|---|---|

| 1 | $15,650 | $21,597 | $39,125 | $62,600 |

| 2 | $21,150 | $29,187 | $52,875 | $84,600 |

| 3 | $26,650 | $36,777 | $66,625 | $106,600 |

| 4 | $32,150 | $44,367 | $80,375 | $128,600 |

This calculation determines whether you qualify for Medicaid, Premium Tax Credits, or Cost-Sharing Reductions (CSRs). In Illinois, incomes below 138% FPL generally qualify for Medicaid instead of Marketplace subsidies. If your income falls between 100% and 400% FPL, you’re eligible for Premium Tax Credits. Additionally, incomes between 100% and 250% FPL qualify for CSRs, which reduce out-of-pocket costs but are only available with Silver plans. However, earning above 400% FPL typically results in no subsidy eligibility for 2026.

Step 3: Understand the 2026 Subsidy Changes and Repayment Rules

Accurately projecting your income is especially important for 2026 because of major policy changes. One key change is the return of the “subsidy cliff.” Enhanced subsidies, which previously allowed individuals earning above 400% FPL to qualify for premium tax credits, are no longer available. For example, a family of four earning over $128,600 will lose all subsidy eligibility.

Cynthia Cox, Director of the Program on the ACA at KFF, highlights the financial impact:

“On average, people are going to pay about twice as much next year as they do this year”.

For older couples with incomes just above 400% FPL, she adds:

“they actually, because it’s two of them, might see their premium costs go up by almost $20,000”.

Another critical change is the removal of repayment caps for excess premium subsidies starting in 2026. If your actual income exceeds your estimate, you’ll need to repay the full amount of any excess subsidies on your federal tax return. For example, underestimating your income by $10,000 could result in repaying the entire subsidy difference. This makes precise income forecasting crucial, particularly for self-employed individuals with fluctuating earnings.

Tools to Help Calculate Your Subsidy

Online Subsidy Calculators

If you’re looking to estimate your health insurance subsidies, free online calculators like the KFF Health Insurance Marketplace Calculator and the Healthinsurance.org 2026 Subsidy Calculator can be incredibly useful. These tools let you compare your projected income against Federal Poverty Level thresholds. For example, the KFF calculator allows you to input details like your projected income, age, household size, and zip code to estimate your potential premium tax credits and Medicaid eligibility. Meanwhile, the Healthinsurance.org calculator has been updated to account for the return of the subsidy cliff and changes in benchmark plan costs.

When using these calculators, make sure to input your net self-employment income. To calculate your Modified Adjusted Gross Income (MAGI), add back non-taxable Social Security benefits, tax-exempt interest, and any excluded foreign-earned income to your net self-employment income. Precision is key here, especially since repayment caps have been removed for 2026.

It’s worth noting that some brokers have expressed concerns that without the expanded subsidies, enrollment and subsidy participation may drop in 2026. For those wanting more tailored advice, Illinois Health Agents can provide expert assistance customized to your specific needs.

How Illinois Health Agents Can Help

While online calculators are a great starting point, working with a licensed agent can provide a more personalized approach to subsidy calculations and plan selection. Illinois Health Agents specialize in helping self-employed individuals navigate the complexities of the ACA. They can assist with calculating your MAGI, factoring in business deductions, and identifying income adjustments relevant to your situation.

For Illinois residents, Get Covered Illinois (getcovered.illinois.gov) is the official state marketplace. It connects individuals with trained local enrollment assisters and Navigators who offer free, expert help. As the Illinois Department of Revenue explains:

“Get Covered Illinois also can help connect you with local, trained enrollment assisters and Navigators who provide free, expert assistance and help you enroll in the plan that is right for you”.

You can contact Get Covered Illinois directly at 1-866-311-1119. Professional guidance is especially valuable for self-employed individuals with fluctuating incomes. Licensed agents can help you report income changes to the Marketplace, reducing the risk of unexpected tax repayments. Additionally, they can guide you toward the right plan, such as a Silver plan with Cost-Sharing Reductions if your income falls between 100% and 250% of the Federal Poverty Level. This ensures your subsidies are applied correctly during the enrollment process.

Key Takeaways for Self-Employed Individuals in Illinois

If you’re self-employed in Illinois and planning for 2026 health coverage, understanding ACA income limits is crucial. To qualify for a Marketplace plan, your annual income needs to be at least $15,650 for an individual or $32,150 for a family of four. If your income is below these amounts, you might be eligible for Illinois Medicaid under the ACA Adult category. This program covers individuals aged 19 to 64 with monthly income limits of $1,366 for an individual or $1,845 for a couple. Accurately calculating your income is essential to determine your eligibility for subsidies.

Your eligibility is based on your Modified Adjusted Gross Income (MAGI). To calculate this, start with your net self-employment income and add back any non-taxable benefits. This figure not only determines if you’re eligible for subsidies but also how much financial assistance you might receive.

With the enhanced subsidies set to expire in 2026, projecting your income accurately becomes even more critical. If your income exceeds 400% of the Federal Poverty Level, you could lose access to premium tax credits entirely. For those with fluctuating income, keeping your Marketplace application updated is key to avoiding unexpected tax bills.

For personalized assistance with MAGI calculations and plan selection, you can contact Get Covered Illinois at 1-866-311-1119 or visit their website at GetCoveredIllinois.gov. Additionally, Illinois Health Agents can offer guidance tailored to your business situation, helping you understand deductions and adjustments that may maximize your subsidy eligibility. Their expertise can make it easier to navigate income fluctuations and apply subsidies correctly.

FAQs

How can I avoid losing my ACA subsidy in 2026?

To keep your ACA subsidy intact for 2026, it’s essential to manage your Modified Adjusted Gross Income (MAGI) and ensure it stays below 400% of the Federal Poverty Level (FPL). If you’re self-employed, here are a few strategies to help:

- Adjust your income timing: Strategically time or defer income to remain within the subsidy-eligible range.

- Take full advantage of deductions: This includes claiming business expenses, contributing to retirement accounts, and adding to your Health Savings Account (HSA).

- Keep your income estimate updated: If your earnings fluctuate, update your income details on the Marketplace to avoid surprises.

By actively tracking and managing your income, you can secure your ACA subsidies and steer clear of unexpected financial burdens.

How can self-employed individuals in Illinois estimate their income for ACA subsidies?

To figure out your income for ACA subsidy eligibility, you’ll need to calculate your Adjusted Gross Income (AGI) first. If you’re self-employed, this involves deducting allowable business expenses – like supplies, mileage, or home-office costs – from your gross self-employment income. Once you’ve got your AGI, you’ll adjust it to your Modified Adjusted Gross Income (MAGI) by adding back items like non-taxable Social Security benefits, tax-exempt interest, and any untaxed foreign income.

Next, compare your MAGI to the Federal Poverty Level (FPL) guidelines for the year. For instance, in 2025, subsidies are typically available if your MAGI falls between 100% and 400% of the FPL. However, newer rules may extend subsidies beyond this range if your premiums exceed 8.5% of your income. Keep in mind, if your income changes during the year, it’s important to update your Marketplace application to avoid surprises at tax time.

If you’re looking for help with estimating your income or getting the most out of your ACA subsidy, Illinois Health Agents can offer guidance tailored specifically to your needs.

What does it mean if there are no repayment caps for ACA subsidies?

If there aren’t repayment caps in place, you might have to return the entire amount of any excess ACA subsidy you received. This could lead to a hefty tax bill, particularly for self-employed individuals whose income tends to vary throughout the year. To minimize financial stress during tax season, it’s crucial to estimate your annual income as accurately as possible.

Related Blog Posts

- Open Enrollment 2025 Deadlines in Illinois

- Illinois ACA Updates: H.B. 579 and H.B. 2296

- APTC Calculation Basics for Illinois Residents

- How to Calculate Household Income for ACA Plans

Recent Comments