Understanding ACA Subsidies: A Simple Way to Save on Healthcare

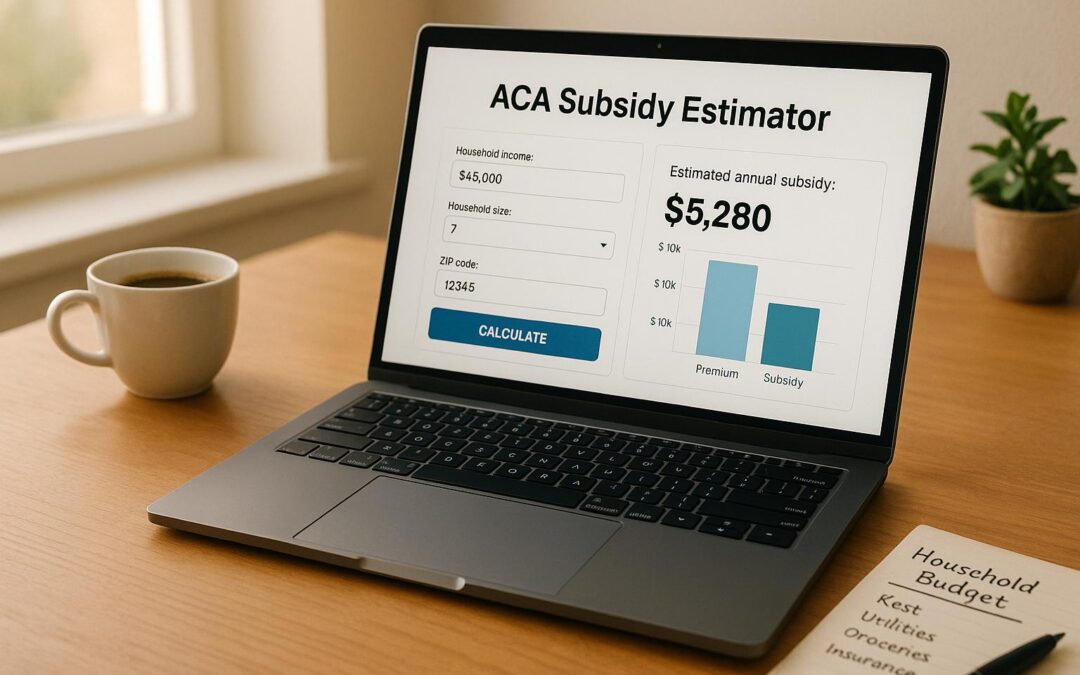

Navigating the world of health insurance can feel overwhelming, especially when you’re trying to figure out if you qualify for financial help. The Affordable Care Act (ACA) offers premium assistance to many Americans, but the rules and calculations often seem like a puzzle. That’s where tools like our healthcare subsidy estimator come in handy—they break down the complex stuff into clear, actionable insights.

How Subsidies Can Lower Your Costs

If your income falls within a certain range compared to the Federal Poverty Level, you might be eligible for significant savings on marketplace plans. These savings are designed to cap how much of your income goes toward premiums, often keeping costs between 2% and 8.5% depending on where you land in the eligibility spectrum. For many families, this means hundreds or even thousands of dollars saved each year on health coverage.

Why Estimate Your Eligibility?

Getting a rough idea of potential assistance can help you budget and plan for the year ahead. Whether you’re self-employed, between jobs, or just exploring options, knowing where you stand financially is a game-changer. Use our quick calculator to see if you might qualify for support, and take the first step toward more affordable care without the guesswork.

FAQs

Who qualifies for ACA subsidies?

Generally, you might qualify for subsidies if your household income falls between 100% and 400% of the Federal Poverty Level (FPL). For 2023, that’s roughly $13,590 to $54,360 for a single person, with the range increasing for larger households. You also need to be a U.S. citizen or legal resident and not have access to affordable employer-sponsored insurance. Our tool gives you a quick estimate, but final eligibility depends on specific marketplace rules in your state.

How accurate is this ACA subsidy estimate?

Our estimator uses a simplified formula based on 2023 FPL guidelines and income brackets to give you a ballpark figure. It’s a great starting point to understand potential savings, but actual subsidies can vary based on the specific health plans available in your area, your age, and other factors. Think of this as a helpful guide—check with Healthcare.gov or your state marketplace for the final numbers.

Why does my state matter for the subsidy calculation?

While the core subsidy rules are based on federal guidelines, some states have their own marketplace systems or additional assistance programs that can tweak the numbers. Selecting your state helps us provide a more tailored estimate, though our tool still focuses on the broader federal framework. For the most precise info, you’ll want to explore your state’s specific marketplace options after using this estimator.

Recent Comments