Missed the Open Enrollment Period? You may still qualify for health insurance under Special Enrollment Periods (SEPs) if you’ve faced unexpected events or errors. SEPs cover situations like natural disasters, serious medical emergencies, or misinformation during enrollment. Here’s a quick breakdown of what you need to know:

- What qualifies? Events like FEMA-declared disasters, hospitalization, or broker errors. Survivors of domestic abuse and individuals released from incarceration also qualify.

- Timeline: You generally have 60 days from the event to apply, with some cases allowing retroactive coverage.

- Documentation: Proof depends on the situation – FEMA residency, medical records, or official notices may be required.

- Changes for 2026: Stricter verification rules will apply, requiring 75% of SEP applications to be verified before approval. Year-round enrollment for low-income individuals will be discontinued.

To apply, contact the Marketplace Call Center at 1-800-318-2596. If denied, you can appeal within 90 days. Act quickly and keep thorough records to secure coverage.

Special Enrollment Periods: Beyond the Basics 2024 Webinar

sbb-itb-a729c26

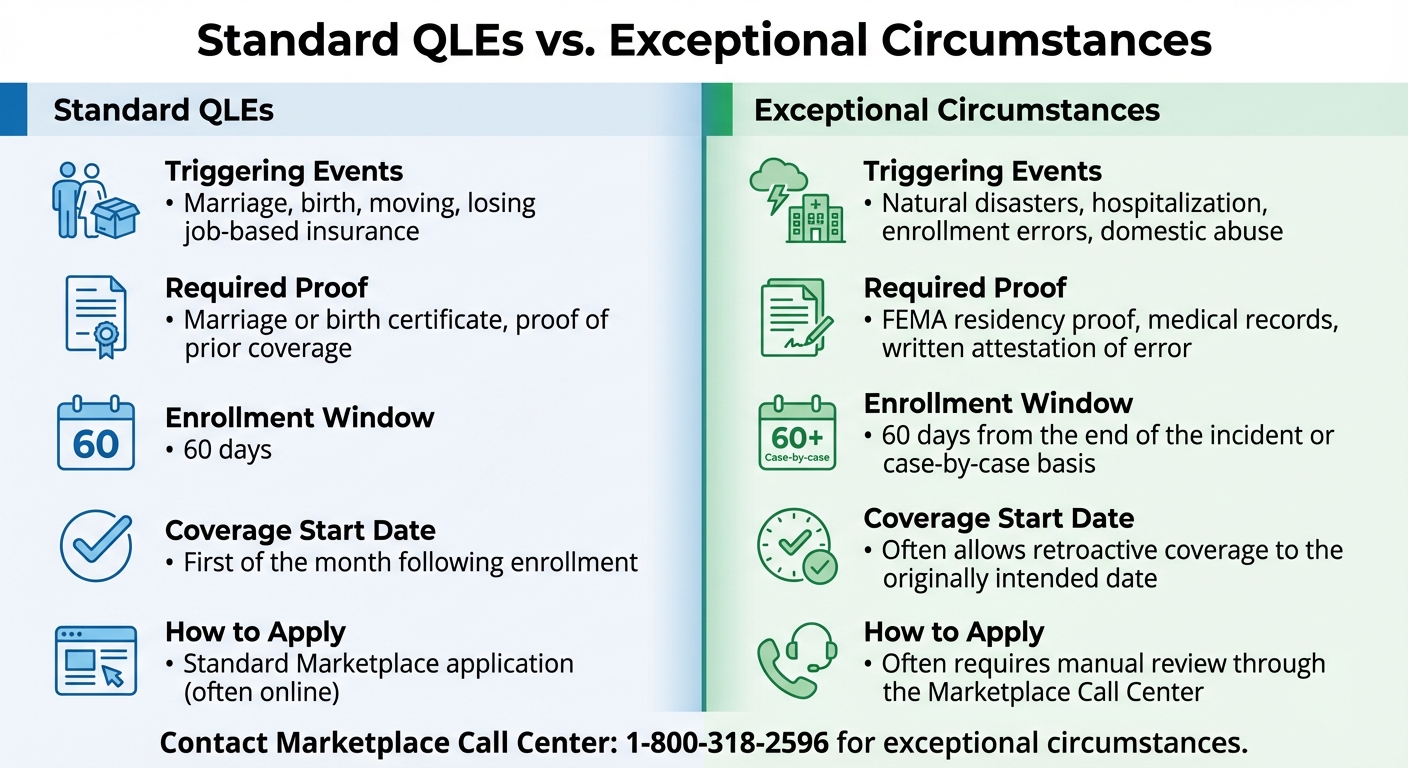

Standard Qualifying Life Events vs. Exceptional Circumstances

Standard Qualifying Life Events vs Exceptional Circumstances SEP Comparison

When exploring Special Enrollment Periods (SEPs) during emergencies, it’s important to understand the difference between standard Qualifying Life Events (QLEs) and exceptional circumstances. The Affordable Care Act (ACA) distinguishes these two categories, as they affect both enrollment timing and how coverage begins. Below, we’ll break down standard QLEs and then dive into how exceptional circumstances set themselves apart.

What Are Standard Qualifying Life Events?

Standard QLEs include events like marriage, childbirth, adoption, losing job-based insurance, moving to a new area, or aging out of a parent’s health plan. These events open a 60-day window to enroll in a health plan, and specific documentation – such as a marriage license or birth certificate – is required to confirm eligibility. Once enrolled, coverage typically begins on the first day of the following month.

For employer-sponsored plans, the enrollment period is somewhat shorter, lasting at least 30 days.

What Counts as Exceptional Circumstances?

Exceptional circumstances are unexpected events or errors that prevent someone from enrolling during the usual timeframe. Unlike standard QLEs, these situations are unplanned and often beyond an individual’s control. Examples include:

- Natural disasters declared by FEMA

- Unexpected hospital stays

- Receiving incorrect advice from a broker or exchange representative

- Technical glitches during the online enrollment process

- Being misled into buying an inadequate health plan

"Exceptional circumstances – personal or widespread – can trigger an SEP." – Louise Norris, Health Insurance Broker

For instance, after the Southern California wildfires on January 7, 2025, an exceptional SEP was granted, extending the enrollment period until March 8, 2025.

How QLEs and Exceptional Circumstances Differ

The processes and timelines for enrollment under these two categories vary significantly:

| Feature | Standard QLEs | Exceptional Circumstances |

|---|---|---|

| Triggering Events | Marriage, birth, moving, losing job-based insurance | Natural disasters, hospitalization, enrollment errors, domestic abuse |

| Required Proof | Marriage or birth certificate, proof of prior coverage | FEMA residency proof, medical records, written attestation of error |

| Enrollment Window | 60 days | 60 days from the end of the incident or as determined on a case-by-case basis |

| Coverage Start Date | First of the month following enrollment | Often allows retroactive coverage to the originally intended date |

| How to Apply | Standard Marketplace application (often online) | Often requires manual review through the Marketplace Call Center |

While standard QLEs can often be handled online, exceptional circumstances usually require contacting the Marketplace Call Center at 1-800-318-2596. It’s crucial to document every interaction and any errors thoroughly. For disaster-related SEPs, check if FEMA has designated your county for "individual assistance" or "public assistance".

Starting January 1, 2026, federal pre-enrollment verification for 75% of SEP applicants will make accurate documentation even more critical.

With these distinctions in mind, the next section will detail eligibility requirements and the documentation needed to successfully apply.

Eligibility Requirements and Required Documentation

To qualify for an exceptional Special Enrollment Period (SEP), you must demonstrate that your situation aligns with the criteria outlined under the Affordable Care Act (ACA). Each case is reviewed individually by the Exchange, and starting January 1, 2026, the Federal platform will verify at least 75% of all new special enrollments before approval. This means having the right documentation ready is more important than ever. Here’s an overview of who qualifies and the paperwork you’ll need.

Who qualifies? Eligibility extends to individuals facing specific circumstances, such as errors by the Exchange or the Department of Health and Human Services (HHS), violations of contract terms by health plans, or victims of domestic abuse seeking independent coverage. Those whose enrollment was impacted by material misrepresentations or delays in citizenship or lawful presence verification by HHS may also qualify, especially if their income is below 100% of the Federal Poverty Level. Additionally, there’s a category for "other exceptional circumstances", which HHS evaluates on a case-by-case basis.

What documentation is required? The necessary paperwork depends on your situation:

- For disaster-related SEPs, you’ll need proof of residency in a FEMA-declared disaster area during the event.

- If your SEP is due to an Exchange or HHS error, keep all related communications as evidence.

- Recently released from incarceration? Provide discharge documents or Social Security confirmation of release.

- If your Medicaid or CHIP coverage ended on or after January 1, 2023, you’ll need the official termination notice from your state agency.

Timing and Appeals

Most exceptional SEPs provide a 60-day window to enroll, while some cases, like the loss of Medicaid, extend up to 90 days. It’s critical to submit verifiable documentation – such as termination notices, marriage certificates, medical records, or legal documents – because incomplete or missing paperwork will result in a denied enrollment. Some cases require additional steps, like contacting the Marketplace Call Center at 1-800-318-2596, as they cannot be processed online.

If your SEP request is denied, you have the right to appeal the decision. For residents in Illinois, personalized guidance on documentation and enrollment is available through Illinois Health Agents.

Enrollment Deadlines and When Coverage Starts

How Long You Have to Apply

The clock for enrollment starts ticking as soon as the exceptional event occurs, although the exact beginning date depends on the situation. Most exceptional Special Enrollment Periods (SEPs) give you a 60-day window to submit your application.

For natural disasters or national emergencies, this 60-day period begins after the FEMA-designated incident period ends. For example, if a hurricane hits on March 1, 2025, and FEMA declares the incident period over on March 31, 2025, your enrollment window would start on April 1, 2025. If you’re enrolling because you lost Medicaid or CHIP coverage after January 1, 2023, you generally have up to 90 days to pick a Marketplace plan.

In cases of enrollment errors – like technical issues on HealthCare.gov or misinformation from the Exchange – the timeframe depends on when you identify the problem. Survivors of domestic abuse or spousal abandonment are given a 60-day enrollment period starting from the time they request independent coverage. For more complicated situations that need manual review, calling the Marketplace Call Center at 1-800-318-2596 ensures your case gets the attention it deserves.

After meeting the enrollment deadline, the next step is figuring out when your coverage officially begins.

When Your Coverage Begins

Once you’ve completed your enrollment, the start date of your health coverage depends on the event that qualified you for it. For most qualifying life events, like marriage or moving, coverage begins on the first day of the month after you select a plan. However, exceptional circumstances often allow for more flexibility, including retroactive start dates.

For events like the birth of a child, adoption, or foster care placement, coverage starts on the day of the event, as long as you enroll within the 60-day window. If a court order adds a dependent, coverage will begin on the date specified in the order. And if you successfully appeal a denied SEP request, your coverage may be backdated to your original intended start date – but keep in mind, you’ll need to pay all premiums from that date before the coverage becomes active.

Survivors of natural disasters can request their plan’s start date to align with when they would have enrolled if the disaster hadn’t disrupted their plans. Remember, coverage only starts once you’ve paid your first premium.

2025-2026 Changes to Exceptional SEP Rules

The Affordable Care Act (ACA) continues to evolve, and the latest updates bring adjustments to the Special Enrollment Period (SEP) rules. These changes tighten pre-enrollment verification requirements and remove year-round enrollment for certain low-income applicants. Here’s what you need to know about how these updates impact enrollment procedures.

New Pre-Enrollment Verification Rules

Starting with the 2026 plan year, the Federal Marketplace will require eligibility verification for at least 75% of all new SEP applications before enrollment is finalized. This stricter pre-enrollment verification process is set to expire at the end of the 2026 plan year, though it could be extended.

For instance, if you’re released from incarceration on or after January 1, 2025, you’ll need to provide discharge papers to qualify for SEP. Similarly, if you’re applying for SEP due to employer or agent misrepresentation, you’ll have to prove that incorrect information significantly influenced your enrollment decision.

It’s worth noting that state-based Marketplaces are not subject to these new verification requirements.

Updates to Low-Income SEPs

The option for year-round enrollment for individuals with household incomes at or below 150% of the Federal Poverty Level (approximately $23,475 for an individual in 2025) will no longer be available starting in 2026. This means individuals in this income bracket must now enroll during the standard Open Enrollment Period (November 1 through January 15) or qualify through specific life events like marriage, childbirth, or losing other coverage.

This change aims to curb unauthorized enrollments. Additionally, the Department of Health and Human Services (HHS) has clarified that an income change alone will no longer qualify as an "Exceptional Circumstance" for SEP eligibility.

Before and After 2025: What Changed

Here’s a side-by-side look at how the rules have shifted:

| Feature | Policy Before 2025 | Policy for 2025-2026 |

|---|---|---|

| Pre-Enrollment Verification | Not required for a set percentage of SEPs. | Federal platform must verify at least 75% of new SEP applications (2026 plan year). |

| Low-Income SEP (<150% FPL) | Allowed year-round enrollment. | Eliminated for the 2026 plan year. |

| Incarceration SEP Scope | Applied to releases from custody of penal authorities. | Now explicitly includes those released from jails, prisons, or penal institutions (effective January 1, 2025). |

| Incarceration SEP Retroactivity | Standard prospective coverage. | Allows up to 6 months of retroactive coverage. |

| Income Changes | Sometimes triggered SEP eligibility. | Defined as NOT an "Exceptional Circumstance". |

Additionally, individuals automatically re-enrolled in a $0 premium plan who fail to confirm their eligibility for the 2026 plan year will be charged a $5 monthly premium on the Federal platform. This measure is also set to expire at the end of 2026.

These updates aim to streamline the enrollment process while addressing exceptional circumstances more effectively. If you need help navigating these new rules, Illinois Health Agents can provide personalized assistance to ensure you meet the latest ACA requirements.

How to Appeal a Denied Exceptional SEP Request

Facing a denial for an exceptional SEP request can feel frustrating, but knowing how to navigate the appeal process can make all the difference.

If your request is denied, you have 90 days from the date on the denial notice to file an appeal. The denial letter will outline the reasons for the decision and provide instructions for disputing it. If you miss this deadline, you can request an extension, but you’ll need to explain the reason for the delay.

You can choose between a standard or expedited appeal. Opt for expedited processing if a delay could seriously impact your health. Appeals can be submitted online, by mail, or via fax. Submitting online is the quickest option.

When filing, include copies of all supporting documents that back up your claim of exceptional circumstances. Examples of useful documentation include medical records, FEMA disaster declarations, discharge papers from incarceration, or written statements explaining any misinformation you received from an agent or broker . Be sure to send copies, not originals. You also have the option to appoint an authorized representative – such as a family member, attorney, or insurance agent – to handle the appeal for you.

"If the appeal process finds that the initial eligibility determination and/or effective date were incorrect, you’ll have an opportunity to enroll again with the correct information, even if open enrollment has ended." – Louise Norris, Health Insurance Broker

This highlights the importance of filing your appeal correctly, as it could allow you to reapply if errors are discovered.

While your appeal is under review, continue to pay your premiums. Stopping payments could result in losing your coverage, and even if your appeal is approved, you’d have to wait until the next Open Enrollment Period to re-enroll. Additionally, if you’re receiving premium tax credits during the process and your appeal is denied, you’ll need to repay those credits when you file your federal taxes.

For further help, reach out to the Marketplace Call Center or Illinois Health Agents for personalized support in submitting a strong appeal.

Conclusion

The Affordable Care Act’s exceptional enrollment rules are designed to safeguard individuals who face unexpected challenges, such as natural disasters, hospitalizations, or enrollment errors, ensuring they can still access health coverage when they need it most. These provisions can help shield you from overwhelming medical expenses during emergencies.

It’s crucial to act promptly and keep detailed records, as many of these special enrollment periods (SEPs) require you to enroll within 60 days of the qualifying event. In some cases, retroactive coverage may be available to close any gaps in your insurance. Proper documentation is key to making your case.

For more complex situations – like those involving domestic abuse, spousal abandonment, or denied SEP requests – seeking professional guidance can make all the difference. Expert assistance can help you navigate the paperwork and appeals process effectively.

FAQs

What documents are required for a Special Enrollment Period due to a natural disaster?

To qualify for a Special Enrollment Period (SEP) because of a natural disaster, you must provide proof of residence in the FEMA-declared disaster area. Acceptable forms of documentation include a driver’s license, utility bill, lease agreement, mortgage statement, or any other official paperwork that confirms your address. You may also need the FEMA disaster declaration for the specific event.

If you can’t supply these documents, you have the option to submit an attestation confirming your residence in the affected area, which the sponsor is obligated to accept.

What are the new 2026 rules for verifying eligibility during a Special Enrollment Period (SEP)?

Starting in 2026, anyone applying for a Special Enrollment Period (SEP) after losing minimum essential coverage will need to go through a verification process before their application is approved and coverage begins. This verification can either be done automatically using trusted data sources or by submitting specific documents.

These updates aim to confirm eligibility for SEPs while making the enrollment process more efficient. If you’re uncertain about the steps or what documents are required, consulting a knowledgeable health insurance expert, such as Illinois Health Agents, can make the process easier and help ensure everything is completed correctly.

Can I appeal if my Special Enrollment Period (SEP) request is denied?

Yes, you can challenge a denied Special Enrollment Period (SEP) request. To do this, you’ll need to file an appeal with the Health Insurance Marketplace within 90 days of receiving the denial notice. Make sure to include any relevant supporting documents, such as medical records or evidence of the exceptional circumstance, along with a detailed explanation of why you believe the decision should be reconsidered.

You can file your appeal through HealthCare.gov by submitting it online, by mail, or via fax. If your situation is time-sensitive, you can request an expedited review to speed up the process. Always keep copies of all submitted documents for your own records.

Recent Comments