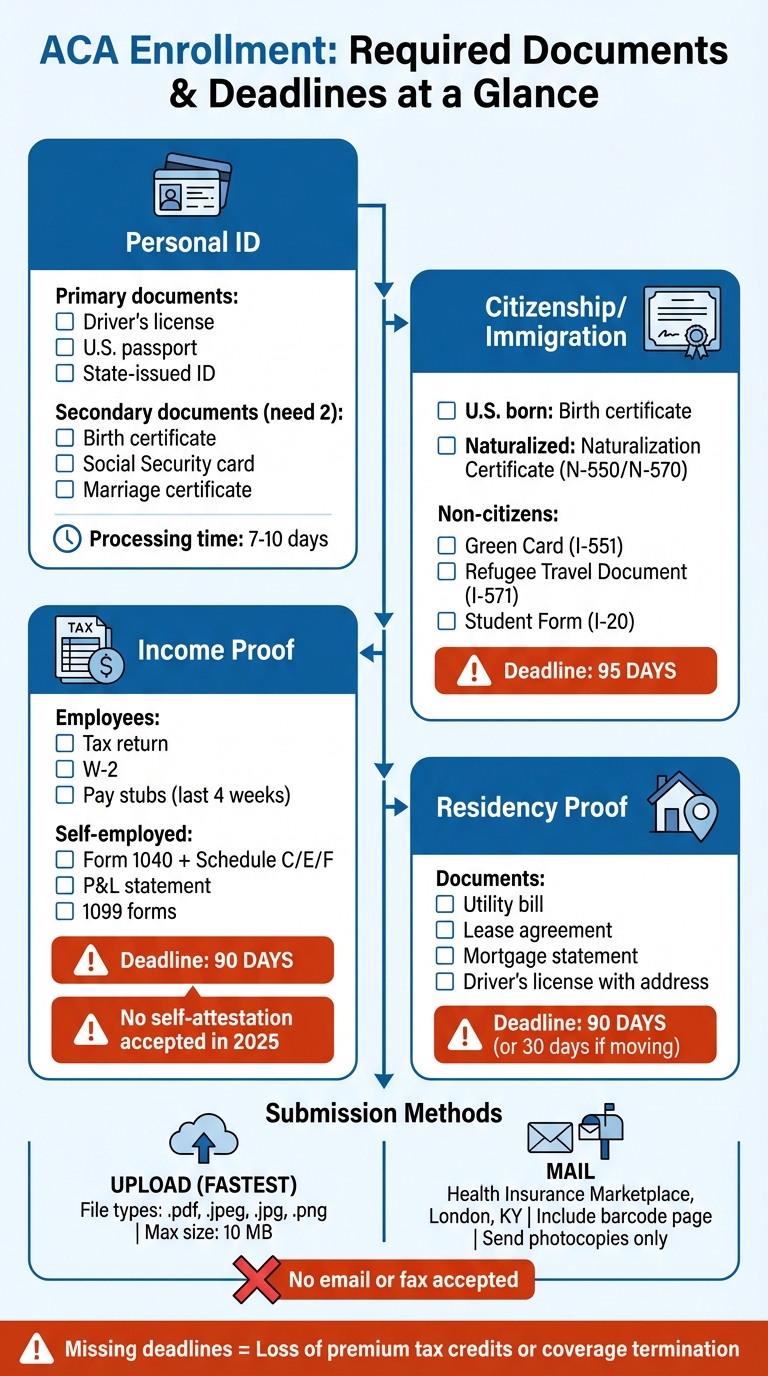

To enroll in ACA health coverage, you need specific documents to verify your identity, income, residency, and eligibility for financial assistance. Missing deadlines could result in losing coverage or financial help.

Here’s what you’ll need:

- Personal ID: Driver’s license, passport, or state-issued ID.

- Citizenship/Immigration Proof: Birth certificate, Naturalization Certificate, or Green Card.

- Income Proof: Recent tax return, W-2, pay stubs, or self-employment records.

- Residency Proof: Utility bill, lease agreement, or government-issued document with your address.

- Household Information: Social Security Numbers, birth certificates, or adoption papers for dependents.

Deadlines:

- Submit most documents within 90 days of your eligibility notice.

- Citizenship/immigration documents have a 95-day deadline.

How to Submit:

- Upload to your HealthCare.gov account (preferred) or mail photocopies to the Marketplace.

Prepare your documents in advance to avoid delays!

ACA Enrollment Required Documents and Deadlines Guide

Getting Ready for ACA Open Enrollment

sbb-itb-a729c26

Personal Identification Documents

When applying for ACA coverage, you’ll need to verify both your identity and legal status. These documents help the Marketplace determine your eligibility for health coverage and any financial assistance.

Accepted Forms of Identification

To confirm your identity, submit one primary document, such as:

- A driver’s license

- U.S. passport or passport card

- State-issued ID

- School ID

- Voter registration card

- U.S. military card

- Native American tribal document

If you don’t have a primary document, you can provide two secondary documents, which might include:

- U.S. public birth certificate

- Social Security card

- Marriage certificate or divorce decree

- Employer ID

- Academic diploma

- Property deed or title

Once submitted, identity verification typically takes 7 to 10 days to process.

In addition to verifying your identity, you’ll also need to prove your citizenship or lawful immigration status.

Proof of Citizenship or Immigration Status

If you were born in the U.S., a public birth certificate will suffice. Naturalized citizens should provide a Naturalization Certificate (Form N-550 or N-570) along with your Alien number and Certificate number. For derived citizens, submit a Certificate of Citizenship (Form N-560 or N-561) with the required details.

For non-citizens with lawful status, the necessary documents depend on your specific status:

- Permanent residents: Permanent Resident Card (Green Card, Form I-551)

- Refugees and asylees: Refugee Travel Document (I-571) or Arrival/Departure Record (I-94 or I-94A)

- Students: Certificate of Eligibility for Nonimmigrant Student Status (Form I-20)

- Exchange visitors: Certificate of Eligibility for Exchange Visitor Status (Form DS-2019)

- Employment authorization: Employment Authorization Document (Form I-766)

Make sure your Alien Registration Number (an "A" followed by 7–9 digits) is clearly visible on the documents you submit.

You’ll have 95 days from the date of your eligibility notice to resolve any citizenship or immigration data issues. The quickest way to submit documents is by uploading clear scans or photos to your HealthCare.gov account. Accepted file types include .pdf, .jpeg, .jpg, .gif, .xml, .png, .tiff, and .bmp, and files must be under 10 MB. Be cautious with your filenames – avoid special characters like colons, semicolons, or asterisks, as these can cause upload errors.

If mailing documents is your preference, send photocopies (never originals) to the Health Insurance Marketplace in London, KY. Include the printed barcode page from your eligibility notice to ensure proper processing.

Proof of Income

Your household income plays a key role in determining your eligibility for premium tax credits and cost-sharing reductions. To verify the income you report, you’ll need to submit accurate documentation. If there’s a mismatch, you’ll receive a data matching notice and must provide proof within 90 days of your eligibility notice.

"If you don’t meet your deadline, we’ll make a new determination of the insurance and savings you’re eligible for. These results will be based on information from our data sources, not what you put on your application." – HealthCare.gov

Failing to meet this deadline means the Marketplace will recalculate your eligibility using government data, not the information you provided. Starting in 2025, the rules have tightened – self-attestation is no longer accepted. Only documented, IRS-verified income will qualify for subsidies.

Here’s what you need to know about the required income documents, whether you have standard earnings or irregular income.

Standard Income Documents

If you’re an employee with steady income, you’ll need to submit your most recent federal tax return or W-2 forms. For those who have recently started a new job, provide current pay stubs from your current employer rather than documents from a previous position.

Make sure your pay stubs clearly show your full name, gross income, pay period, and payment date. Typically, you’ll need to submit documentation covering the last four weeks of income.

If your income doesn’t come from regular employment, the next section outlines what you’ll need to provide.

Self-Employed or Irregular Income Documentation

For self-employed individuals, acceptable documents include your Federal Income Tax Form 1040 along with the relevant schedules – Schedule C for business income, Schedule E for rental income, or Schedule F for farm income. You can also submit a Profit and Loss (P&L) statement that details your gross profit and expenses for the last three months.

If your income is irregular, you can use 1099 forms, bank or investment account statements, or invoices as proof. If you expect changes to your income – such as the end of a contract or the start of a new job – include documentation that specifies when the contract will end or what your new wages will be.

For self-prepared P&L statements or business records, include a signed statement affirming, "The information provided is true and correct to the best of my knowledge." Maintaining a separate bank account for business expenses can also help show consistent income deposits.

Proof of Residency

After verifying your income, the next important step is confirming your residency. The Marketplace needs to confirm that you live in the state where you’re applying. In most cases, this happens automatically through government databases. However, if electronic verification fails, you’ll need to provide documentation.

If you’ve recently moved to a new state, you may qualify for a Special Enrollment Period. This allows you to enroll in a health plan outside the usual Open Enrollment period, but it also means you’ll need to verify your residency as part of the process.

"If you don’t submit requested documents by the deadline, you can lose your financial help or health insurance coverage." – Get Covered Illinois

Typically, you have 90 days to resolve any residency-related data issues. However, if you’re enrolling due to a move, you’ll usually need to submit your documents within 30 days of choosing a plan.

Accepted Residency Documents

The Marketplace accepts several types of documents to verify your address. Here are some common options:

- Government-issued documents with your current address, like a state driver’s license or voter registration card.

- Rental agreements or a landlord’s letter confirming your tenancy if you’re renting.

- Mortgage statements or property deeds/titles if you own your home.

- Utility bills (e.g., electric, gas, or water) that show your name and address.

If you can’t provide these traditional documents, you can submit a letter from a friend, family member, or caseworker who lives in your state and can confirm your residency. The person writing the letter must also include their own proof of residency. Additionally, you can write a letter of explanation outlining why you’re unable to provide standard documents. The Marketplace will review these on a case-by-case basis.

When submitting documents, make sure to upload clear scans or photos in formats like .pdf, .jpeg, .jpg, .gif, .xml, .png, .tiff, or .bmp. Files must be under 10 MB, and filenames should avoid special characters. If mailing documents, send photocopies only – never originals – and include the barcode page from your eligibility notice.

Once your residency is verified, you can move on to providing household information.

Household Information

When applying for ACA coverage, you’ll need to provide details about each household member who requires insurance. This information helps the Marketplace verify eligibility for tax credits and establish family relationships. The data you provide plays a key role in determining your premium tax credit eligibility.

"SSNs are used to verify your identity and obtain data to help with your eligibility determination." – HealthCare.gov

You’ll also need to clarify your tax filing status. This includes whether you plan to file a federal tax return, your marital status, and whether you’ll file jointly or separately. Additionally, you’ll identify any dependents you claim, such as children under 19, full-time students under 25, or disabled household members. For each person, specify their relationship to the tax filer – this could be a spouse, domestic partner, biological or adopted child, stepchild, foster child, or sibling.

Social Security Numbers

Social Security Numbers (SSNs) are essential for all household members applying for coverage. The Marketplace uses these to confirm identities and access federal records to determine eligibility for financial assistance. It’s crucial to ensure your SSN matches government records; any mismatch will result in a request for your Social Security card.

If documentation is requested, you typically have 90 days to submit it. Refer to the submission instructions provided earlier in the article to either upload or mail your Social Security card.

Birth Certificates or Adoption Papers

When adding a dependent during a Special Enrollment Period (due to birth, adoption, foster care placement, or a court order), you’ll need to submit birth certificates or adoption papers. These documents confirm your eligibility to enroll outside of Open Enrollment.

For adopted children, list "son/daughter" on the application. If the adoption occurred internationally, you can provide a U.S. Department of Homeland Security document showing the child’s name and adoption date. All adoption records, foster care documents, and court orders must be signed by a government or court official to be valid.

If you’re unable to provide these documents, you can submit a Letter of Explanation using the Marketplace’s official form. This letter should outline why the required documentation isn’t available. Typically, you have 30 days to submit these documents after selecting a plan during a Special Enrollment Period.

Submission and Deadline Guidelines

Here’s what you need to know about submitting your documents and meeting deadlines to complete your application. Timely submission is crucial to avoid delays or losing financial assistance.

How to Submit Documents

Once you’ve gathered the required documents, choose the quickest way to submit them. The fastest option? Log into your Marketplace account, go to "Application details", and click "Upload documents" next to the specific item. Make sure your files follow the size and format rules outlined earlier, and use the correct file naming conventions. It typically takes about 7 to 10 days for identity verification after submission.

If you’d rather mail your documents, send photocopies (not originals) to:

Health Insurance Marketplace

Attn: Supporting Documentation

465 Industrial Blvd.

London, KY 40750-0001

Don’t forget to include the printed barcode page from your eligibility notice. If that’s not possible, clearly write your full name and Application ID on every page. Remember, original documents won’t be returned, so always send copies.

Avoid submitting documents via email or fax, as these methods are not accepted.

Key Deadlines to Remember

You typically have 90 days from the date on your eligibility notice to submit most required documents. For citizenship or immigration-related documents, the timeframe extends to 95 days.

Missing these deadlines can have serious consequences. If you don’t submit on time, the Marketplace will rely on federal data sources instead of the information you provided, which could lead to reduced or eliminated premium tax credits, loss of cost-sharing reductions, or even termination of your health coverage. That said, the Marketplace will notify you in advance and provide a reminder phone call before making any changes. If you’ve already missed a deadline, submit your documents as soon as possible – this might help restore your coverage or financial assistance.

| Document Type | Deadline | Processing Time |

|---|---|---|

| General (Income, Household) | 90 days from notice date | Varies |

| Citizenship/Immigration | 95 days from notice date | Varies |

| Identity Verification | Submit immediately | 7–10 days |

Conclusion and Next Steps

Get your ACA enrollment documents in order ahead of time. Make sure you have your identification, proof of income, and residency documents ready in the correct digital format and within the size limits. This preparation can save you time and help you meet the required deadlines – typically 90 days for most documents or 95 days for citizenship and immigration papers.

Use online uploads for faster processing. According to Healthcare.gov, "Uploading is the fastest and easiest way to get [documents] to us. We can’t accept documents by email or fax". Once you upload your documents, double-check that everything is confirmed before logging out.

Act quickly and avoid procrastination. Missing the deadline means the Marketplace will rely on government data instead of the information you provided, which could result in losing premium tax credits or even having your coverage terminated. If you’ve already submitted your documents and haven’t received a response within a month, reach out to the Marketplace Call Center to confirm they’ve been received.

Need help navigating the process? Illinois Health Agents can assist you with ACA enrollment. Their licensed brokers offer personalized guidance, helping you explore your coverage options and ensuring all necessary documents are correctly submitted. Best of all, their support comes at no cost to you, making the enrollment process smoother and stress-free.

FAQs

What should I do if I miss the deadline to submit documents for ACA enrollment?

If you miss the deadline to submit your documents for ACA enrollment, you could lose your health coverage or any financial assistance you might be eligible for. To prevent this, it’s crucial to send in the required documents as soon as you can.

If meeting the deadline isn’t possible, contact the ACA Marketplace or consult a trusted health insurance professional for advice. Taking quick action can help you address any problems and keep your coverage intact.

What documents can I use to prove my income if I’m self-employed or have irregular earnings?

If you’re self-employed or have an income that fluctuates, you can estimate your annual net income by looking at your past earnings, current industry trends, and realistic projections for the year ahead. It’s important to keep your application updated if your income changes during the year, as this could affect your eligibility or coverage.

To verify your income, you might need to submit documents like recent tax returns, pay stubs, profit and loss statements, or even a signed letter explaining your income estimate. Ensure these documents accurately represent your financial situation to prevent delays in your ACA enrollment process.

What can I do if I don’t have standard documents to prove residency?

If you don’t have standard residency documents, there are other ways to prove your address. You can use utility bills, employment records, lease agreements, or similar paperwork that confirms your Illinois address. Just ensure these documents align with the ACA enrollment requirements.

It’s important that the documents clearly show your Illinois residency to prevent any delays in processing your application.

Recent Comments