Understanding ACA Eligibility: A Simple Guide to Subsidies and Medicaid

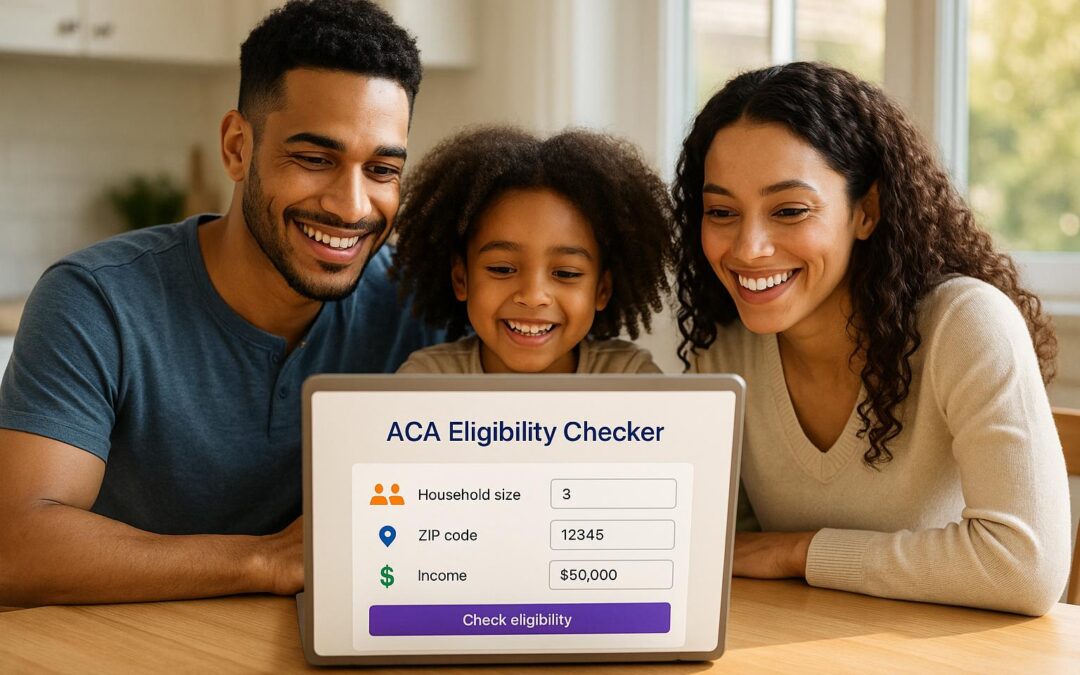

Navigating the world of health insurance can feel overwhelming, especially when trying to figure out if you qualify for financial help. The Affordable Care Act (ACA) offers a lifeline through marketplace subsidies and, in many states, expanded Medicaid coverage. Tools like our eligibility checker simplify this process by comparing your household income to federal poverty guidelines, helping you uncover potential savings or free coverage options without the guesswork.

Why Check Your Eligibility?

Health insurance costs can take a big bite out of your budget, but millions of Americans are eligible for assistance and don’t even know it. If your income falls within a certain range—typically 100% to 400% of the federal poverty level—you might qualify for premium tax credits to lower your monthly costs on a marketplace plan. For those with lower earnings, especially in states that expanded Medicaid, free or low-cost coverage could be within reach. Knowing where you stand is the first step to accessing affordable care.

Taking the Next Step

While online tools provide a quick snapshot, state-specific rules and plan details matter. After using a health insurance qualification tool, head to Healthcare.gov or your local exchange to explore plans and confirm your options. A little time invested now could mean big savings on medical expenses down the road.

FAQs

How does this tool determine if I qualify for ACA subsidies or Medicaid?

Great question! Our tool uses federal poverty level (FPL) guidelines to assess your eligibility. For 2023, the FPL starts at $14,580 for a single person and increases by $5,140 for each additional household member. If your income is below 138% of the FPL and you’re in a Medicaid expansion state, you might qualify for Medicaid. If it’s between 100% and 400% of the FPL, you could be eligible for marketplace subsidies. We crunch those numbers for you and provide a quick snapshot of where you stand.

Are the subsidy estimates accurate for my situation?

The subsidy ranges we provide—like saving $100 to $300 a month on premiums—are rough estimates based on typical cases within your income bracket. Actual savings depend on factors like your age, specific plan, and state marketplace rules. Think of our results as a starting point; you’ll want to visit Healthcare.gov or your state’s exchange for a precise quote tailored to you.

Does my state of residence affect my eligibility?

Absolutely, it does. Not all states have expanded Medicaid, so if you’re in a non-expansion state, the income threshold for Medicaid might not apply, even if you’re below 138% of the FPL. Our tool flags whether your state has expanded coverage and notes that rules can vary. After getting your results, it’s a good idea to check with your state’s health department or marketplace for any unique policies or exceptions.

Recent Comments