Recent Articles

Employee Benefits Tax Savings Calculator

Estimate your tax savings from employee benefits like 401(k) or health premiums with our easy calculator. See how much you can save today!

Pre-Existing Conditions in Group Health Plans

Learn how the ACA protects coverage for pre-existing conditions in group health plans, and the importance of choosing the right insurance.

How to Appeal ACA Eligibility Denials in Illinois

Learn how to effectively appeal ACA eligibility denials in Illinois, ensuring you secure health coverage and benefits.

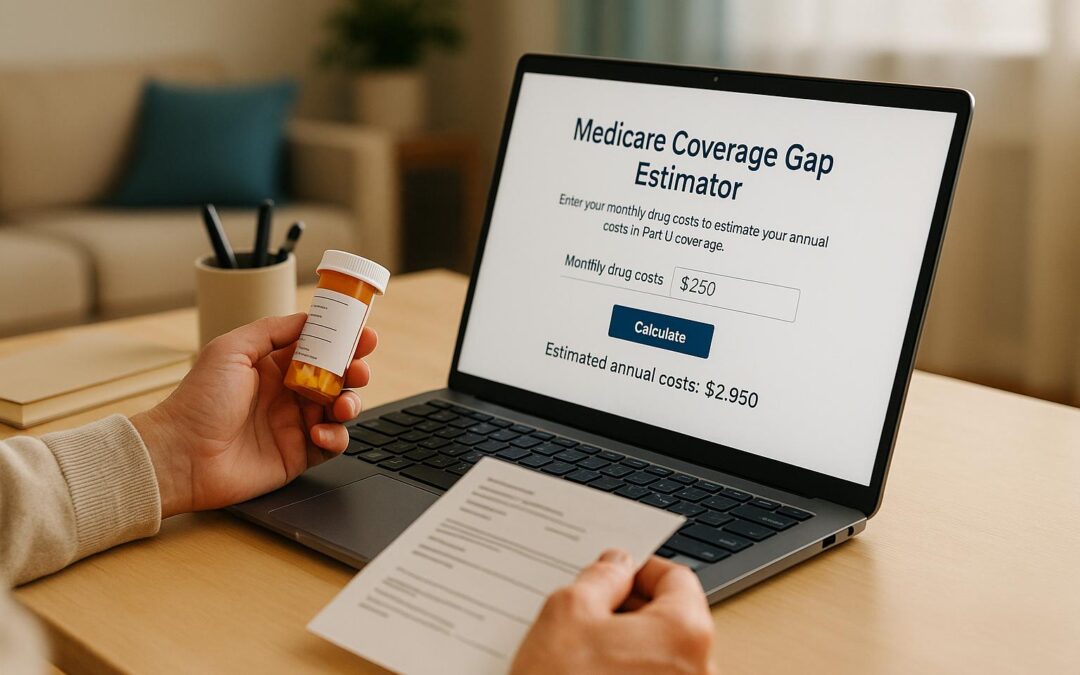

Medicare Coverage Gap Estimator

Estimate if you’ll hit the Medicare coverage gap (donut hole) with our easy tool. Enter your drug costs and get a clear cost breakdown now!

ACA Plan Cost Estimator

Curious about ACA health plan costs? Use our free estimator to calculate your monthly premiums and see if you qualify for tax credits!

Complete Guide to Choosing a Medical Insurance Plan

Learn how to select the best medical insurance plan that fits your budget, health needs, and coverage preferences with this comprehensive guide.

HSA Eligibility: Tax Benefits and Requirements

Learn about HSA eligibility requirements, tax benefits, and how to maximize savings for healthcare costs in 2025.

5 Ways to Cut Administrative Costs in Group Health Plans

Explore five effective strategies to reduce administrative costs in group health plans, enhancing efficiency and employee satisfaction.

How to Claim Medigap Premiums on Taxes

Learn how to deduct Medigap premiums on your taxes, including eligibility, record-keeping, and IRS guidelines for maximum savings.

How to Calculate Household Income for ACA Plans

Learn how to accurately calculate your household income for ACA health plans to determine eligibility for subsidies and Medicaid.